Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nailed It ! Construction ( Nailed It ! or the Company ) , an SEC registrant, is a construction company that manufactures commercial and residential

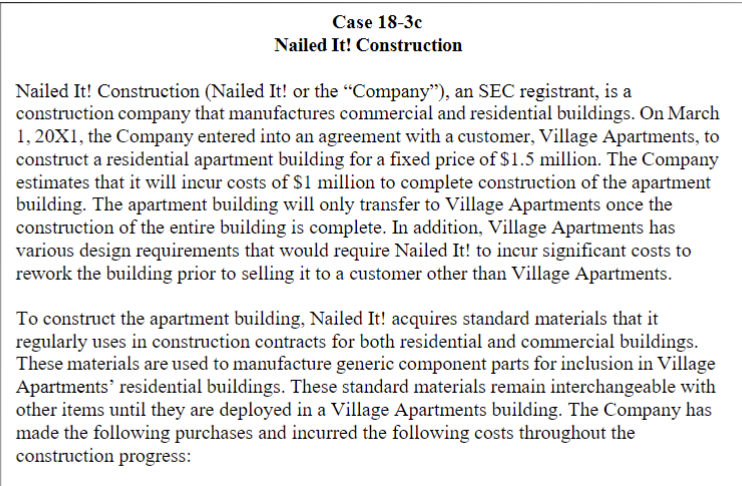

Nailed It Construction Nailed It or the Company an SEC registrant, is a

construction company that manufactures commercial and residential buildings. On March

X the Company entered into an agreement with a customer, Village Apartments, to

construct a residential apartment building for a fixed price of $ million. The Company

estimates that it will incur costs of $ million to complete construction of the apartment

building. The apartment building will only transfer to Village Apartments once the

construction of the entire building is complete. In addition, Village Apartments has

various design requirements that would require Nailed It to incur significant costs to

rework the building prior to selling it to a customer other than Village Apartments.

To construct the apartment building, Nailed It acquires standard materials that it

regularly uses in construction contracts for both residential and commercial buildings.

These materials are used to manufacture generic component parts for inclusion in Village

Apartments residential buildings. These standard materials remain interchangeable with

other items until they are deployed in a Village Apartments building. The Company has

made the following purchases and incurred the following costs throughout the

construction progress:

As of June X in total, Nailed It has purchased $ of component

parts. As of June X $ of component parts remain in inventory and

$ have been integrated into the project. Further, Nailed It has incurred

$ of direct costs to integrate the component parts into the Village

Apartments construction project during the three months ended June X

During the three months ended September X Nailed It purchased an

additional $ of component parts $ in total Of the $ of

component parts, $ remain in inventory and $ have been

integrated into the project during the three months ended September X

$ have been integrated into the project during the six months ended

September X During the three months ended September X

Nailed It incurred an additional $ of direct costs to integrate the

component parts into the Village Apartments construction project.

As of September X Nailed It determined that the project was over budget

and revised its cost estimate from $ million to $ million.

As of December X the construction project was completed. During the

three months ended December X Nailed It purchased an additional

$ of generic component parts $ million in total Of the $ million

component parts, $ remain in inventory and $ were integrated into the

project during the three months ended December Xall $ have

been integrated into the project during the year ended December X

Nailed It has incurred $ of direct costs to integrate the component parts

into the Village Apartments construction project during the three months ended

December X

If Village Apartments cancels the contract, Nailed It will be entitled to reimbursement

for costs incurred for work completed to date plus a margin of percent, which is

considered to be a reasonable margin. Nailed It will not be reimbursed for any materials

that have been purchased for use in the contract but have not yet been used and are still

controlled by Nailed It

Required:

Does the performance obligation meet any of the criteria for recognition of

revenue over time?

How should the entity recognize revenue for the satisfaction of its performance

obligation? What amount of revenue should be recognized for the following

periods:

a The three months ended June X

b The three months ended September X

c The three months ended December X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started