Answered step by step

Verified Expert Solution

Question

1 Approved Answer

N t W S X 36 command ng 1-Chap. 14 Working capital Current ratio E D Revenues C Expenses ) Acid-test ratio 1) Accounts receivable

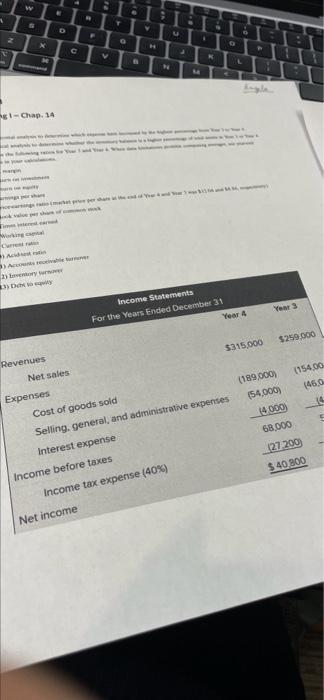

N t W S X 36 command ng 1-Chap. 14 Working capital Current ratio E D Revenues C Expenses ) Acid-test ratio 1) Accounts receivable turnover 2) Inventory turnover 13) Debt to equity Net sales R V N zontal analysis to determine which expense item increased by the highest percentage from Year 3 to Year 4. cal analysis to determine whether the inventory balance is a higher percentage of totall assets in Year 3 or Year 4 e the following ratios for Year 3 and Year 4. When data limitations prohibit computing averages, use yearend s in your calculations. Net income M margin turn on investment turn on equity arnings per share rice-earnings ratio (market price per share at the end of Year 4 and Year 3 was $12.04 and $8.86, respectively) ook value per share of common stock Times interest earned WALE K Income tax expense (40%) 750 Income Statements For the Years Ended December 31 O Angela Cost of goods sold Selling, general, and administrative expenses Interest expense Income before taxes Year 4 $315,000 Veli Year 3 $259,000 (189,000) (54,000) (4,000) 68,000 (154,00 (46,0 (4 (27,200) $ 40,800 21 F

" W D A X C V M gl-Chap. 14 ok value per sha Working capital Current rat Acidest rii Accounts receivable un 2) Inventory sur 3) Dich to equity Revenues 4 T M Y 3 . 9 9 " 4 K L 4 N LA Income Statements For the Years Ended December 31 Year 4 Year 3 Net sales $315,000 $259,000 Expenses Cost of goods sold (189,000) (154,00 Selling, general, and administrative expenses (54,000) (46,0 Interest expense (4.000) 14 Income before taxes 68,000 5 Income tax expense (40%) (27,200) $40,800 Net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started