Answered step by step

Verified Expert Solution

Question

1 Approved Answer

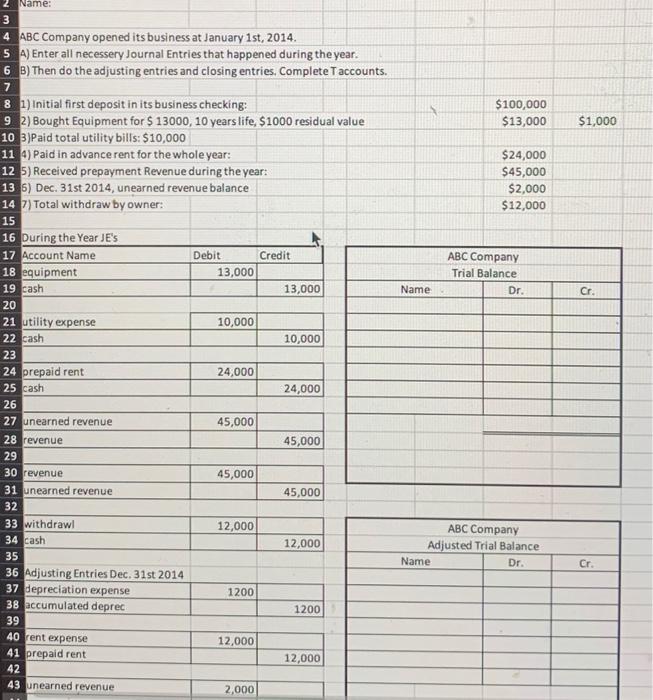

Name: 3 4 ABC Company opened its business at January 1st, 2014. 5 A) Enter all necessery Journal Entries that happened during the year. 6

Name: 3 4 ABC Company opened its business at January 1st, 2014. 5 A) Enter all necessery Journal Entries that happened during the year. 6 B) Then do the adjusting entries and closing entries. Complete Taccounts. 7 8 1) Initial first deposit in its business checking: 9 2) Bought Equipment for $ 13000, 10 years life, $1000 residual value 10 3)Paid total utility bill's: $10,000 11 4) Paid in advance rent for the whole year: 12 5) Received prepayment Revenue during the year: 13 6) Dec. 31st 2014, unearned revenue balance 14 7) Total withdraw by owner: 15 16 During the Year JE's 17 Account Name 18 equipment 19 cash 20 21 utility expense 22 cash 23 24 prepaid rent 25 cash 26 27 unearned revenue 28 revenue 29 30 revenue 31 unearned revenue 32 33 withdrawl 34 cash 35 36 Adjusting Entries Dec. 31st 2014 37 depreciation expense 38 accumulated deprec 39 40 rent expense 41 prepaid rent 42 43 unearned revenue Debit 13,000 10,000 24,000 45,000 45,000 12,000 1200 12,000 2,000 Credit 13,000 10,000 24,000 45,000 45,000 12,000 1200 12,000 Name $100,000 $13,000 Name $24,000 $45,000 $2,000 $12,000 ABC Company Trial Balance Dr. ABC Company Adjusted Trial Balance Dr. $1,000 Cr. Cr.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started