Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NAL INFORMATION If you need to make a quick edit before renewing your subscription, learn more about the Office Web Apps. Learn More Chapter 6

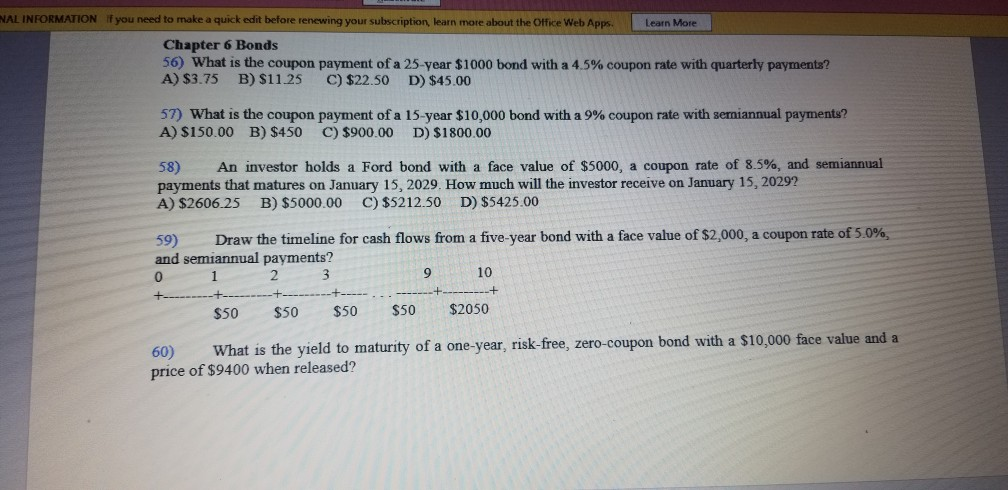

NAL INFORMATION If you need to make a quick edit before renewing your subscription, learn more about the Office Web Apps. Learn More Chapter 6 Bonds 56) What is the coupon payment of a 25-year $1000 bond with a 4.5% coupon rate with quarterly payments? A) $3.75 B) $11.25 C) $22.50 D) $45.00 57) What is the coupon payment of a 15-year $10,000 bond with a 9% coupon rate with semiannual payments? A) $150.00 B) $450 C) $900.00 D) $1800.00 58) An investor holds a Ford bond with a face value of $5000, a coupon rate of 8.5%, and semiannual payments that matures on January 15, 2029. How much will the investor receive on January 15, 20292 A) $2606.25 B) $5000.00 C) $5212.50 D) $5425.00 59) Draw the timeline for cash flows from a five-year bond with a face value of $2,000, a coupon rate of 5.0% and semiannual payments? 0 1 2 3 9 10 +-------+--- -+- $50 $50 $50 $50 $2050 60) What is the yield to maturity of a one-year risk-free, zero-coupon bond with a $10,000 face value and a price of $9400 when released

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started