Question

Naglaa Ltd is a medium-sized company producing thick wool blankets. Budgeted and actual information about the best-selling blanket, 'MEEDCO' is shown below. Since budget preparation

Naglaa Ltd is a medium-sized company producing thick wool blankets.

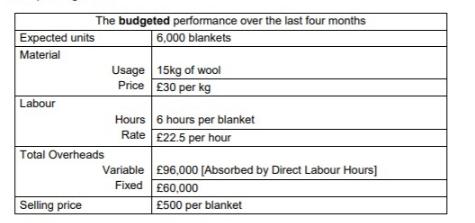

Budgeted and actual information about the best-selling blanket, 'MEEDCO' is shown below. Since budget preparation four months ago, the company discovered serious problems in sales and operating costs.

The actual performance over the last four months revealed the following:

a. Naglaa Ltd produced and sold 4,500 blankets.

b. Sales revenue was £2,625,000.

c. 54,000kgs of wool were bought and used at a cost of £1,296,000.

d. Total direct labour cost was £755,628 for 31,000 hours. This includes 1500 idle hours, caused by machine's breakdown.

e. Total variable overhead was £104,625 and total fixed overhead was £67,500.

a) Produce a statement reconciling the flexed budgeted profit/loss to the actual profit/loss for the last four months. (30 marks)

b) Calculate with supporting formulas the appropriate operating variances. (30 marks)

c) From your point of view, identify a reasonable cause for each variance. (10 marks)

The budgeted performance over the last four months Expected units Material 6,000 blankets Usage 15kg of wool Price E30 per kg Labour Hours 6 hours per blanket Rate E225 per hour Total Overheads Variable 96,000 [Absorbed by Direct Labour Hours] Fixed 60,000 Selling price 500 per blanket

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Expected units6000 Blankets Budgeted amounts material per unit3015450 Labour per unit 2256135 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started