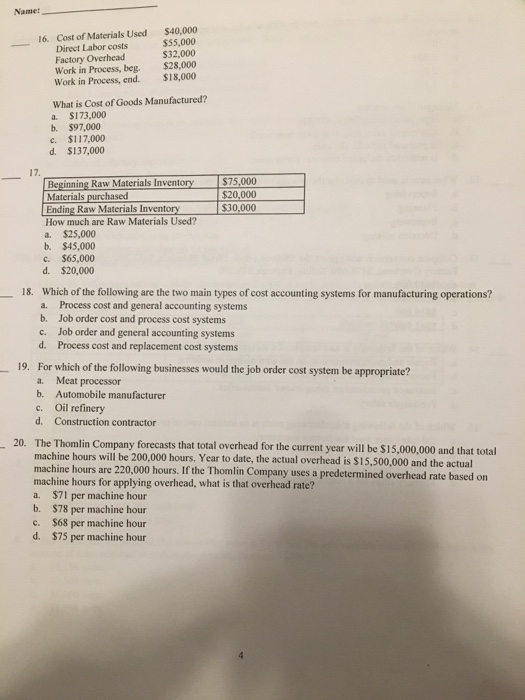

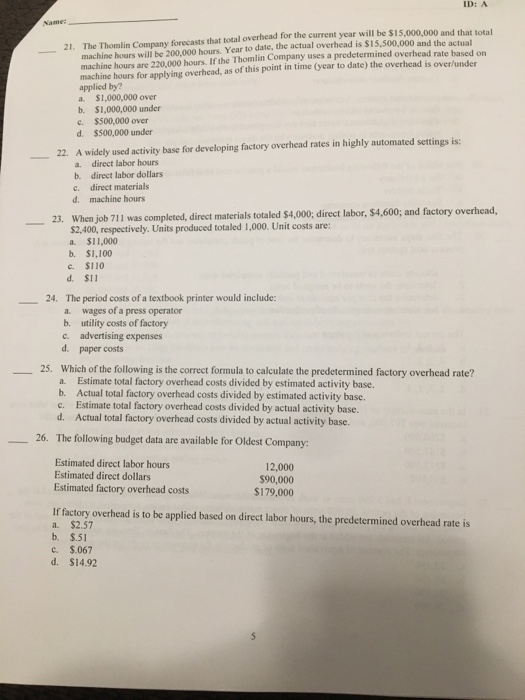

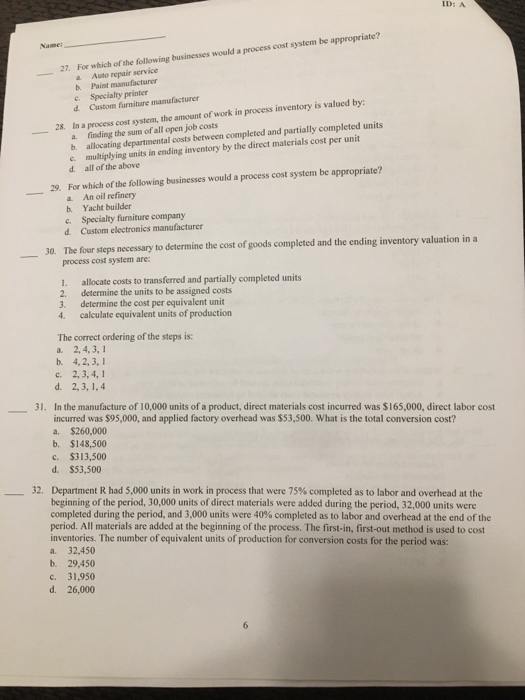

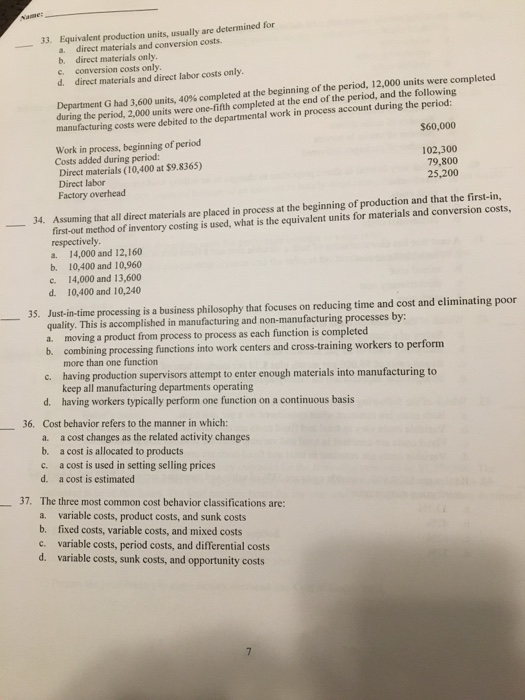

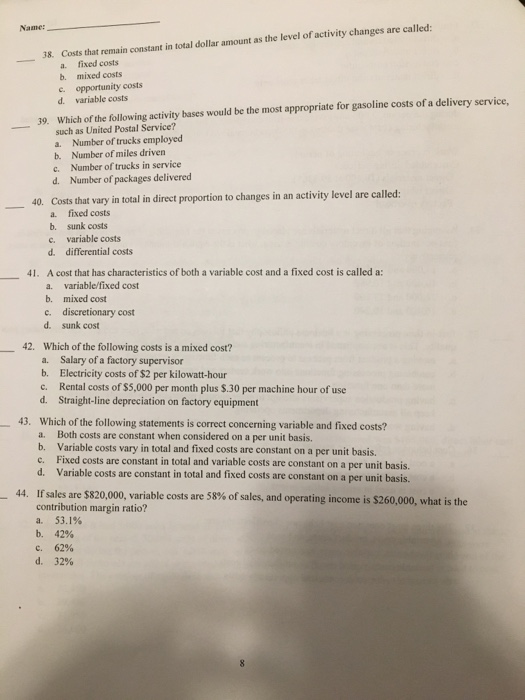

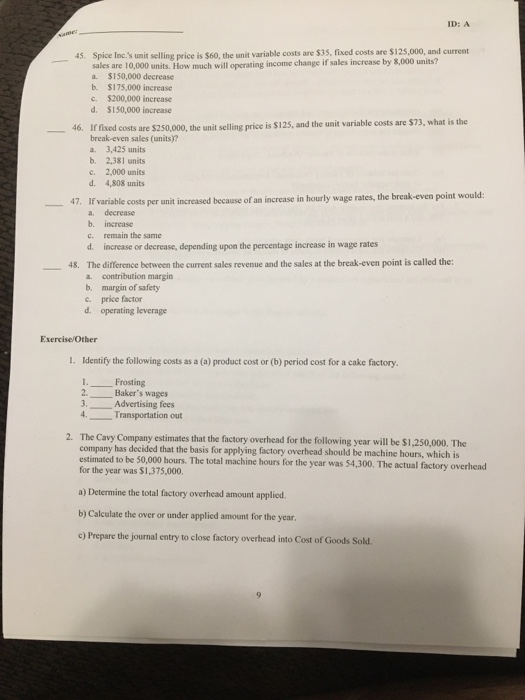

Name: $40,000 555,000 Cost of Materials Used Direct Labor costs Factory Overhead Work in Process, beg. $28,000 Work in Process, end.$18,000 16. $32,000 What is Cost of Goods Manufactured? a. $173,000 b. $97,000 c. $117,000 d. $137,000 $75,000 $20,000 $30,000 Raw How much are Raw Materials Used? a. $25,000 b. $45,000 c. $65,000 d. $20,000 Which of the following are the two main types of cost accounting systems for manufacturing operations? 18. Process cost and general accounting systems b. a. Job order cost and process cost systems Job order and general accounting systems Process cost and replacement cost systems c. d. For which of the following businesses would the job order cost system be appropriate? a. Meat processor b. Automobile manufacturer c. Oil refinery d. Construction contractor 19. 20. The Thomlin Company forecasts that total overhead for the current year will be $15,000,000 and that total machine hours will be 200,000 hours. Year to date, the actual overhead is $15,500,000 and the actual machine hours are 220,000 hours. If the Thomlin Company uses a predetermined overhead rate based on machine hours for applying overhead, what is that overhead rate? a. $71 per machine hour b. $78 per machine hour c. $68 per machine hour d. $75 per machine hour ID:A 21. The Thomlin Company forecasts that total overhead for the current year will be $15,000,000 and that total machine hours will be 200,000 hours. Year to date, the actual overhead is $15,500,000 and the actual machine hours are 220,000 hours. If the Thomlin Company uses a predetermined overhead rate based on machine hours for applying overhead, as of this point in time (year to date) the overhead is over/under applied by? a. $1,000,000 over b. $1,000,000 under c. $500,000 over d. $500,000 under A widely used activity base for developing factory overhead rates in highly automated settings is: 22. direct labor hours direct labor dollars a. b. c. direct materials d. machine hours 23. When job 711 was completed, direct materials totaled $4,000; direct labor, $4,600; and factory overhead, $2,400, respectively. Units produced totaled 1,000. Unit costs are: a. $11,000 b. $1,100 c. $110 d. $11 The period costs of a textbook printer would include: 24. wages of a press operator utility costs of factory a. b. advertising expenses c. d. paper costs 25. Which of the following is the correct formula to calculate the predetermined factory overhead rate? Estimate total factory overhead costs divided by estimated activity base. Actual total factory overhead costs divided by estimated activity base. a. b. Estimate total factory overhead costs divided by actual activity base. c. d. Actual total factory overhead costs divided by actual activity base. 26. The following budget data are available for Oldest Company: Estimated direct labor hours Estimated direct dollars Estimated factory overhead costs 12,000 90,000 $179,000 If factory overhead is to be applied based on direct labor hours, the predetermined overhead rate is a. $2.57 b. $.51 c. $.067 d. $14.92 ID: A For which of the following businesses would a process cost system be appropriate? 2 Auto repair service a. b. Paint manufacturer e Specialty printer d. Custom furniture manufacturer a process cost system, the amount of work in process inventory is valued by: 28 a. finding the sum of all open job costs b allocating departmental costs between completed and partially completed units multiplying units in ending inventory by the direct materials cost per unit d. all of the above For which of the following businesses would a process cost system be appropriate? a An oil refinery b. Yacht builder c. Specialty furniture company d. Custom electronics manufacturer 29. The four steps necessary to determine the cost of goods completed and the ending inventory valuation in a process cost system are: 30. allocate costs to transferred and partially completed units 2. determine the units to be assigned costs 3. determine the cost per equivalent unit 4 calculate equivalent units of production The correct ordering of the steps is: a. 2,4,3,1 b. 4,2,3I c. 2,3,4,1 d. 2,3,1.4 In the manufacture of 10,000 units of a product, direct materials cost incurred was $165,000, direct labor cost incurred was $95,000, and applied factory overhead was $53,500. What is the total conversion cost? a. $260,000 b. $148,500 c. $313,500 d. $53,500 31. Department R had 5,000 units in work in process that were 75% completed as to labor and overhead at the 32 beginning of the period, 30,000 units of direct materials were added during the period, 32,000 units were completed during the period, and 3,000 units were 40% completed as to labor and overhead at the end of the period. All materials are added at the beginning of the process. The first-in, first-out method is used to cost inventories. The number of equivalent units of production for conversion costs for the period was: a. 32,450 b. 29,450 c. 31,950 d. 26,000 Equivalent production units, usually are determined for 33. direct materials and conversion costs. a. b. direct materials only conversion costs only c. direct materials and direct labor costs only d. Department G had 3,600 units, 40% completed at the beginning of the period-12,000 units were completed during the period, 2,000 units were one-fifth completed at the end of the period, and the following manufacturing costs were debited to the departmental work in process account during the period $60,000 Work in process, beginning of period Costs added during period: Direct materials (10,400 at $9.8365) Direct labor Factory overhead 102,300 79,800 25,200 34. Assuming that all direct materials are placed in process at the beginning of production and that the first-in, first-out method of inventory costing is used, what is the equivalent units for materials and conversion costs, respectively a. 14,000 and 12,160 b. 10,400 and 10,960 c. 14,000 and 13,600 d. 10,400 and 10,240 35. Just-in-time processing is a business philosophy that focuses on reducing time and cost and eliminating poor lity. This is accomplished in manufacturing and non-manufacturing processes by: a. moving a product from process to process as each function is completed combining processi more than one function ing functions into work centers and cross-training workers to perform c. having production supervisors attempt to enter enough materials into manufacturing to keep all manufacturing departments operating d. having workers typically perform one function on a continuous basis 36. Cost behavior refers to the manner in which: a. a cost changes as the related activity changes b. a cost is allocated to products c. a cost is used in setting selling prices d. a cost is estimated 37. The three most common cost behavior classifications are: a. variable costs, product costs, and sunk costs b. fixed costs, variable costs, and mixed costs c. variable costs, period costs, and differential costs d. variable costs, sunk costs, and opportunity costs Name: Costs that remain constant in total dollar amount as the level of activity changes are called 38. a. fixed costs b. mixed costs c. opportunity costs d. variable costs 39. Which of the following activity bases would be the most appropriate for gasoline costs of a delivery service such as United Postal Service? a. Number of trucks employed b. c. d. Number of miles driven Number of trucks in service Number of packages delivered Costs that vary in total in direct proportion to changes in an activity level are called a. fixed costs b. sunk costs c. variable costs d. differential costs 40. A cost that has characteristics of both a variable cost and a fixed cost is called a: 41. a. variable/fixed cost b. mixed cost c. discretionary cost d. sunk cost 42. Which of the following costs is a mixed cost? Salary of a factory supervisor b. a. Electricity costs of $2 per kilowatt-hour Rental costs of $5,000 per month plus $.30 per machine hour of use c. d. Straight-line depreciation on factory equipment Which of the following statements is correct concerning variable and fixed costs? 43. Both costs are constant when considered on a per unit basis. a. Variable costs vary in total and fixed costs are constant on a per unit basis. b. Fixed costs are constant in total and variable costs are constant on a per unit basis. c. d. Variable costs are constant in total and fix ed costs are constant on a per unit basis. If sales are S 820,000, variable costs are 58% of sales, and operating income is S260.000, what is the contribution margin ratio? a. 53.1% b. 42% . 62% d. 32% ID: A Spice Inc.'s unit selling price is $60, the unit variable costs are $35, fixed costs are $125,000, and current 45. sales are 10,000 units. How much will operating income change if sales increase by 8,000 units? a. $150,000 decrease b. $175,000 increase c. $200,000 increase d. $130,000 increase the unit variable costs are $73, what is the 46. If fixed costs are $250,000, the unit selling price is $125, and break-even sales (units)? a. 3,425 units b. 2,381 units c. 2,000 units d. 4,808 units 47. If variable costs per unit increased because of an increase in hourly wage rates, the break-even po a decrease b. increase c. remain the same d. increase or decrease, depending upon the percentage increase in wage rates 48. The difference between the current sales revenue and the sales at the break-even point is called the: contribution margin margin of safety price factor operating leverage a. b. e. d. ExerciseOther Identify the following costs as a (a) product cost or (b) period cost for a cake factory 1. Frosting 2. 3, 4. Baker's wages Advertising fees Transportation out 2. The Cavy Company estimates that the factory overhead for the following year will be $1,250,000. The company has decided that the basis for applying factory overhead should be machine hours, which is estimated to be 50,000 hours. The total machine hours for the year was 54,300. The actual factory overhead for the year was $1,375,000. a) Determine the total factory overhead amount applied. b) Calculate the over or under applied amount for the year c) Prepare the journal entry to close factory overhead into Cost of Goods Sold