Answered step by step

Verified Expert Solution

Question

1 Approved Answer

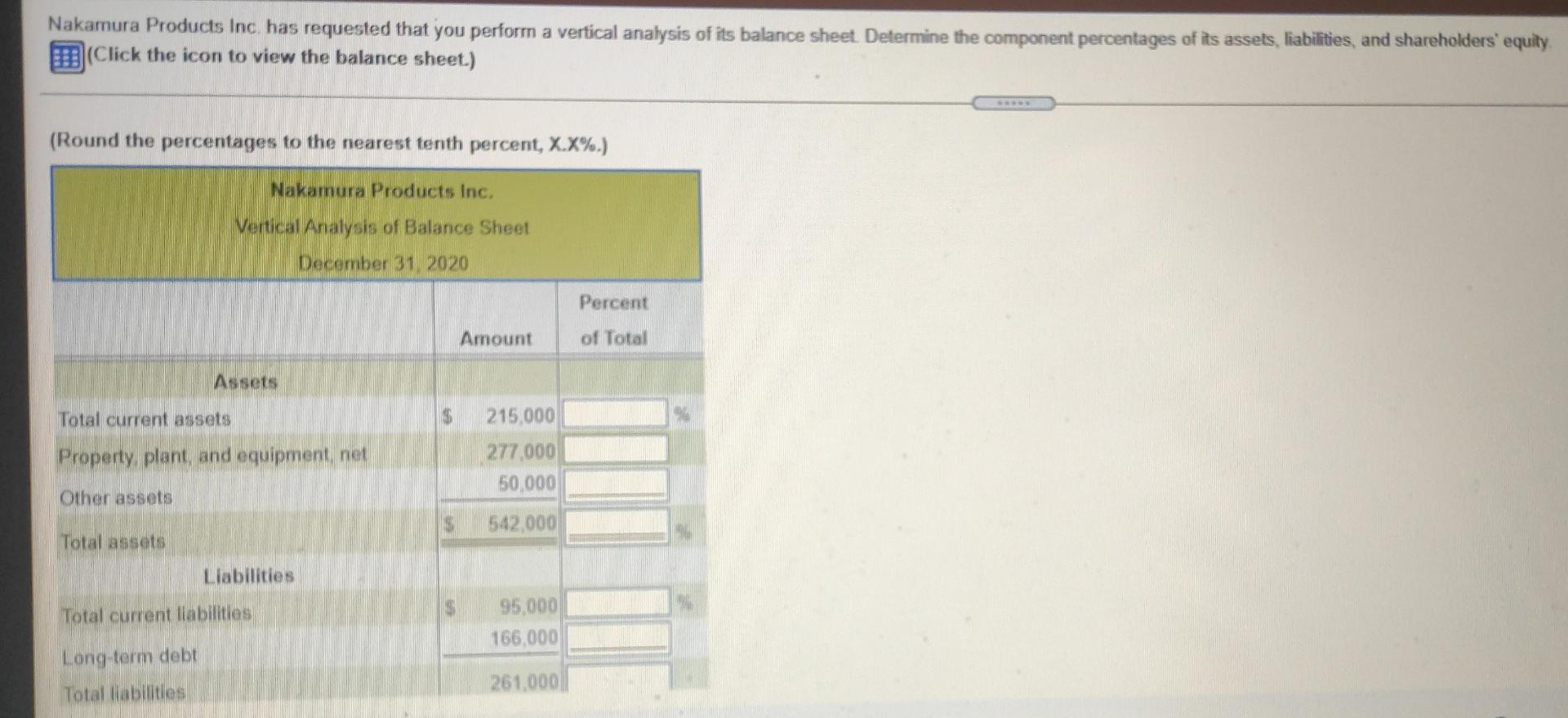

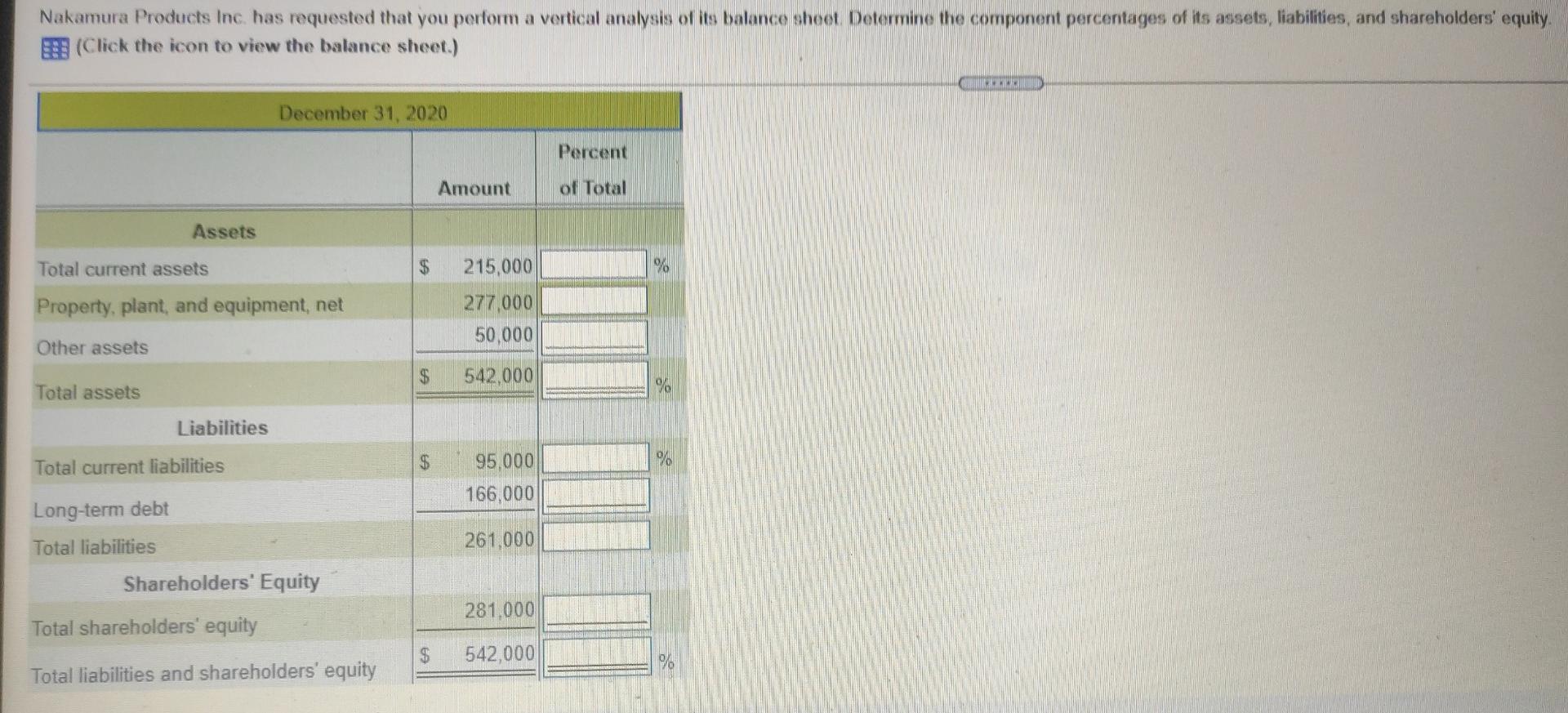

Nakamura Products Inc has requested that you perform a vertical analysis of its balance sheet. Determine the component percentages of its assets, liabilities, and shareholders'

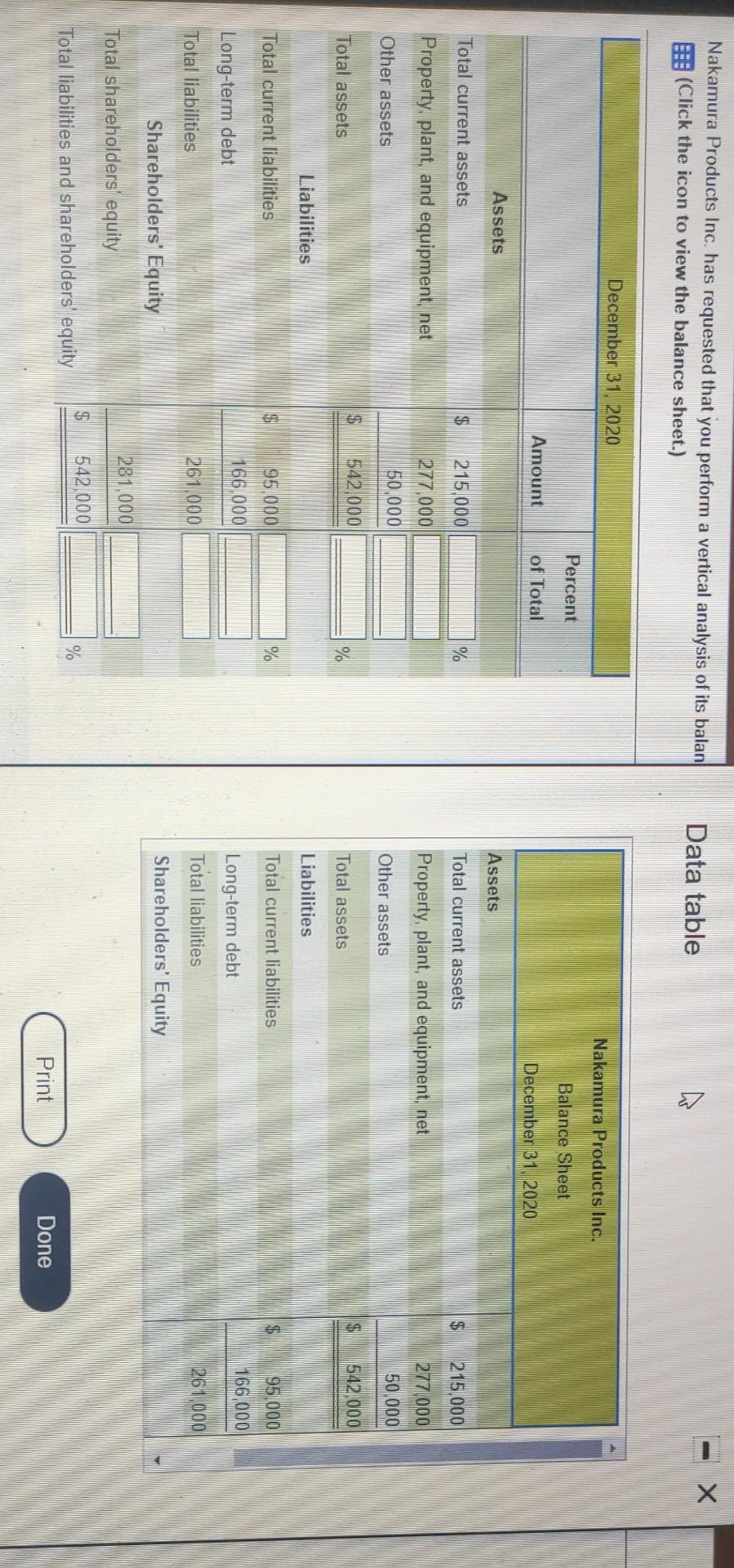

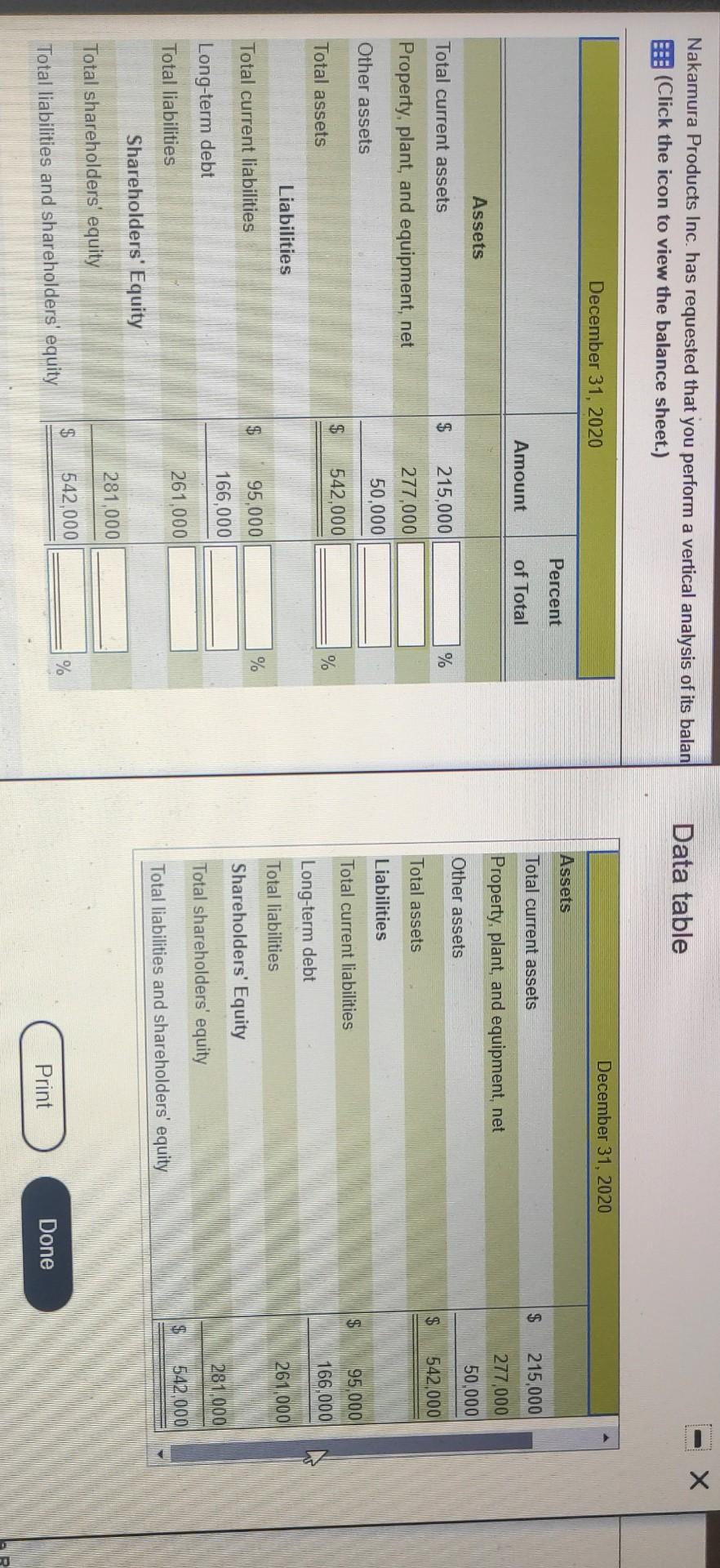

Nakamura Products Inc has requested that you perform a vertical analysis of its balance sheet. Determine the component percentages of its assets, liabilities, and shareholders' equity D(Click the icon to view the balance sheet.) (Round the percentages to the nearest tenth percent, X.X%.) Nakamura Products Inc. Vertical Analysis of Balance Sheet December 31, 2020 Percent Amount of Total Assets Total current assets Property, plant, and equipment, net 215,000 277,000 50,000 Other assets 542.000 Total assets Liabilities Total current llabilities 95.000 166,000 Long-term debt Total liabilities 261.000 Nakamura Products Inc has requested that you perform a vertical analysis of its balance shoot Determine the component percentages of its assets, liabilities, and shareholders' equity (Click the icon to view the balance sheet.) December 31, 2020 Percent Amount of Total Assets Total current assets $ 215,000 Property, plant, and equipment, net 277000 50,000 Other assets $ 542.000 Total assets 9 Liabilities $ Total current liabilities 18 95.000 166,000 Long-term debt Total liabilities 261,000 Shareholders' Equity 281,000 Total shareholders' equity $ 542,000 % Total liabilities and shareholders' equity Nakamura Products Inc. has requested that you perform a vertical analysis of its balan (Click the icon to view the balance sheet.) Data table A December 31, 2020 Nakamura Products Inc. Percent Balance Sheet Amount of Total December 31, 2020 Assets Assets Total current assets $ 215,000 % Total current assets $ Property, plant, and equipment, net Property, plant, and equipment net 277 000 50.000 215,000 277000 50,000 Other assets Other assets $ 542.000 $ 542 000 Total assets % Total assets Liabilities Liabilities Total current liabilities 9 95.000 % Total current liabilities 95.000 166.000 166.000 Long-term debt Long-term debt Total liabilities 261.000 Total liabilities 26000 Shareholders' Equity Shareholders' Equity 281.000 Total shareholders equity $ 542 000 % Total liabilities and shareholders' equity Print Done Nakamura Products Inc. has requested that you perform a vertical analysis of its balan (Click the icon to view the balance sheet.) Data table December 31, 2020 December 31, 2020 Assets Percent Total current assets $ 215,000 Amount of Total Property, plant, and equipment, net Assets 277,000 50.000 Other assets Total current assets $ % $ 542,000 215,000 277,000 50,000 Total assets Property, plant, and equipment, net Liabilities Other assets Total current liabilities $ $ 542,000 95,000 166,000 Total assets % Long-term debt Liabilities 261 000 Total liabilities Total current liabilities EA % 95,000 Shareholders' Equity 166,000 281.000 Long-term debt Total shareholders' equity $ 261 000 Total liabilities 542.000 Total liabilities and shareholders' equity Shareholders' Equity 281,000 Total shareholders' equity S 542,000 % Total liabilities and shareholders equity Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started