Answered step by step

Verified Expert Solution

Question

1 Approved Answer

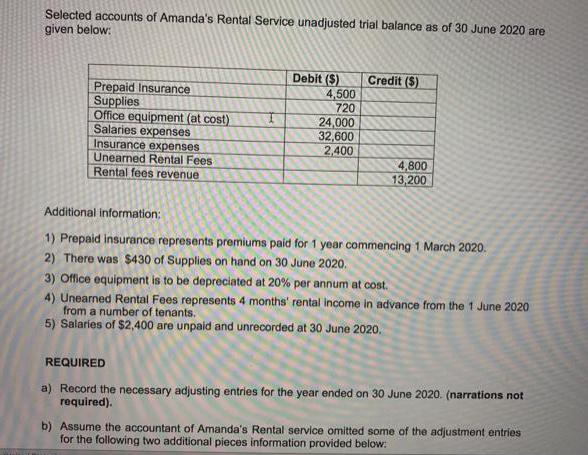

Selected accounts of Amanda's Rental Service unadjusted trial balance as of 30 June 2020 are given below: Debit ($) 4,500 720 24,000 32,600 2,400

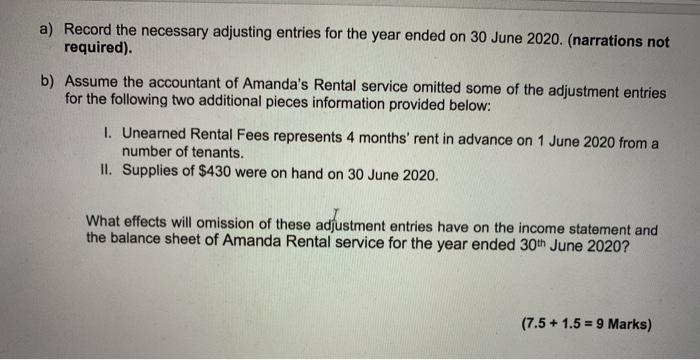

Selected accounts of Amanda's Rental Service unadjusted trial balance as of 30 June 2020 are given below: Debit ($) 4,500 720 24,000 32,600 2,400 Credit ($) Prepaid Insurance Supplies Office equipment (at cost) Salaries expenses Insurance expenses Unearned Rental Fees Rental fees revenue 4,800 13,200 Additional information: 1) Prepaid insurance represents premiums paid for 1 year commencing 1 March 2020. 2) There was $430 of Supplies on hand on 30 June 2020. 3) Office equipment is to be depreciated at 20% per annum at cost. 4) Unearned Rental Fees represents 4 months' rental income in advance from the 1 June 2020 from a number of tenants. 5) Salaries of $2,400 are unpaid and unrecorded at 30 June 2020, REQUIRED a) Record the necessary adjusting entries for the year ended on 30 June 2020. (narrations not required). b) Assume the accountant of Amanda's Rental service omitted some of the adjustment entries for the following two additional pieces information provided below: a) Record the necessary adjusting entries for the year ended on 30 June 2020. (narrations not required). b) Assume the accountant of Amanda's Rental service omitted some of the adjustment entries for the following two additional pieces information provided below: I. Unearned Rental Fees represents 4 months' rent in advance on 1 June 2020 from a number of tenants. II. Supplies of $430 were on hand on 30 June 2020. What effects will omission of these adjustment entries have on the income statement and the balance sheet of Amanda Rental service for the year ended 30th June 2020? (7.5 + 1.5 = 9 Marks)

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Adjusting entries AMANDAS ART SUPPLIES General Journal Date Particulars Debit Credit June 30 Insur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started