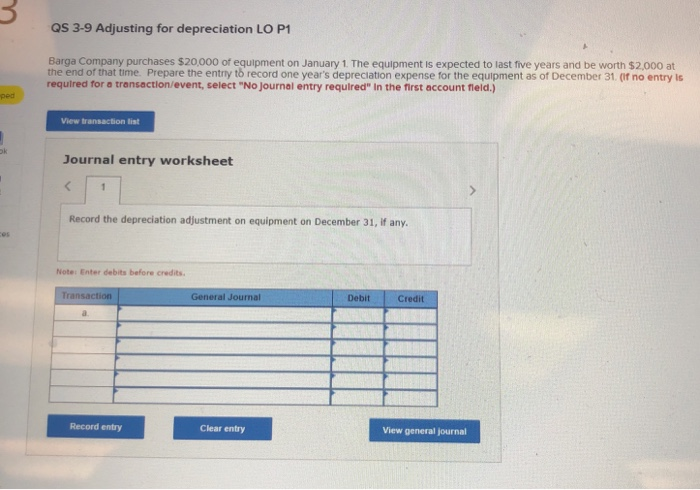

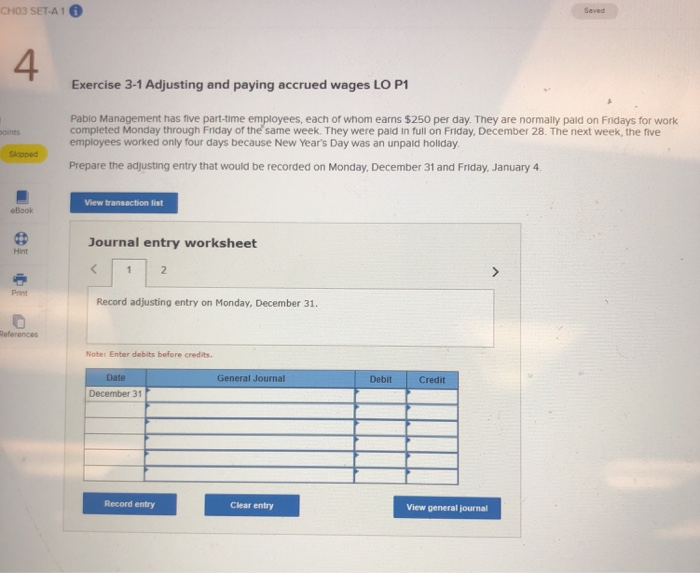

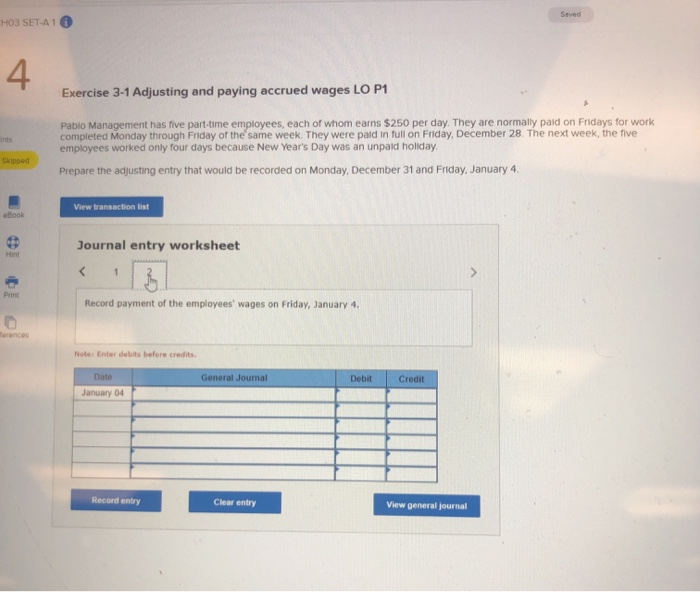

n QS 3-9 Adjusting for depreciation LO P1 Barga Company purchases $20,000 of equipment on January 1. The equipment is expected to last five years and be worth $2.000 at the end of that time. Prepare the entry to record one year's depreciation expense for the equipment as of December 31. (if no entry is required for a transaction event, select "No journal entry required in the first account field.) ped View transaction list Journal entry worksheet Record the depreciation adjustment on equipment on December 31, if any. Note: Enter debits before credits Transaction General Journal Debit Credit Record entry Clear entry View general journal CHOS SET-A1 Exercise 3-1 Adjusting and paying accrued wages LO P1 Pablo Management has five part-time employees, each of whom earns $250 per day. They are normally paid on Fridays for work completed Monday through Friday of the same week. They were paid in full on Friday, December 28. The next week, the five employees worked only four days because New Year's Day was an unpaid holiday Skloped Prepare the adjusting entry that would be recorded on Monday, December 31 and Friday, January 4 View transaction list Journal entry worksheet Pront Record adjusting entry on Monday, December 31. fence Notes Enter debits before credits General Journal Debit Credit December 31 Record entry Clear entry View general journal HO3 SET-A1 Exercise 3-1 Adjusting and paying accrued wages LO P1 Pablo Management has five part-time employees, each of whom earns $250 per day. They are normally paid on Fridays for work completed Monday through Friday of the same week. They were paid in full on Friday, December 28. The next week, the five employees worked only four days because New Year's Day was an unpaid holiday Skipood Prepare the adjusting entry that would be recorded on Monday, December 31 and Friday, January 4. View transaction list Book Journal entry worksheet Print Record payment of the employees' wages on Friday, January 4. rences Note: Enter debits before credits General Journal Debit Credit January 04 Record entry Clear entry View general journal