Answered step by step

Verified Expert Solution

Question

1 Approved Answer

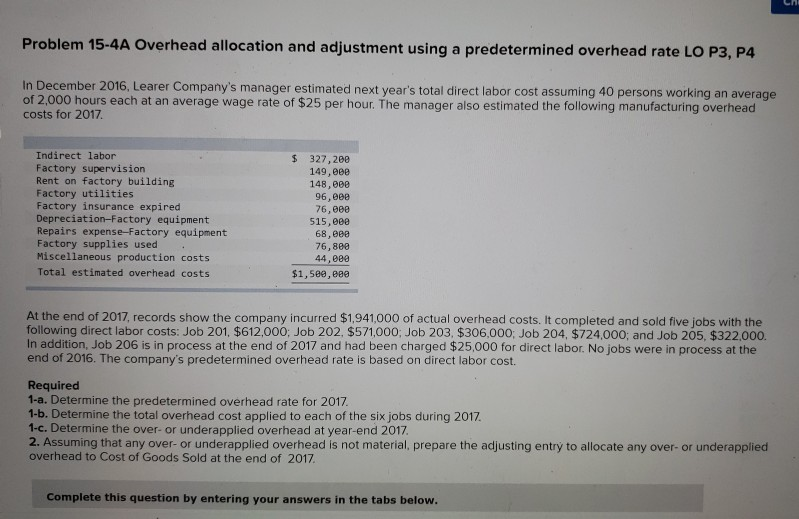

n Problem 15-4A Overhead allocation and adjustment using a predetermined overhead rate LO P3, P4 In December 2016, Learer Company's manager estimated next year's total

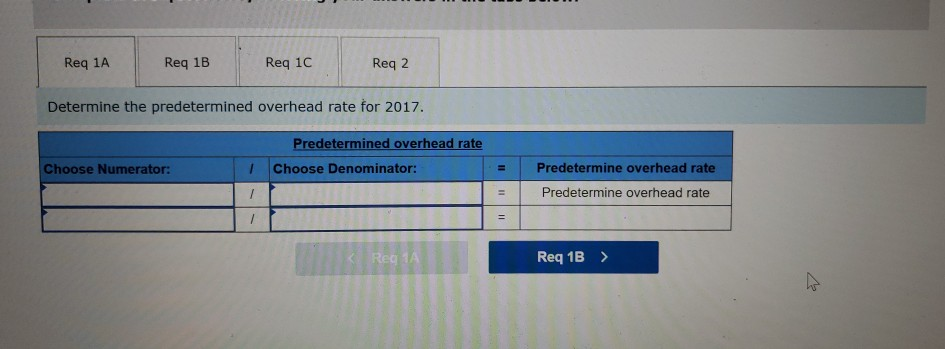

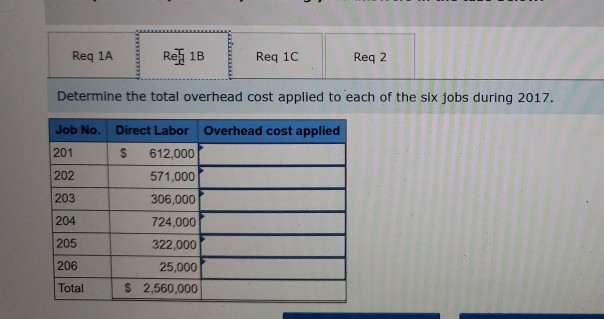

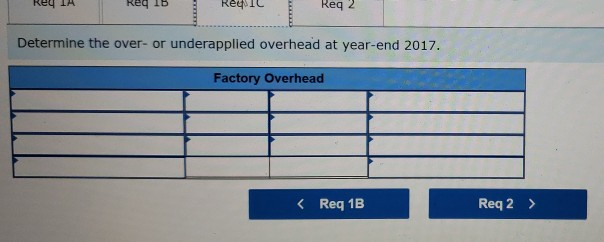

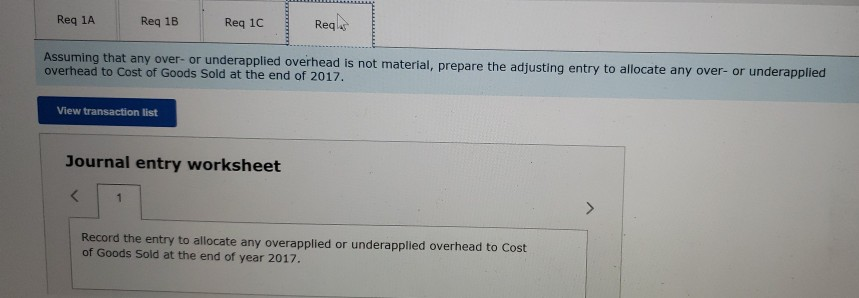

n Problem 15-4A Overhead allocation and adjustment using a predetermined overhead rate LO P3, P4 In December 2016, Learer Company's manager estimated next year's total direct labor cost assuming 40 persons working an average of 2,000 hours each at an average wage rate of $25 per hour. The manager also estimated the following manufacturing overhead costs for 2017 Indirect labor Factory supervision Rent on factory building Factory utilities Factory insurance expired Depreciation-Factory equipment Repairs expense-Factory equipment Factory supplies used Miscellaneous production costs Total estimated overhead costs $ 327,200 149,000 148,000 96,000 76,00 515, eee 68,888 76,888 44,000 $1,500,000 At the end of 2017, records show the company incurred $1,941,000 of actual overhead costs. It completed and sold five jobs with the following direct labor costs: Job 201. $612,000: Job 202, $571,000, Job 203, $306,000: Job 204, $724,000; and Job 205, $322,000. In addition, Job 206 is in process at the end of 2017 and had been charged $25,000 for direct labor. No jobs were in process at the end of 2016. The company's predetermined overhead rate is based on direct labor cost. Required 1-a. Determine the predetermined overhead rate for 2017. 1-b. Determine the total overhead cost applied to each of the six jobs during 2017 1-c. Determine the over- or underapplied overhead at year-end 2017 2. Assuming that any over- or underapplied overhead is not material, prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold at the end of 2017 Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 1C Req 2 Determine the predetermined overhead rate for 2017. Predetermined overhead rate Choose Denominator: Choose Numerator: Il Predetermine overhead rate Predetermine overhead rate Il = Reg 1A Req 1B > Req 1A Rea 1B Req 1C Req 2 Determine the total overhead cost applied to each of the six jobs during 2017. Job No. 201 202 203 Direct Labor Overhead cost applied $ 612,000 571,000 306,000 724,000 322,000 25,000 $ 2,560,000 204 205 206 Total IM Red B Rey 1 Reg 2 Determine the over- or underapplied overhead at year-end 2017. Factory Overhead Req 1A Reg 1B Req 1C Reqs Assuming that any over- or underapplied overhead is not material, prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold at the end of 2017. View transaction list Journal entry worksheet 1 Record the entry to allocate any overapplied or underapplied overhead to Cost of Goods Sold at the end of year 2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started