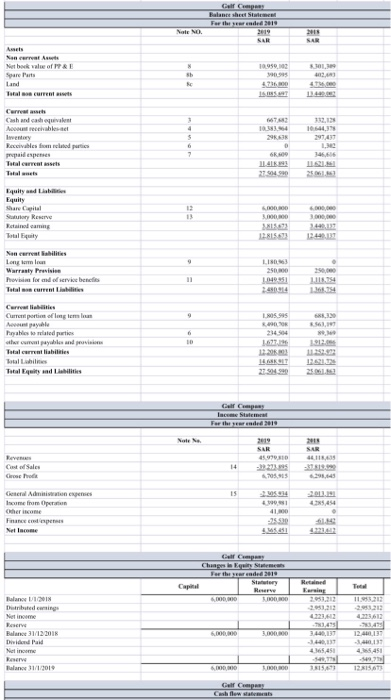

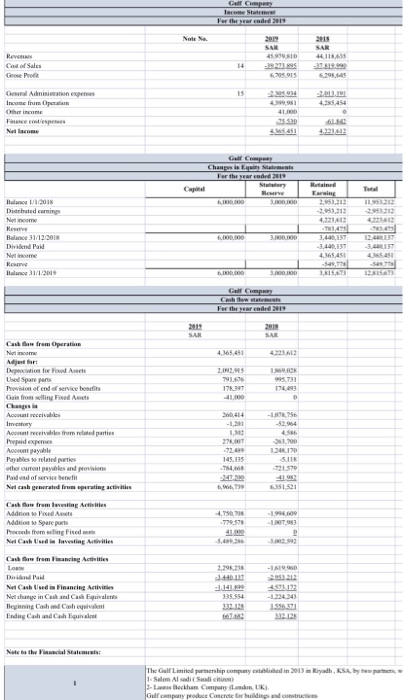

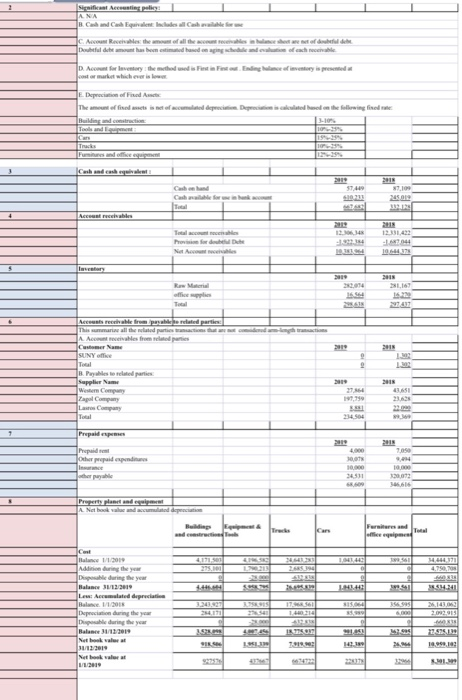

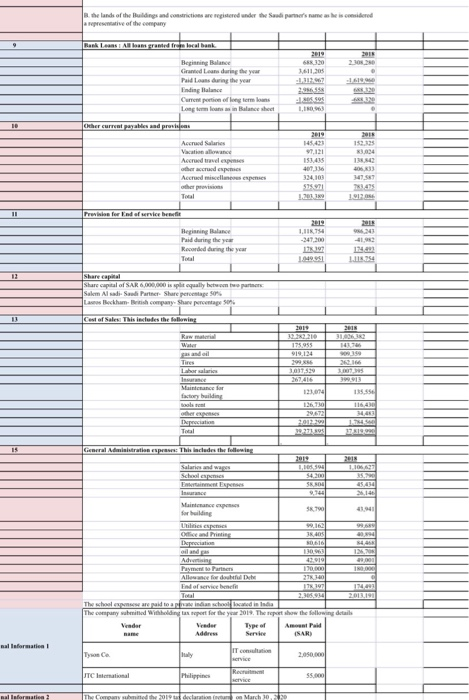

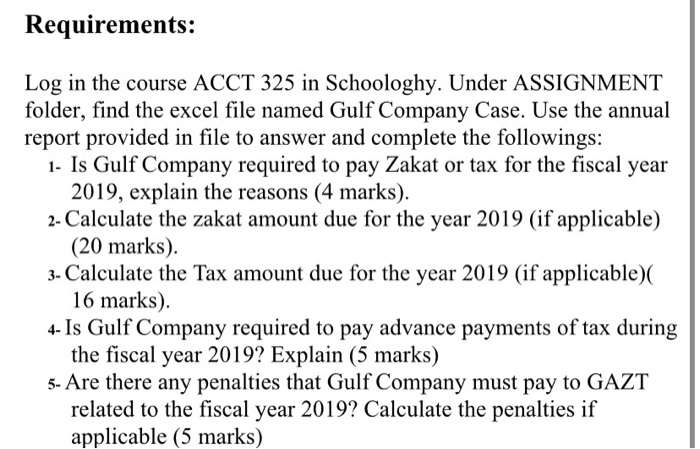

Nam Nu bekal af Chand taly L WP h and be Com Avale 361 21404 16 1012 Ta l iabilis IRAN Totality and C ole LUGH 11815893 Sales CA 1111 4.6.451 Adri Spare parts ofend of wivice na + A m parties Para Power N ordrering af 21 Ad AS homwa h Nu Cash wit Cand BCC 1 335 554 edin 2013 Radh KSA The Gulf Limerensip 1. Aldia - Tastam in Gulf c o ncrete for building 25 A A lfred Supplem LLLLLLL L Pand they ILAR 4.336 SI 1211 Hegge Paid during the Recorded during the year 1124 to SAR6,000,000 is split equally how Salum Ali Saar Share proper Cost of Sales This includes the following 123014 elelaldeli M T ec Requirements: Log in the course ACCT 325 in Schoologhy. Under ASSIGNMENT folder, find the excel file named Gulf Company Case. Use the annual report provided in file to answer and complete the followings: 1. Is Gulf Company required to pay Zakat or tax for the fiscal year 2019, explain the reasons (4 marks). 2- Calculate the zakat amount due for the year 2019 (if applicable) (20 marks). 3- Calculate the Tax amount due for the year 2019 (if applicable)( 16 marks). 4- Is Gulf Company required to pay advance payments of tax during the fiscal year 2019? Explain (5 marks) 5- Are there any penalties that Gulf Company must pay to GAZT related to the fiscal year 2019? Calculate the penalties if applicable (5 marks) Nam Nu bekal af Chand taly L WP h and be Com Avale 361 21404 16 1012 Ta l iabilis IRAN Totality and C ole LUGH 11815893 Sales CA 1111 4.6.451 Adri Spare parts ofend of wivice na + A m parties Para Power N ordrering af 21 Ad AS homwa h Nu Cash wit Cand BCC 1 335 554 edin 2013 Radh KSA The Gulf Limerensip 1. Aldia - Tastam in Gulf c o ncrete for building 25 A A lfred Supplem LLLLLLL L Pand they ILAR 4.336 SI 1211 Hegge Paid during the Recorded during the year 1124 to SAR6,000,000 is split equally how Salum Ali Saar Share proper Cost of Sales This includes the following 123014 elelaldeli M T ec Requirements: Log in the course ACCT 325 in Schoologhy. Under ASSIGNMENT folder, find the excel file named Gulf Company Case. Use the annual report provided in file to answer and complete the followings: 1. Is Gulf Company required to pay Zakat or tax for the fiscal year 2019, explain the reasons (4 marks). 2- Calculate the zakat amount due for the year 2019 (if applicable) (20 marks). 3- Calculate the Tax amount due for the year 2019 (if applicable)( 16 marks). 4- Is Gulf Company required to pay advance payments of tax during the fiscal year 2019? Explain (5 marks) 5- Are there any penalties that Gulf Company must pay to GAZT related to the fiscal year 2019? Calculate the penalties if applicable