Answered step by step

Verified Expert Solution

Question

1 Approved Answer

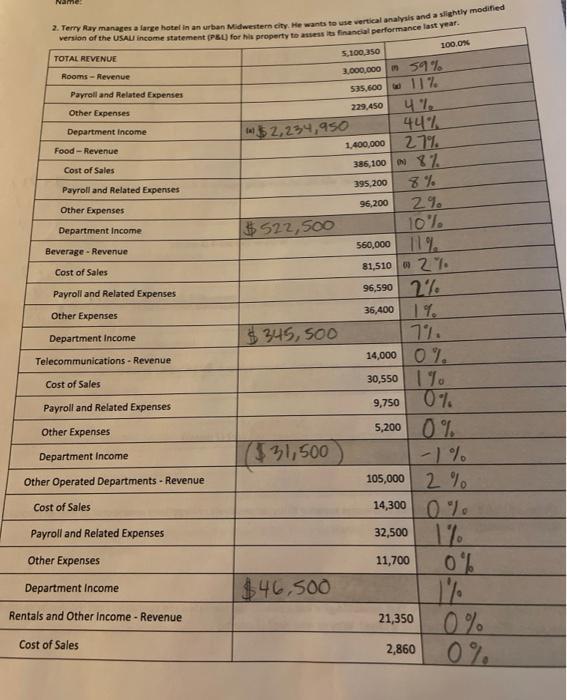

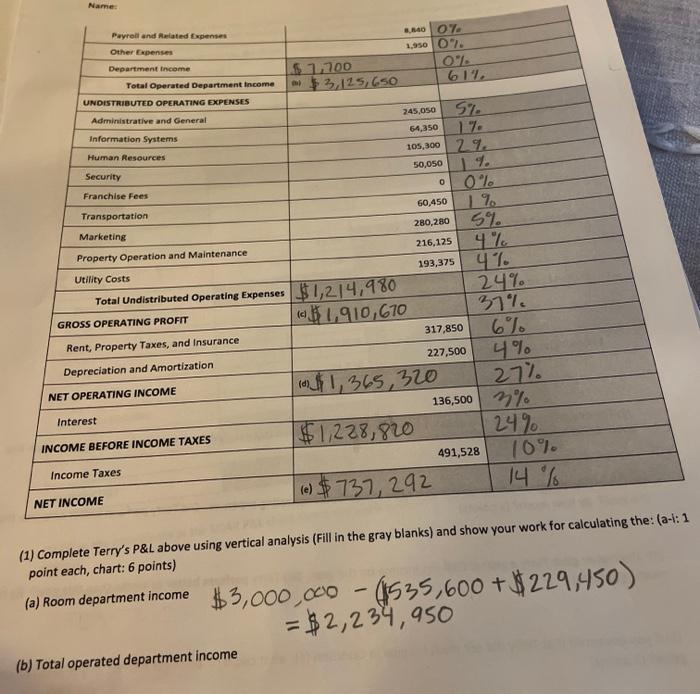

Name: 2. Terry Ray manages a large hotel in an urban Midwestern city. He wants to use vertical analysis and a slightly modified version

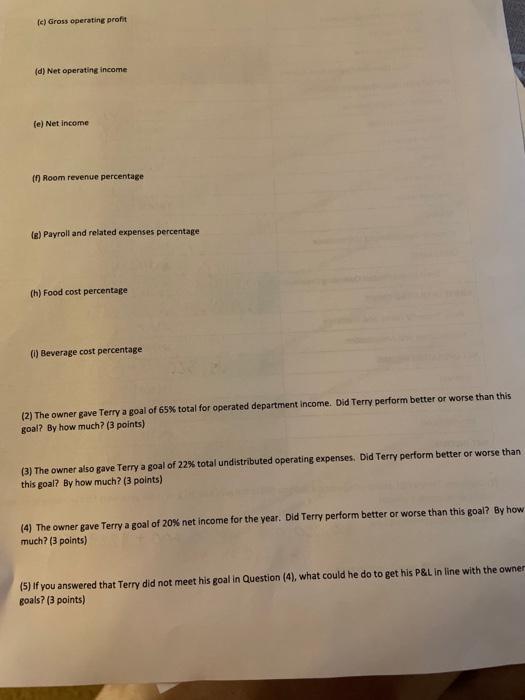

Name: 2. Terry Ray manages a large hotel in an urban Midwestern city. He wants to use vertical analysis and a slightly modified version of the USALI income statement (P&L) for his property to assess its financial performance last year. TOTAL REVENUE 100.0% Rooms-Revenue Payroll and Related Expenses Other Expenses Department Income Food-Revenue Cost of Sales Payroll and Related Expenses Other Expenses Department Income Beverage- Revenue Cost of Sales Payroll and Related Expenses Other Expenses Department Income Telecommunications - Revenue Cost of Sales Payroll and Related Expenses Other Expenses Department Income Other Operated Departments - Revenue Cost of Sales Payroll and Related Expenses Other Expenses Department Income Rentals and Other Income - Revenue Cost of Sales $2,234,950 $522,500 $345, 500 31,500 5,100,350 3,000,000 m 59% $35,600 11% 229,450 $46.500 4% 44% 27% 1,400,000 386,100 % 395,200 96,200 8% 2% 10% 560,000 11% 81,510 2%. 96,590 % 36,400 1 14,000 30,550 9,750 5,200 105,000 79. 0%. 1% 0% 21,350 2,860 0% -1% 2% 14,300 32,500 1% 11,700 0% 0% 0% Name: Payroll and Related Expenses Other Expenses Department Income UNDISTRIBUTED OPERATING EXPENSES Administrative and General Information Systems Total Operated Department Income Human Resources Security Franchise Fees Transportation Interest GROSS OPERATING PROFIT Rent, Property Taxes, and Insurance Depreciation and Amortization NET OPERATING INCOME Marketing Property Operation and Maintenance Utility Costs Total Undistributed Operating Expenses $1,214,980 (c) 1,910,670 NET INCOME INCOME BEFORE INCOME TAXES Income Taxes $1,700 $3,125,650 8.840 0% 1,950 0%. (b) Total operated department income 0% 245,050 5% 64,350 17 105,300 29 50,050 14. 61% 0 60,450 280,280 10$1,365, 320 $1,228,820 216,125 193,375 0% 317,850 227,500 1% 5% 4% 4% 24% 37% 6% 4% 27% 136,500 % 491,528 24%. (e)$737, 292 (1) Complete Terry's P&L above using vertical analysis (Fill in the gray blanks) and show your work for calculating the: (a-i: 1 point each, chart: 6 points) (a) Room department income 10% 14% $3,000,000-$535,600 + $229,450) = $2,234,950 (c) Gross operating profit (d) Net operating income (e) Net income (f) Room revenue percentage (g) Payroll and related expenses percentage (h) Food cost percentage (i) Beverage cost percentage (2) The owner gave Terry a goal of 65% total for operated department income. Did Terry perform better or worse than this goal? By how much? (3 points) (3) The owner also gave Terry a goal of 22% total undistributed operating expenses. Did Terry perform better or worse than this goal? By how much? (3 points) (4) The owner gave Terry a goal of 20% net income for the year. Did Terry perform better or worse than this goal? By how much? (3 points) (5) If you answered that Terry did not meet his goal in Question (4), what could he do to get his P&L in line with the owner goals? (3 points)

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started