Answered step by step

Verified Expert Solution

Question

1 Approved Answer

n6 Barok Manufacturing produces machine parts on a job-order basis. Most business is obtained through bidding. Most firms competing with Barok bid full cost plus

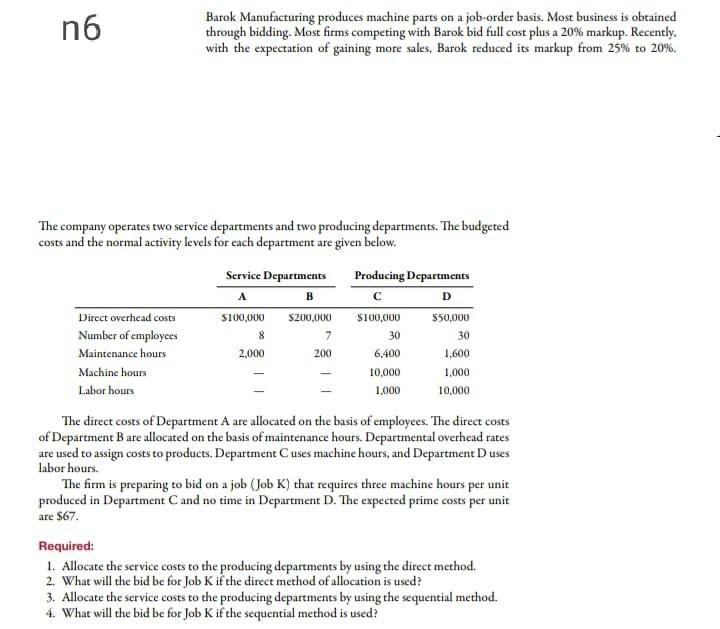

n6 Barok Manufacturing produces machine parts on a job-order basis. Most business is obtained through bidding. Most firms competing with Barok bid full cost plus a 20% markup. Recently. with the expectation of gaining more sales, Barok reduced its markup from 25% to 20%. The company operates two service departments and two producing departments . The budgeted costs and the normal activity levels for each department are given below. Service Departments Producing Departments A B D Direct overhead costs $100,000 S200,000 $100,000 $50,000 Number of employees 8 7 30 30 Maintenance hours 2.000 200 6,400 1.600 Machine hours 10,000 1.000 Labor hours 1,000 10,000 The direct costs of Department A are allocated on the basis of employees. The direct costs of Department B are allocated on the basis of maintenance hours. Departmental overhead rates are used to assign costs to products. Department Cuses machine hours, and Department Duses labor hours. The firm is preparing to bid on a job (Job K) that requires three machine hours per unit produced in Department C and no time in Department D. The expected prime costs per unit are $67. Required: 1. Allocate the service costs to the producing departments by using the direct method. 2. What will the bid be for Job Kif the direct method of allocation is used? 3. Allocate the service costs to the producing departments by using the sequential method. 4. What will the bid be for Job Kif the sequential method is used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started