Question

Naheed Qureshi recently graduated with an MBA in finance and has just been hired as a special assistant to Lateef Qureshi who is the director

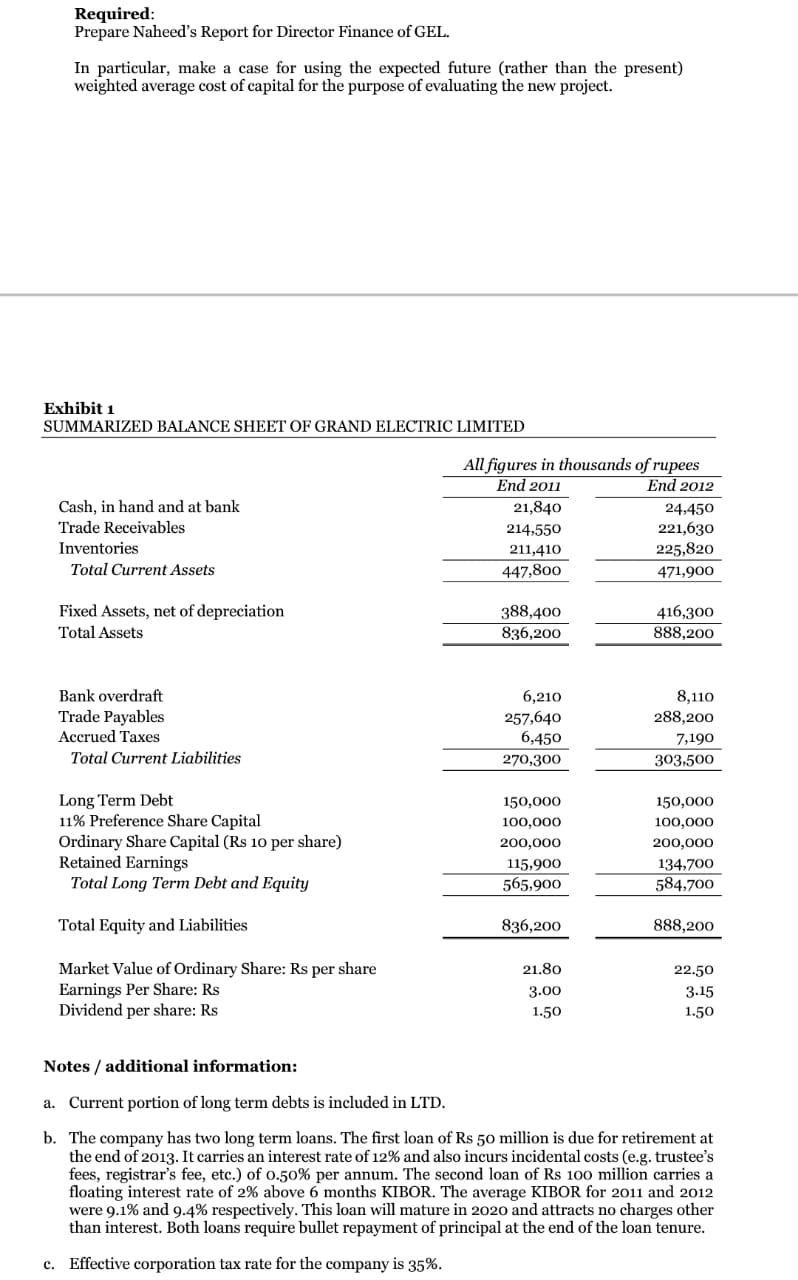

Naheed Qureshi recently graduated with an MBA in finance and has just been hired as a special assistant to Lateef Qureshi who is the director finance and a major shareholder of Grand Electric Group Ltd. It is a mere coincidence that Lateef Qureshi happens to be her paternal uncle and the companys chairman, Kamal Qureshi is her father. Grand Electric Group Ltd (GEL) is one of countrys better established companies operating in the field of electrical goods. It has an interesting history. It was started by Jamal Qureshi, the father of the current chairman, some 35 years ago as a small wholesale concern that was distributing electrical equipment for household use like irons, vacuum cleaners, food mixers, etc. He did well in his business and soon set up a private li mited company to start assembling household electrical equipment. Later he acquired another company that was manufacturing electric cables in a factory in Hattar Industrial Estate. A few years later, they ventured into manufacture of electric lighting item s, table and floor lamps and other similar fixtures. The original company that was dealing in wholesale business was also converted in a private limited company but it moved on to deal in larger items like generators, transmitters, etc. Some eight years ag o, Kamal Qureshi took over as the chairman of the group and restructured the whole business. He formed a public limited company, to be called Grand Electric Ltd (GEL), liquidated all other businesses and brought their assets under the new company. Later, GEL was listed at the Karachi Stock Exchange. The Qureshi family still holds over 60% of the companys outstanding shares, the rest are held by public at large. The company has four principal divisions: 1. Home Appliances Division that assembles home appli ances and markets them through a network of appointed distributors in all parts of the country. It has a fairly well established brand name of Grand. 2. 3. 4. Cables Division that manufactures electric cables and extension wires etc. for household, commercial and industrial use. Lighting Division manufactures a range of lighting fixtures, table lamps, roof lamps, etc. Distribution Division that specializes in sale/import and maintenance of larger electrical equipment like transmitters, generators, etc. GELs financial position over the last two years is given as Exhibit I. As a first exercise, Naheed was asked by Lateef Qureshi to study Exhibit I with one particular objective: to assess its present Weighted Average Cost of Capital (WACC). As Lateef Qureshi explained to her, the company had last computed its WACC some six years ago and since that time, the same rate has been used for evaluating all their investment decisions. Naheed was a bit alarmed at this revelation. She immediately proposed that the company should not use historical WACC for the purpose of evaluating the capital projects; in fact it should not even use its current WACC for this purpose. Instead it must compute WACC on the basis of the expected cost of each component of capital over the duration of the proposed project. Lateef Quresh was not entirely convinced if evaluating capital projects on the basis of an estimate of the future capital costs was a good idea. The company is currently pondering over two important financial decisions: the first is the retirement of a long term loan of Rs 50 million that is due to be repaid in full at the end of 2013 and the second is to invest about Rs 75 million in setting up a new division in the company to manufacture electrical switches and related items. He asks Naheed to work out the following: a. What is the cost of companys equity shares at present, i.e. at the end of 2012? b. What the companys weight average cost of capital at present? c. What would be the companys WACC if the company liquidates the long term loan that is due for retirement at the end of 2013 and replaces it by: i. Additional equity (through a rights issue)? ii. A new loan carrying the same rate of interest as applicable to the other long term loan? (Note: you will need to estimate KIBOR for the next five or so years) d. If the company decides to make a rights issue, how big an issue will it need to fully pay off the first long term loan? e. What WACC should the company use to evaluate the new investment in switches division? Naheed promised to prepare a formal report within one week. She is determined to prove, through use of actual facts and figures as well references to financial theories that using the past WACC is not appropriate to a growing company. She believes that one can forecast the future cost of funds to same degree of accuracy as one can forecast a projects future cash flows.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started