Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Na commenced self-employment as a hairdresser on 1 January 2019. She had tax adjusted trading profits of 25,200 for the six-month period ended 30 June

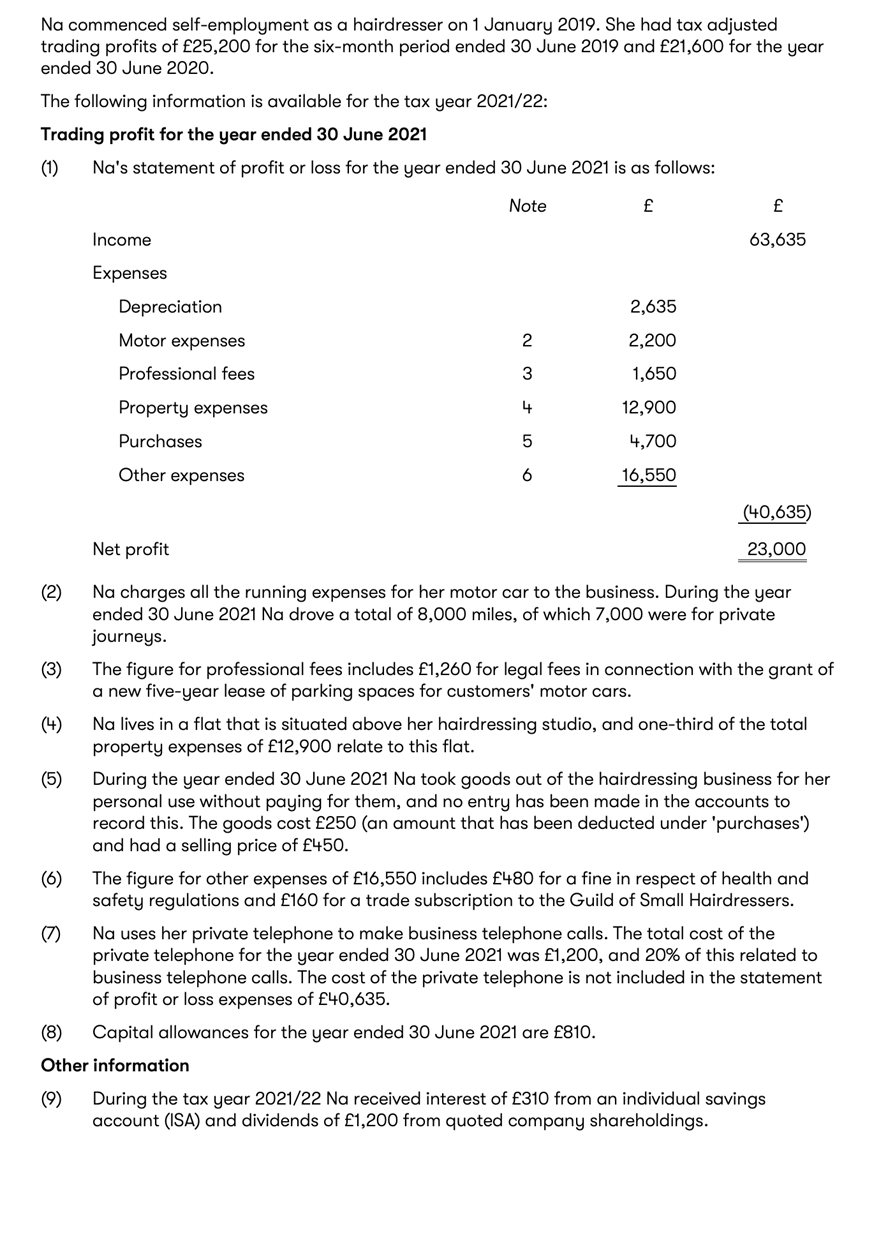

Na commenced self-employment as a hairdresser on 1 January 2019. She had tax adjusted trading profits of 25,200 for the six-month period ended 30 June 2019 and 21,600 for the year ended 30 June 2020. The following information is available for the tax year 2021/22: Trading profit for the year ended 30 June 2021 (1) Na's statement of profit or loss for the year ended 30 June 2021 is as follows: (4U,000) Net profit 23,000 (2) Na charges all the running expenses for her motor car to the business. During the year ended 30 June 2021 Na drove a total of 8,000 miles, of which 7,000 were for private journeys. (3) The figure for professional fees includes 1,260 for legal fees in connection with the grant of a new five-year lease of parking spaces for customers' motor cars. (4) Na lives in a flat that is situated above her hairdressing studio, and one-third of the total property expenses of 12,900 relate to this flat. (5) During the year ended 30 June 2021 Na took goods out of the hairdressing business for her personal use without paying for them, and no entry has been made in the accounts to record this. The goods cost 250 (an amount that has been deducted under 'purchases') and had a selling price of 450. (6) The figure for other expenses of 16,550 includes 480 for a fine in respect of health and safety regulations and 160 for a trade subscription to the Guild of Small Hairdressers. (7) Na uses her private telephone to make business telephone calls. The total cost of the private telephone for the year ended 30 June 2021 was 1,200, and 20% of this related to business telephone calls. The cost of the private telephone is not included in the statement of profit or loss expenses of 40,635. (8) Capital allowances for the year ended 30 June 2021 are 810. Other information (9) During the tax year 2021/22 Na received interest of 310 from an individual savings account (ISA) and dividends of 1,200 from quoted company shareholdings

Na commenced self-employment as a hairdresser on 1 January 2019. She had tax adjusted trading profits of 25,200 for the six-month period ended 30 June 2019 and 21,600 for the year ended 30 June 2020. The following information is available for the tax year 2021/22: Trading profit for the year ended 30 June 2021 (1) Na's statement of profit or loss for the year ended 30 June 2021 is as follows: (4U,000) Net profit 23,000 (2) Na charges all the running expenses for her motor car to the business. During the year ended 30 June 2021 Na drove a total of 8,000 miles, of which 7,000 were for private journeys. (3) The figure for professional fees includes 1,260 for legal fees in connection with the grant of a new five-year lease of parking spaces for customers' motor cars. (4) Na lives in a flat that is situated above her hairdressing studio, and one-third of the total property expenses of 12,900 relate to this flat. (5) During the year ended 30 June 2021 Na took goods out of the hairdressing business for her personal use without paying for them, and no entry has been made in the accounts to record this. The goods cost 250 (an amount that has been deducted under 'purchases') and had a selling price of 450. (6) The figure for other expenses of 16,550 includes 480 for a fine in respect of health and safety regulations and 160 for a trade subscription to the Guild of Small Hairdressers. (7) Na uses her private telephone to make business telephone calls. The total cost of the private telephone for the year ended 30 June 2021 was 1,200, and 20% of this related to business telephone calls. The cost of the private telephone is not included in the statement of profit or loss expenses of 40,635. (8) Capital allowances for the year ended 30 June 2021 are 810. Other information (9) During the tax year 2021/22 Na received interest of 310 from an individual savings account (ISA) and dividends of 1,200 from quoted company shareholdings Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started