Answered step by step

Verified Expert Solution

Question

1 Approved Answer

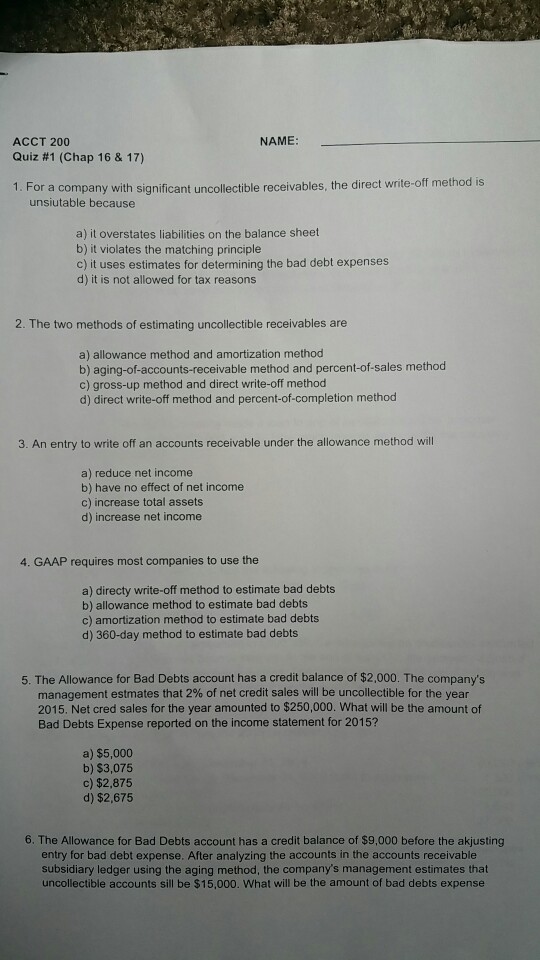

NAME: ACCT 200 Quiz #1 (Chap 16 & 17) 1. For a company with significant uncollectible receivables, the direct write-off method is unsiutable because a)

NAME: ACCT 200 Quiz #1 (Chap 16 & 17) 1. For a company with significant uncollectible receivables, the direct write-off method is unsiutable because a) it overstates liabilities on the balance sheet b) it violates the matching principle c) it uses estimates for determining the bad debt expenses d) it is not allowed for tax reasons 2. The two methods of estimating uncollectible receivables are a) allowance method and amortization method b) aging-of-accounts-receivable method and percent-of-sales method c) gross-up method and direct write-off method d) direct write-off method and percent-of-completion method 3. An entry to write off an accounts receivable under the allowance method will a) reduce net income b) have no effect of net income c) increase total assets d) increase net income 4. GAAP requires most companies to use the a) directy write-off method to estimate bad debts b) allowance method to estimate bad debts c) amortization method to estimate bad debts d) 360-day method to estimate bad debts 5. The Allowance for Bad Debts account has a credit balance of $2,000. The company's management estmates that 2% of net credit sales will be un colectible for the year 2015. Net cred sales for the year amounted to $250,000. What will be the amount of Bad Debts Expense reported on the income statement for 2015? a) $5,000 b) $3,075 c) $2,875 d) $2,675 6. The Allowance for Bad Debts account has a credit balance of $9,000 before the akjusting entry for bad debt expense. After analyzing the accounts in the accounts receivable subsidiary ledger using the aging method, the company's management estimates that uncollectible accounts sill be $15,000. What will be the amount of bad debts expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started