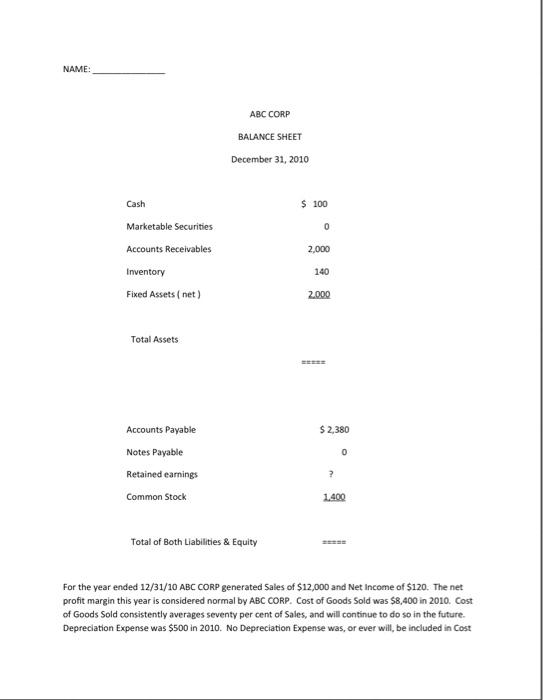

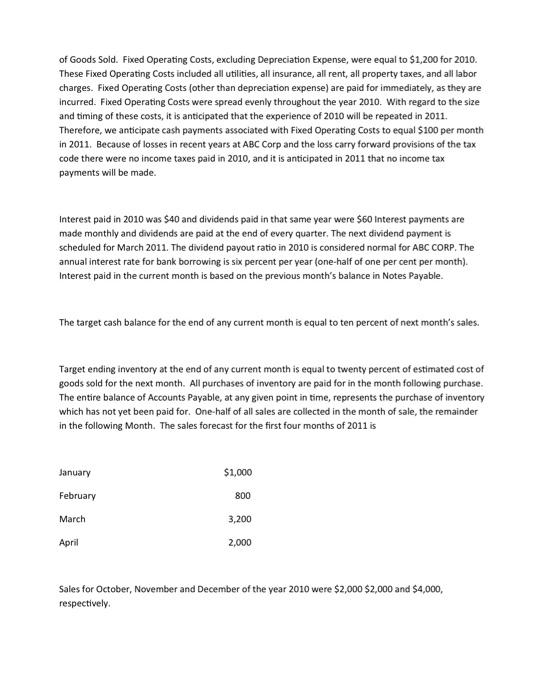

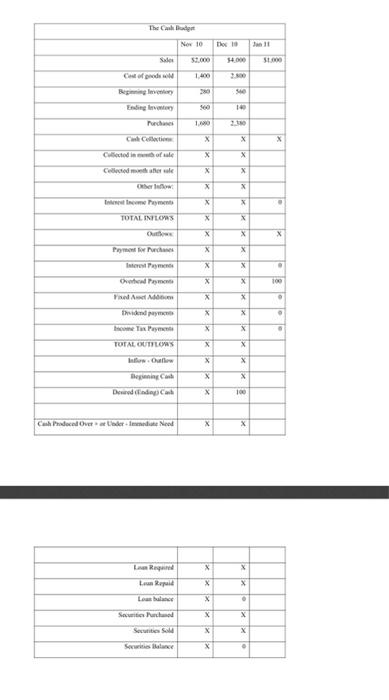

NAME: ABC CORP BALANCE SHEET December 31, 2010 Cash $ 100 0 Marketable Securities Accounts Receivables 2,000 140 Inventory Fixed Assets (net) 2.000 Total Assets 1 $ 2,380 0 Accounts Payable Notes Payable Retained earnings Common Stock ? 1.400 Total of Both Liabilities & Equity For the year ended 12/31/10 ABC CORP generated Sales of $12,000 and Net Income of $120. The net profit margin this year is considered normal by ABC CORP. Cost of Goods Sold was $8,400 in 2010. Cost of Goods Sold consistently averages seventy per cent of Sales, and will continue to do so in the future. Depreciation Expense was $500 in 2010. No Depreciation Expense was, or ever will be included in Cost of Goods Sold. Fixed Operating costs, excluding Depreciation Expense, were equal to $1,200 for 2010. These Fixed Operating costs included all utilities, all insurance, all rent, all property taxes, and all labor charges. Fixed Operating costs (other than depreciation expense) are paid for immediately, as they are incurred. Fixed Operating costs were spread evenly throughout the year 2010. With regard to the size and timing of these costs, it is anticipated that the experience of 2010 will be repeated in 2011. Therefore, we anticipate cash payments associated with Fixed Operating costs to equal $100 per month in 2011. Because of losses in recent years at ABC Corp and the loss carry forward provisions of the tax code there were no income taxes paid in 2010, and it is anticipated in 2011 that no income tax payments will be made Interest paid in 2010 was $40 and dividends paid in that same year were $60 Interest payments are made monthly and dividends are paid at the end of every quarter. The next dividend payment is scheduled for March 2011. The dividend payout ratio in 2010 is considered normal for ABC CORP. The annual interest rate for bank borrowing is six percent per year (one-half of one per cent per month). Interest paid in the current month is based on the previous month's balance in Notes Payable. The target cash balance for the end of any current month is equal to ten percent of next month's sales. Target ending inventory at the end of any current month is equal to twenty percent of estimated cost of goods sold for the next month. All purchases of inventory are paid for in the month following purchase. The entire balance of Accounts Payable, at any given point in time, represents the purchase of inventory which has not yet been paid for. One-half of all sales are collected in the month of sale, the remainder in the following Month. The sales forecast for the first four months of 2011 is January $1,000 February 800 March 3,200 April 2,000 Sales for October, November and December of the year 2010 were $2,000 $2,000 and $4,000, respectively. It is the policy of the company to repay bank borrowing as soon as possible; if money is not needed for this purpose, then investments of marketable securities are made. Marketable Securities should be liquidated to satisfy any subsequent need for cash flow before any new bank borrowing is done. The annual yield on marketable securities is three per cent (one-quarter of one percent per month). Interest payments to the firm are based on the previous month's balance in Marketable Securities. On the next two pages, you will find a partially completed Cash Budget. Some numbers are filled in for your convenience. For only the month of January 2011, you are to fill in missing amounts in this cash Budget. When you answer to this requirement remember to write zero if you mean zero because a blank will not be interpreted as zero. The Cake Dog Now 10 the 10 14.000 1.400 14 1.6.0 31 Cinete X X X X X Collector X Other X mm X . TOTAL INTLONS X X X X Payment Purch X X X X X X X X X One Pesmente PAM Tidende TP TOTAL OUTILS Infos. Out Being a X X X X X X Dreddie Cod 100 Cash ProcedOverder med X X X X La Red La Rapid Los X X Sached X Set X X