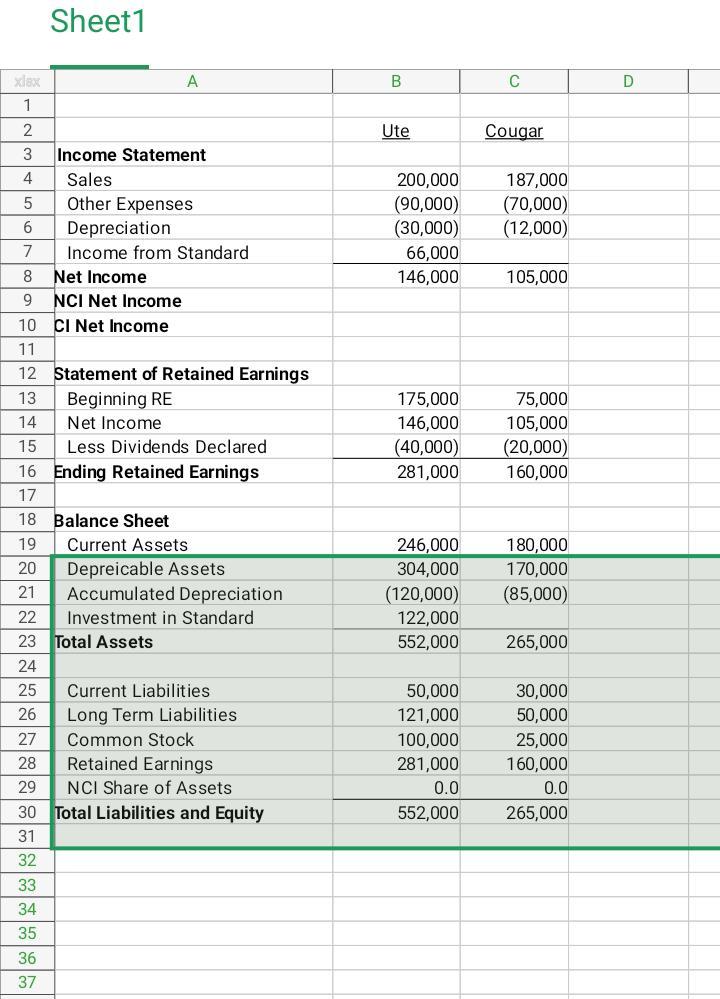

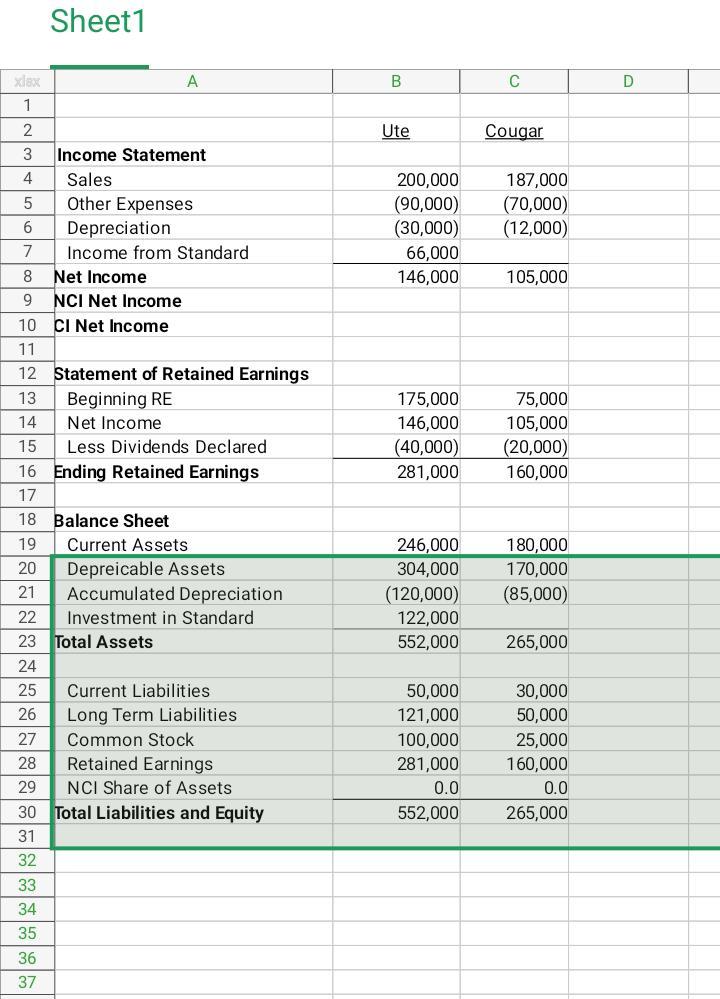

Name 1.On January 1, 2009, Ute Company acquired 70 percent of Cougar Company's common shares at the underlying book value. Ute paid $70,000 for the 70% ownership. Ute uses the equity method in accounting for its ownership of Standard. During the year, Ute sold $200K inventory to Cougar. Ute's original price on the inventory was $150K. At the end of the year Cougar had $30K in ending inventory. a Prepare all the equity and eliminating entries needed as of December 31, 20X9, and complete the attached consolidated worksheet. Sheet1 B D Ute Cougar 200,000 (90,000) (30,000) 66,000 146,000 187,000 (70,000) (12,000) 105,000 175,000 146,000 (40,000) 281,000 75,000 105,000 (20,000) 160,000 A 1 2 3 Income Statement 4 Sales 5 Other Expenses 6 Depreciation 7 Income from Standard 8 Net Income 9 NCI Net Income 10 CI Net Income 11 12 Statement of Retained Earnings 13 Beginning RE 14 Net Income 15 Less Dividends Declared 16 Ending Retained Earnings 17 18 Balance Sheet 19 Current Assets 20 Depreicable Assets 21 Accumulated Depreciation 22 Investment in Standard 23 Total Assets 24 25 Current Liabilities 26 Long Term Liabilities 27 Common Stock 28 Retained Earnings 29 NCI Share of Assets 30 Total Liabilities and Equity 31 32 33 246,000 304,000 (120,000) 122,000 552,000 180,000 170,000 (85,000) 265,000 50,000 121,000 100,000 281,000 0.0 552,000 30,000 50,000 25,000 160,000 0.0 265,000 34 35 36 37 Name 1.On January 1, 2009, Ute Company acquired 70 percent of Cougar Company's common shares at the underlying book value. Ute paid $70,000 for the 70% ownership. Ute uses the equity method in accounting for its ownership of Standard. During the year, Ute sold $200K inventory to Cougar. Ute's original price on the inventory was $150K. At the end of the year Cougar had $30K in ending inventory. a Prepare all the equity and eliminating entries needed as of December 31, 20X9, and complete the attached consolidated worksheet. Sheet1 B D Ute Cougar 200,000 (90,000) (30,000) 66,000 146,000 187,000 (70,000) (12,000) 105,000 175,000 146,000 (40,000) 281,000 75,000 105,000 (20,000) 160,000 A 1 2 3 Income Statement 4 Sales 5 Other Expenses 6 Depreciation 7 Income from Standard 8 Net Income 9 NCI Net Income 10 CI Net Income 11 12 Statement of Retained Earnings 13 Beginning RE 14 Net Income 15 Less Dividends Declared 16 Ending Retained Earnings 17 18 Balance Sheet 19 Current Assets 20 Depreicable Assets 21 Accumulated Depreciation 22 Investment in Standard 23 Total Assets 24 25 Current Liabilities 26 Long Term Liabilities 27 Common Stock 28 Retained Earnings 29 NCI Share of Assets 30 Total Liabilities and Equity 31 32 33 246,000 304,000 (120,000) 122,000 552,000 180,000 170,000 (85,000) 265,000 50,000 121,000 100,000 281,000 0.0 552,000 30,000 50,000 25,000 160,000 0.0 265,000 34 35 36 37