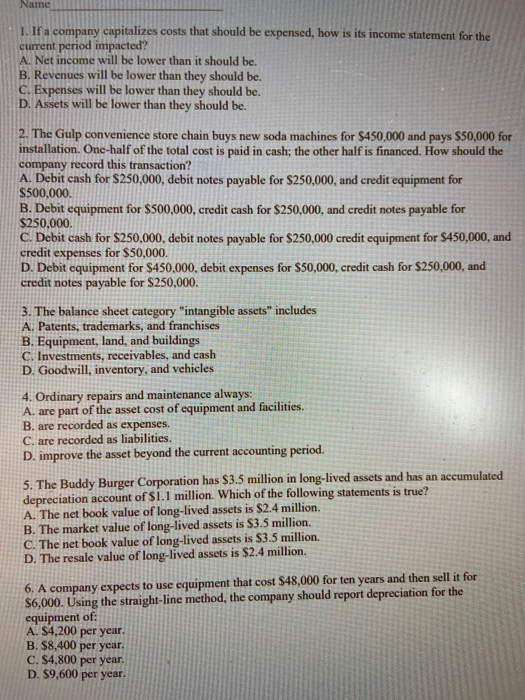

Name 1. If a company capitalizes costs that should be expensed, how is its income statement for the current period impacted? A. Net income will be lower than it should be. B. Revenues will be lower than they should be. C. Expenses will be lower than they should be. D. Assets will be lower than they should be. 2. The Gulp convenience store chain buys new soda machines for $450,000 and pays $50,000 for installation. One-half of the total cost is paid in cash; the other half is financed. How should the company record this transaction? A. Debit cash for $250,000, debit notes payable for $250,000, and credit equipment for $500,000 B. Debit equipment for $500,000, credit cash for $250,000, and credit notes payable for $250,000. C. Debit cash for $250,000, debit notes payable for $250,000 credit equipment for $450,000, and credit expenses for $50,000. D. Debit equipment for $450,000, debit expenses for $50,000, credit cash for $250,000, and credit notes payable for $250,000. 3. The balance sheet category "intangible assets" includes A. Patents, trademarks, and franchises B. Equipment, land, and buildings C. Investments, receivables, and cash D. Goodwill, inventory, and vehicles 4. Ordinary repairs and maintenance always: A. are part of the asset cost of equipment and facilities. B. are recorded as expenses. C. are recorded as liabilities. D. improve the asset beyond the current accounting period. 5. The Buddy Burger Corporation has $3.5 million in long-lived assets and has an accumulated depreciation account of $1.1 million. Which of the following statements is true? A. The net book value of long-lived assets is $2.4 million. B. The market value of long-lived assets is $3.5 million. C. The net book value of long-lived assets is $3.5 million. D. The resale value of long-lived assets is $2.4 million. 6. A company expects to use equipment that cost $48,000 for ten years and then sell it for $6,000. Using the straight-line method, the company should report depreciation for the equipment of: A. $4,200 per year. B. $8,400 per year. C. $4,800 per year. D. $9,600 per year