Answered step by step

Verified Expert Solution

Question

1 Approved Answer

n ut of Antony and Cleopatra have been together for many years. They bought a home in their first year of marriage and currently have

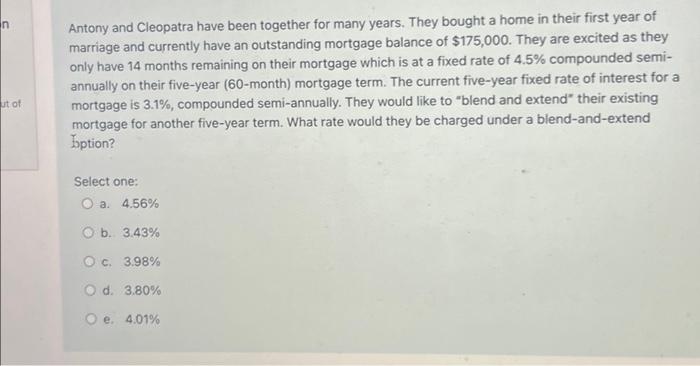

n ut of Antony and Cleopatra have been together for many years. They bought a home in their first year of marriage and currently have an outstanding mortgage balance of $175,000. They are excited as they only have 14 months remaining on their mortgage which is at a fixed rate of 4.5% compounded semi- annually on their five-year (60-month) mortgage term. The current five-year fixed rate of interest for a mortgage is 3.1%, compounded semi-annually. They would like to "blend and extend their existing mortgage for another five-year term. What rate would they be charged under a blend-and-extend Option? Select one: O a. 4.56% O b. 3.43% O c. 3.98% O d. 3.80% O e. 4.01%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started