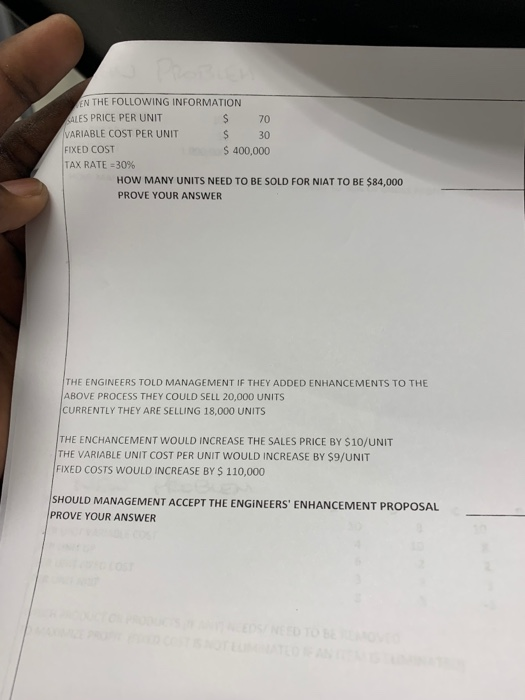

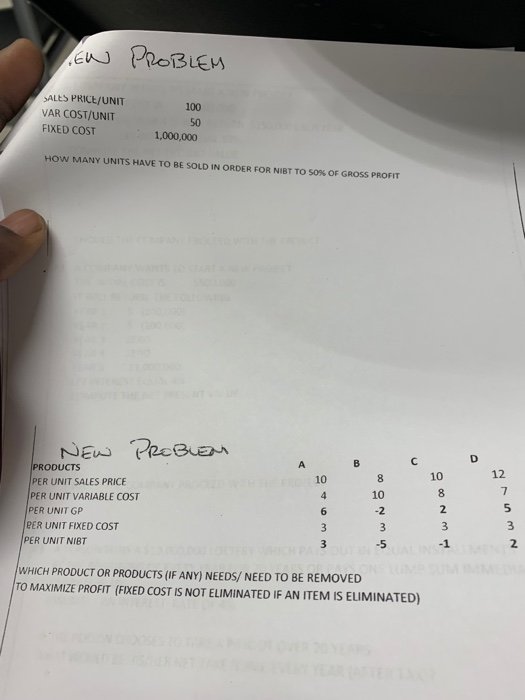

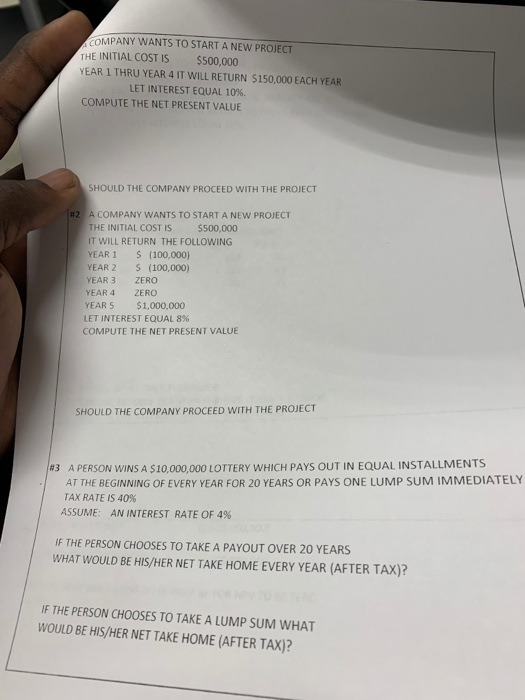

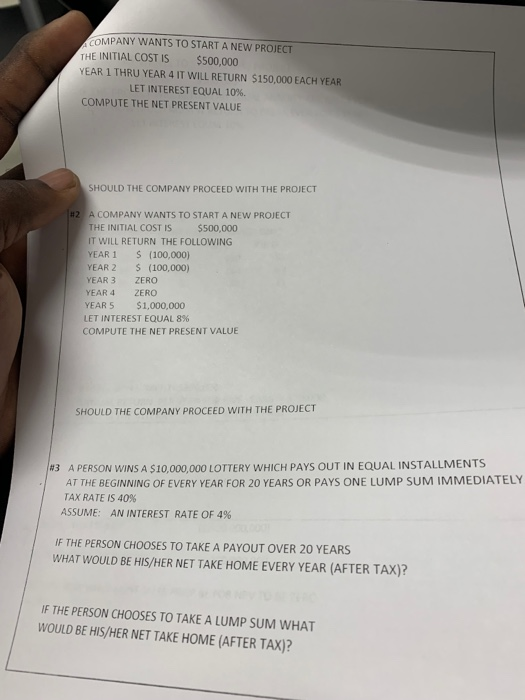

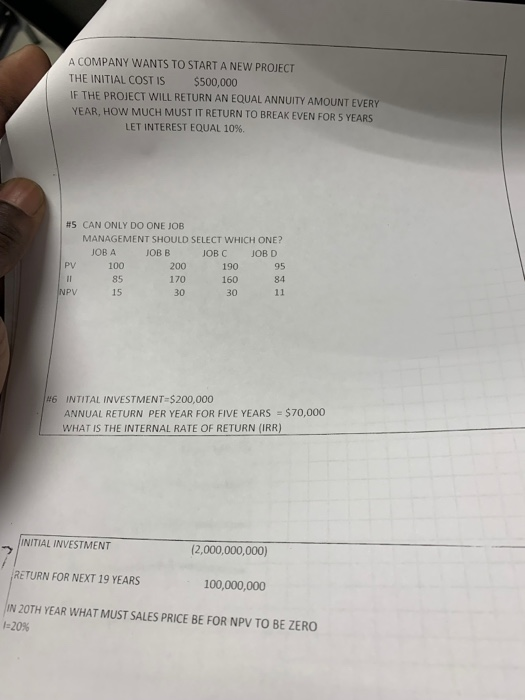

N THE FOLLOWING INFORMATION ES PRICE PER UNIT ARIABLE COST PER UNIT $ 70 $ 30 $400,000 FIXED COST TAX RATE-30% HOW MANY UNITS NEED TO BE SOLD FOR NIAT TO BE $84,000 PROVE YOUR ANSWER THE ENGINEERS TOLD MANAGEMENT IF THEY ADDED ENHANCEMENTS TO THE ABOVE PROCESS THEY COULD SELL 20,000 UNITS CURRENTLY THEY ARE SELLING 18,000 UNITS THE ENCHANCEMENT WOULD INCREASE THE SALES PRICE BY $10/UNIT THE VARIABLE UNIT COST PER UNIT WOULD INCREASE BY $9/UNIT FIXED COSTS WOULD INCREASE BY$ 110,000 SHOULD MANAGEMENT ACCEPT THE ENGINEERS, ENHANCEMENT PROPOSAL PROVE YOUR ANSWER ewo SALES PRICE/UNIT VAR COST/UNIT FIXED COST 100 50 1,000,000 HOW MANY UNITS HAVE TO BE SOLD IN ORDER FOR NIBT TO 50% OF GROSS PROFIT PRODUCTS PER UNIT SALES PRICE PER UNIT VARIABLE COST PER UNIT GP ER UNIT FIXED COST 12 10 8 2 8 10 -2 10 PER UNIT NIBT 2 WHICH PRODUCT OR PRODUCTS (IF ANY) NEEDS/ NEED TO BE REMOVED TO MAXIMIZE PROFIT (FIXED COST IS NOT ELIMINATED IF AN ITEM IS ELIMINATED) OMPANY WANTS TO START A NEW PROJECT THE INITIAL COST IS $500,000 YEAR 1 THRU YEAR 4 IT WILL RETURN $150,000 EACH YEAR LET INTEREST EQUAL 10%. COMPUTE THE NET PRESENT VALUE SHOULD THE COMPANY PROCEED WITH THE PROJECT #2 A COMPANY WANTS TO START A NEW PROJECT THE INITIAL COST IS $500,000 IT WILL RETURN THE FOLLOWING YEAR 1 (100,000) YEAR 2 (100,000) YEAR 3 ZERO YEAR 4 ZERO YEAR 5 $1,000,000 LET INTEREST EQUAL 8% COMPUTE THE NET PRESENT VALUE SHOULD THE COMPANY PROCEED WITH THE PROJECT A PERSON WINS AS10,000,000 LOTTERY WHICH PAYS OUT IN EQUAL INSTALLMENTS AT THE BEGINNING OF EVERY YEAR FOR 20 YEARS OR PAYS ONE LUMP SUM IMMEDIATELY TAX RATE IS 40% /#3 ASSUME: AN INTEREST RATE OF 4% IF THE PERSON CHOOSES TO TAKE A PAYOUT OVER 20 YEARS WHAT WOULD BE HIS/HER NET TAKE HOME EVERY YEAR (AFTER TAX)? IF THE PERSON CHOOSES TO TAKE A LUMP SUM WHAT WOULD BE HIS/HER NET TAKE HOME (AFTER TAX)? OMPANY WANTS TO START A NEW PROJECT THE INITIAL COST IS $500,000 YEAR 1 THRU YEAR 4 IT WILL RETURN $150,000 EACH YEAR LET INTEREST EQUAL 10%. COMPUTE THE NET PRESENT VALUE SHOULD THE COMPANY PROCEED WITH THE PROJECT #2 A COMPANY WANTS TO START A NEW PROJECT THE INITIAL COST IS $500,000 IT WILL RETURN THE FOLLOWING YEAR 1 (100,000) YEAR 2 (100,000) YEAR 3 ZERO YEAR 4 ZERO YEAR 5 $1,000,000 LET INTEREST EQUAL 8% COMPUTE THE NET PRESENT VALUE SHOULD THE COMPANY PROCEED WITH THE PROJECT A PERSON WINS AS10,000,000 LOTTERY WHICH PAYS OUT IN EQUAL INSTALLMENTS AT THE BEGINNING OF EVERY YEAR FOR 20 YEARS OR PAYS ONE LUMP SUM IMMEDIATELY TAX RATE IS 40% /#3 ASSUME: AN INTEREST RATE OF 4% IF THE PERSON CHOOSES TO TAKE A PAYOUT OVER 20 YEARS WHAT WOULD BE HIS/HER NET TAKE HOME EVERY YEAR (AFTER TAX)? IF THE PERSON CHOOSES TO TAKE A LUMP SUM WHAT WOULD BE HIS/HER NET TAKE HOME (AFTER TAX)? A COMPANY WANTS TO START A NEW PROJECT THE INITIAL COST IS $500,000 IF THE PROJECT WILL RETURN AN EQUAL ANNUITY AMOUNT EVERY YEAR, HOW MUCH MUST IT RETURN TO BREAK EVEN FOR 5 YEARS LET INTEREST EQUAL 10% #5 CAN ONLY DO ONE JOB MANAGEMENT SHOULD SELECT WHICH ONE? JOB A JOB B JOB CJOB D 100 85 NPV 15 PV 190 160 30 95 84 200 170 30 INTITALINVESTMENT-$200,000 ANNUAL RETURN PER YEAR FOR FIVE YEARS $70,000 WHAT IS THE INTERNAL RATE OF RETURN (IRR) #6 INITIAL INVESTMENT (2,000,000,000) RETURN FOR NEXT 19 YEARS 100,000,000 N 20TH YEAR WHAT MUST SALES PRICE BE FOR NPV TO BE ZERO 20%