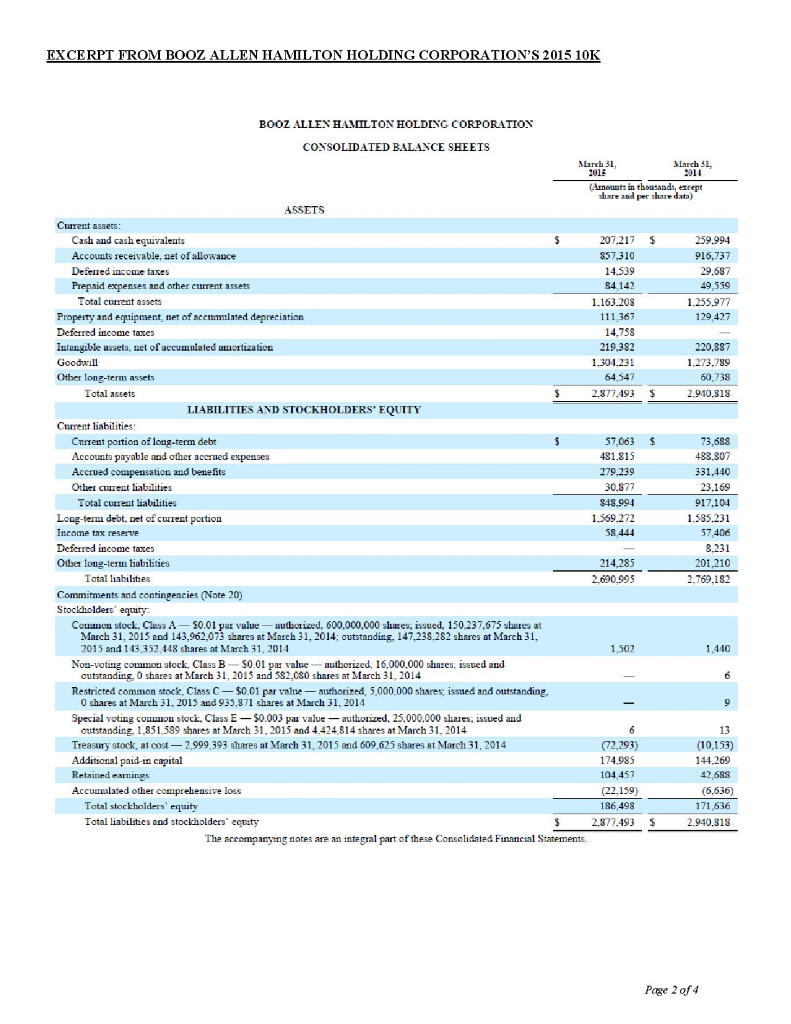

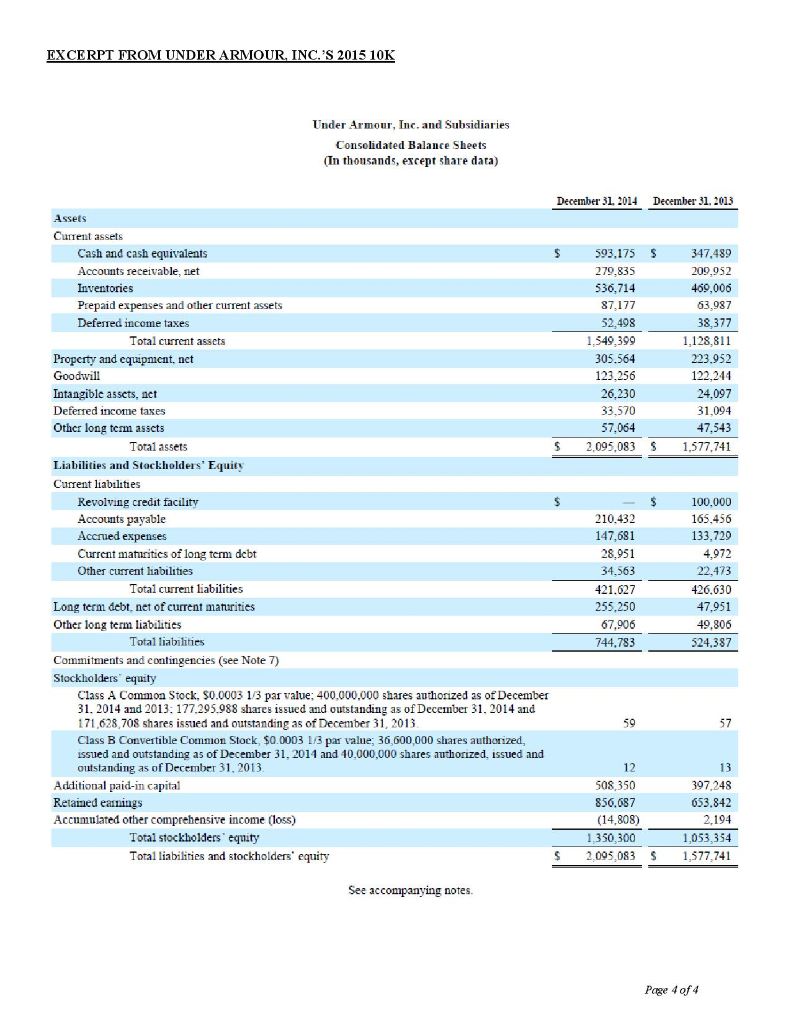

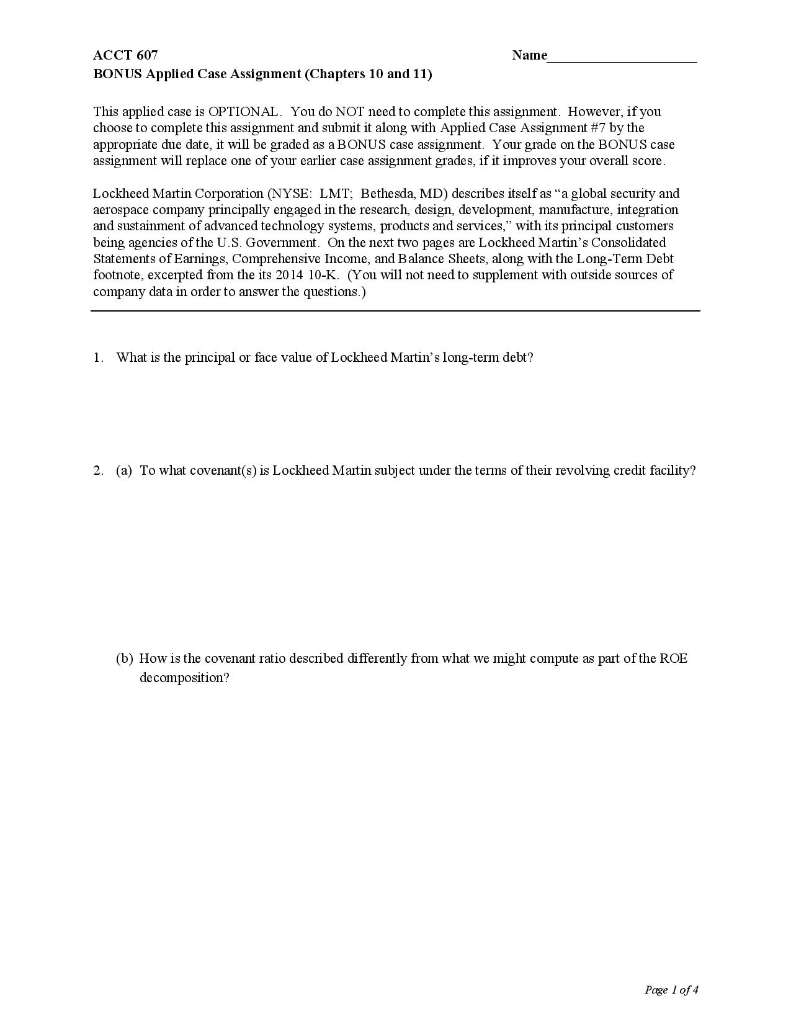

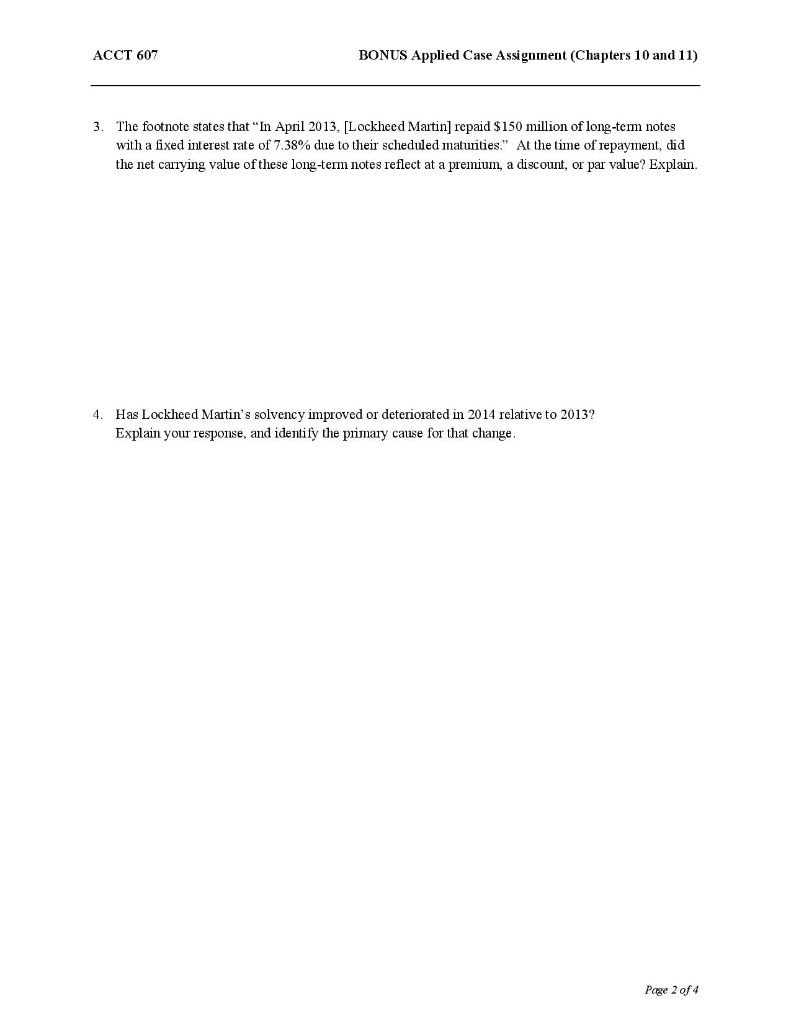

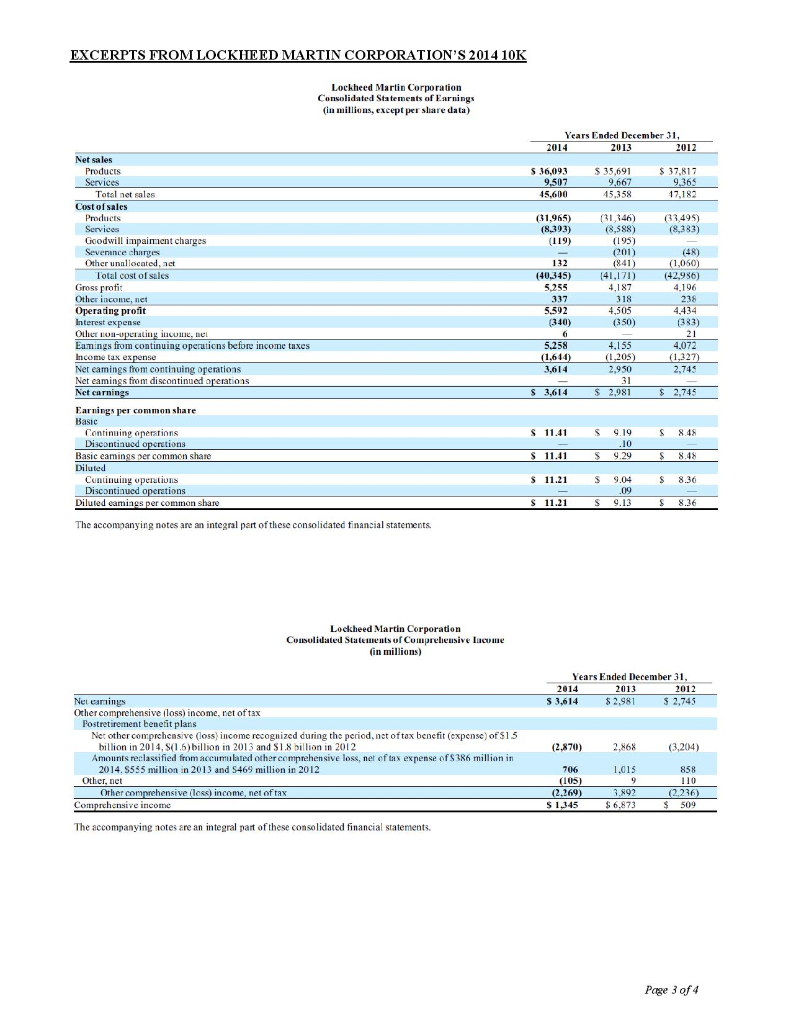

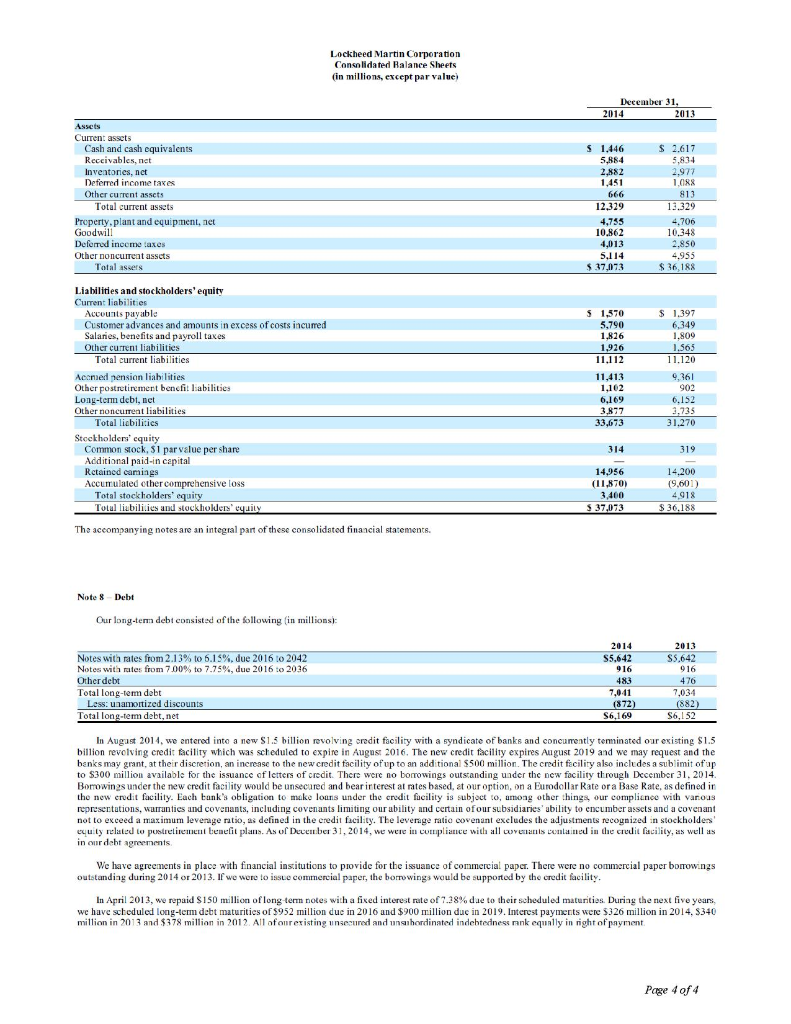

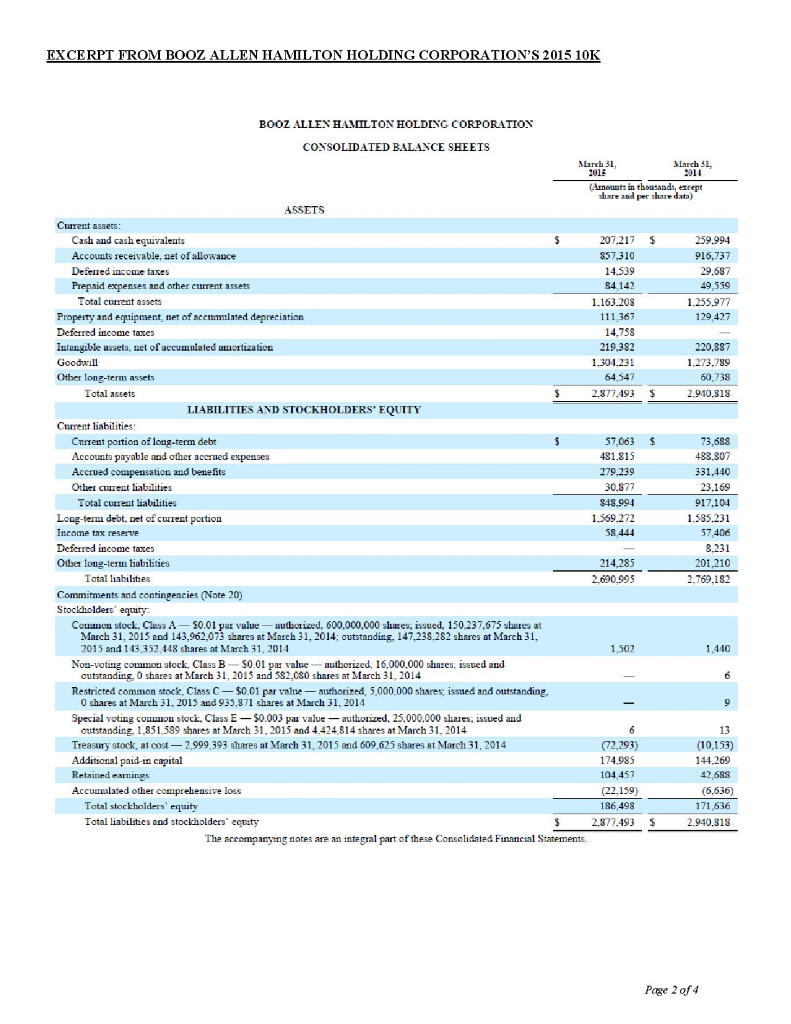

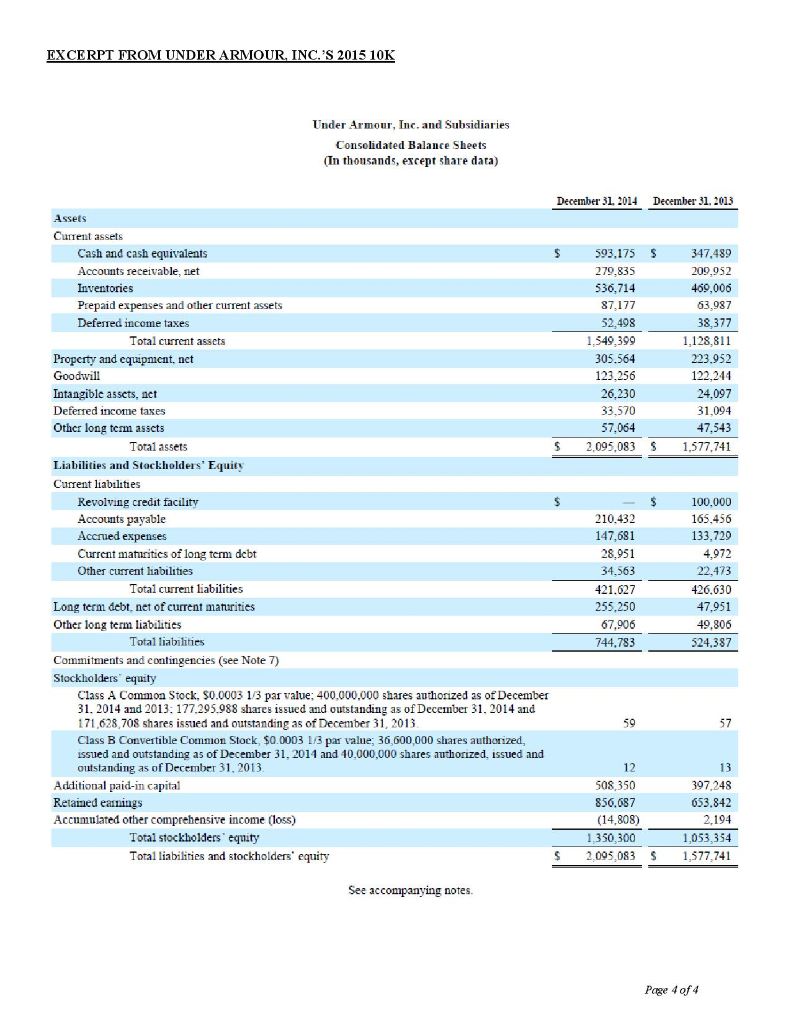

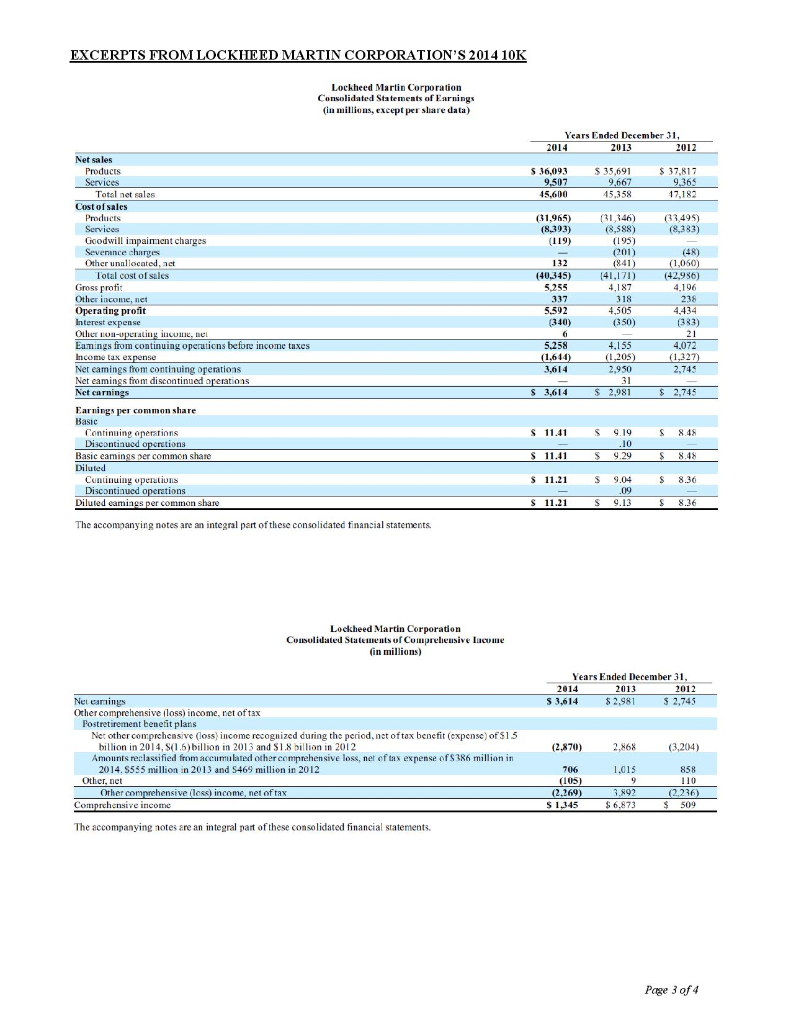

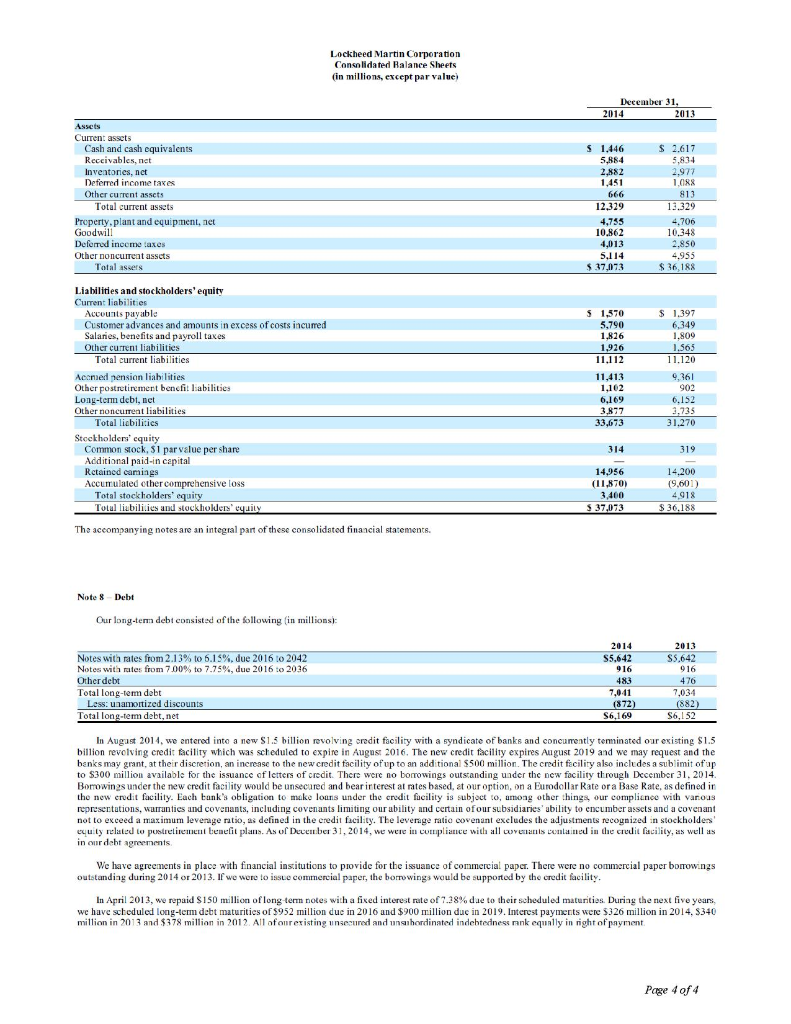

Name ACCT 607 Applied Case Assignment #7 (Chapters 10 and 11) Answer the following questions (Part I and Part II) based on the provided excerpts from a selection of greater Washington area public companies' recent 10-Ks. (You will not need to supplement with outside sources of company data in order to answer the questions.) Part I: Booz Allen Hamilton Holding Corporation (NYSE: BAH; McLean, VA) Founded in 1914, Booz Allen Hamilton describes itself as "a leading provider of management consulting, technology, and engineering services to the U.S. government in the defense, intelligence, and civil markets." Booz Allen Hamilton Holding serves as the top-level holding company for the consolidated Booz Allen Hamilton U.S. government consulting business. Answer the following questions based on the Company's Consolidated Balance Sheets for March 31, 2015 and 2014 (hereafter, FY15 and FY14), which are excerpted and presented on the next page: 1. During FY15, the decreases in Class B, Class C, and Class E shares are because those shares were converted to Class A shares. Assume that the remaining increase in Class A share is due to new share issuances for cash. What journal entry would the Company have recorded for the issuance of those new shares? 2. There were no sales of Treasury Stock during FY15. What was the average share price at which the Company repuurchased additional Treasury Stock shares during FY15? 3. There were no usual transactions affecting the Company's Retained Eamings during FY15. If Net Income for FY2015 was $232,569 thousand, what was the value of dividends declared during the year? Page 1 of 4 EXCERPT FROM BOOZ ALLEN HAMILTON HOLDING CORPORATION'S 2015 10K BOOZ ALLEX HAMILTON HOLDING CORPORATION 1.304,231 CONSOLIDATED BALANCE SHEETS March 31, Larch 31, 2011 2011 (Amounts in thousands, except share and per share data) ASSETS Current assets: Cash and cash equivalents $ s 207.217 $ 259.994 Accounts receivable, aet of allowance 857,310 916,737 Defened income taxes 14.539 29.687 Prepaid expenses and other current assets 84 142 49 559 Total curreat assets 1.163.205 1.255.977 Property and equipment, net of accumulated depreciation 111 367 129 427 Deferred income taxes 14.758 Inlangible avets, set of accumulated amortization 219.382 220,887 Goodwill 1.273,789 Other long-term assets 64.547 60.738 Total assets $ 2.877.493 $ 2.910.818 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Current portion of long-term debt 57,063 $ 73.688 Accounts payable and other accrued expenses 481.815 483.807 Accrued compensation and benefits 279.239 331,440 Other curent liabilities 30.877 23.169 Total current liabilities 848.994 917,104 Long-term debt, bet of curent portion 1.569.272 1.585.231 Income tax reserve 58.444 57 406 Deferred income taxes 3,231 Other long-term lubilities 214,285 201,210 Total liabilities 2.690.995 2.769,182 Commitments and contingencies (Note 20) Stockholders' equity Common stock. Class A -0.01 par value -- authorized, 600,000,000 shes, issued, 150.237,675 sharest March 31, 2013 and 143.962,073 shares at March 31, 2014; outstanding. 147,238,282 shares at March 31, 2015 and 143,352 448 shares at March 31, 2014 1 502 1.440 Non-voting common stock. Class B - 50.01 pu value-autborized, 16,000,000 shuzes, issued and outstanding, shares at March 31, 2015 and 582,0$0 shares at March 31, 2014 Restricted common stock. Class C- $0.01 par value authorized 5,000,000 shares, issued and outstanding, shares at March 31, 2015 and 935,871 shares at March 31, 2014 9 Special voting couLnon stock, Class E-50.003 par value - authorized. 25.000.000 shares, issued and outstanding, 1.851,589 shares at March 31, 2015 and 4.424.814 shares at March 31, 2014 6 13 Treasury stock, at cost 2.999,393 shares at March 31, 2015 and 609.625 shares at March 31, 2014 (72.293) (10,153) Additional paid-in capital 174.985 144.269 Retxined earnings 104 457 42.688 Accumulated other comprehensive loss (22.159) (6.636) Total stockholders' equity 186 498 171,636 Total liabilities and stockholders' cousty $ $ 2.940.818 The accompanying notes are an integral part of these Consolidated Financial Statements 2.827,493 Page 2 of 4 ACCT 607 Applied Case Assignment #7 (Chapter 10, 11) - Continued Part II: Under Armour, Inc. (NYSE: UA; Baltimore, MD) 4. Incorporated in Maryland in 1996, Under Armour', Inc, describes itself as developing, marketing and distributing branded perfornance apparel, footwear and accessories for men, women and youth." On June 15, 2015, Under Armour amounced the creation of a new class of non-voting common stock, the Class C common stock. The press release stated that: Under Armour expects to issue Class C stock through a stock dividend to all existing holders of Under Armour's Class A and Class B common stock, which will hane the same effect as a bro-for-one stock split. Each holder of a share of Class A or Class B stock will receive one share of the new Class C stock Do you agree or disagree that the effect of the Class C stock dividend will be the same as a two-for- one stock split? As an example, assume the transaction would have occurred on January 1, 2015. On the basis of the information on Under Armour's Consolidated Balance Sheet for December 31, 2014 (excerpted and presented on the next page of this assignment), what journal entry would be required to record (a) a two-for-one stock split, and (b) the Class C stock dividend? (a) Two-for-one stock split: (b) Class C stock dividend: Do you agree or disagree that the effect of the Class C stock dividend will be the sane as a fro-for- one stock split? Page 3 of 4 EXCERPT FROM UNDER ARMOUR, INC.'S 2015 10K Under Armour, Inc. and Subsidiaries Consolidated Balance Sheets (In thousands, except share data) December 31, 2014 December 31, 2013 Assets Current assets Cash and cash equivalents $ 593,175 $ 347,489 Accounts receivable, net 279,835 209 952 Inventories 536,714 469,000 Prepaid expenses and other current assets 87.177 63.987 Deferred income taxes 52,498 38,377 Total current assets 1,549.399 1,128,811 Property and equipment, net 305.564 223.952 Goodwill 123.256 122,244 Intangible assets, act 26,230 24,097 Deferred income taxes 33,570 31,094 Other long term assets 57,064 47,543 Total assets $ 2.095,083 S 1,577,741 Liabilities and Stockholders' Equity Current liabilities Revolving credit facility $ 100.000 Accounts payable 210.432 165,456 Accrued expenses 147,681 133,720 Current maturities of long term debt 28.951 4.972 Other current liabilities 34.563 22.473 Total current liabilities 421.627 426.630 Long term debt, net of current maturities 255.250 47.951 Other long term liabilities 67,906 49,806 Total liabilities 744.783 524,387 Commitments and contingencies (see Note 7) Stockholders' equity Class A Common Stock, S0.0003 13 par value: 400,000,000 shares authorized as of December 31. 2014 and 2013: 177,295.988 shares issued and outstanding as of December 31, 2014 and 171,628,708 shares issued and outstanding as of December 31, 2013 50 57 Class B Convertible Common Stock $0.0003 1/8 par value: 36,600,000 shares authorized, issued and outstanding as of December 31, 2014 and 40,000,000 shares authorized, issued and outstanding as of December 31, 2013 12 13 Additional paid-in capital 508 350 397 248 Retained earnings 856.687 653.842 Accumulated other comprehensive income (loss) (14,808) 2,194 Total stockholders' equity 1.350 300 1,053,354 Total liabilities and stockholders' equity $ 2.095,0835 1,577,741 See accompanying notes. Page 4 of 4 Name ACCT 607 BONUS Applied Case Assignment (Chapters 10 and 11) This applied case is OPTIONAL. You do NOT need to complete this assignment. However, if you choose to complete this assignment and submit it along with Applied Case Assignment #7 by the appropriate due date, it will be graded as a BONUS case assignment. Your grade on the BONUS case assignment will replace one of your earlier case assignment grades, if it improves your overall score. Lockheed Martin Corporation (NYSE: LMT; Bethesda, MD) describes itself as a global security and aerospace company principally engaged in the research design, development, mamifacture, integration and sustainment of advanced technology systems, products and services," with its principal customers being agencies of the U.S. Government. On the next two pages are Lockheed Martin's Consolidated Statements of Earnings, Comprehensive Income, and Balance Sheets, along with the Long-Term Debt footnote, excerpted from the its 2014 10-K. (You will not need to supplement with outside sources of company data in order to answer the questions.) 1. What is the principal or face value of Lockheed Martin's long-term debt? 2. (a) To what covenant(s) is Lockheed Martin subject under the terms of their revolving credit facility? (6) How is the covenant ratio described differently from what we might compute as part of the ROE decomposition? Page 1 of 4 ACCT 607 BONUS Applied Case Assignment (Chapters 10 and 11) 3 The footnote states that "In April 2013, [Lockheed Martin) repaid $ 150 million of long-term notes with a fixed interest rate of 7.38% due to their scheduled maturities." At the time of repayment, did the net carrying value of these long-term notes reflect at a premium, a discount, or par value? Explain. 4. Has Lockheed Martin's solvency improved or deteriorated in 2014 relative to 2013? Explain your response, and identify the primary cause for that change. Page 2 of 4 EXCERPTS FROM LOCKHEED MARTIN CORPORATION'S 2014 10K Lockheed Martin Corporation Consolidated Statements of Earnings (in millions, except per share data) Years Ended December 31, 2014 2013 2012 S 36,093 9,507 45.600 $35.691 9,667 45,358 $ 37,817 9.365 17,182 (31,965) (8,393) (119) (33.495) ( (8,383) Net sales Products Services Total net salas Cost of sales Products Services Goodwill impaiment charges Sevenince charges Other unnllocated, net Total cost of sales Gross profit Other income, net Operating profit Interest expense Other non-operating income, met Eamings from continuing operations before income taxes Income tax expense Net eamings from continuing operations Net eamings from discontinued operations Net earnings Earnings per common share Basic Continuing operations Discontinued oportions Basic eamings per common share Diluted Continuing operations Discontinued operations Diluted eamings per common share (31,146) (8,588) (195) (201) (841) 141,171) 4.187 318 4,505 (350) 132 (40.345) 5.255 337 5,592 (340) 6 5.258 (1.610) 3,614 (48) (1,060) (42,986) 4.196 238 4,434 (383) 21 4,072 (1,327) 2,745 4.155 (1,205) 2,950 31 $ 2,981 S 3.614 $ 2,745 S 11.41 S S 8.48 9.19 .10 9.29 S 11.41 S S 8.48 S 11.21 S 8.36 $ 9.04 .09 $ 9.13 $ 11.21 $ 8.36 The accompanying notes are an integral part of these consolidated financial statements . Lockheed Martin Corporation Consolidated Statements of Comprehensive Income (in millions) Years Ended December 31, 2014 2013 2012 $ 3,614 $2.981 $ 2.745 (2.870) 2,868 (3,204) Nel carings Other comprehensive loss) income, net of tax Postretirement benefit plans Net other comprehensive (loss) income recognized during the period, nct of tax benefit (expense) of $15 billion in 2014, S(1.6) billion in 2013 and 51.8 billion in 2012 Amounts reclassified from accumulated other comprehensive loss, ner of tax expense of S386 million in 2014. 5555 million in 2013 and 5469 million in 2012 Other, net Other comprehensive (less) income, net of tax Comprehensive income 706 (105) (2.269) $ 1.345 1,015 9 3.892 $ 6.873 858 110 (2,236) $ 509 The accompanying notes are an integral part of these consolidated financial statements. Page 3 of 4 Lockheed Martin Corporation Consolidated Balance Sheets (in millions, except par value) December 31, 2014 2013 Assets Current assets Cash and cash equivalents Receivables, net Inventories, net Deferred income taxes Other current assets Total current assets Property, plant and equipment, net Goodwill Deferred income taxes Other noncurrent assets Total assers $ 1.446 5,884 2.882 1,451 666 12,329 4,735 10.862 4,013 5,114 $ 37,073 $ 2.617 5,834 2.977 1.ORX 813 13.329 4,706 10.348 2.850 4,955 $36.188 Liabilities and stockholders' equity Current liabilities Accounts payable Customer advances and amounts in excess of costs incurred Salaries, benefits and payroll taxes Other current liabilities Total current liabilities Acomed hension liabilities Other postretirement bencfit liabilities Long-term debi, net Other noncument liabilities Total liabilities Stockholders equity Common stock, 51 par value per share Additional paid in capital Retained camings Accumulated other comprehensive loss Total stockholders' equity Totul liabili.ies and stockholders' equily $ 1,370 5,790 1,826 1,926 11,112 11,413 1,102 6.169 3,877 33,673 $ 1,397 6,349 1.809 1.565 11.120 9,361 902 6,152 3,735 31.270 314 319 14,956 (11,870 3,400 $ 37,073 14,200 (9.601) 4918 $36.188 The accompanying notes are an integral part of these consolidated financial statements. Note 8 Debt Our long-ter debt consisted of the following (in millions): Notes with rates from 2.13% to 6.15% due 2016 to 2042 Notes with rates from 7.00% to 7.75%, due 2016 to 2036 Other debt Total long-tem debt Less: unamortized discounts Total long-term debt, net 2014 S5.642 916 483 7,0-41 (872) S6,169 2013 S5.642 916 476 7,034 (882) S6,152 In August 2014, we entered into a new $1.5 billion revolving credit facility with a syndicate of banks and concurrently terminated our existing $1.5 billion revolving credit facility which was scheduled to expire in August 2016. The new credit facility expires August 2019 and we may request and the banks may grant at their discretion, an increase to the new credit facility of up to an additional $500 million. The credit facility also includes a sublimit of up to $300 million available for the issuance of letters of credit. There were no borrowings outstanding under the new facility through December 31, 2014 Borowings under the new credit facility would be unsecured and bear interest at rates based, at our option, on a Eurodollar Rate or a Base Rate, as defined in the new erodit facility. Each tank's obligation to make loans under the credit fucility is subject to, among other things, our compliance with var.ous representations, warranties and covenants, including covenants limiting our ability and certain of our subsidiaries' ability to encumber assets and a covenant not to exceed a maximum leverage ratio, as defined in the credit facility. The leverage ratio covenant excludes the adjustments recognized in stockholders uity related to postrelitement bemelit plans. As of December 31, 2014, we were in compliance with all covenants contained in the credit facility, as well as in our debt agreements We have agreements in place with financial institutions to provide for the issuance of commercial paper. There were no commercial paper bonowings outstanding during 2014 or 2013. If we were to issue commercial paper, the borrowings would be supported by the credit facility, In April 2013, we repaid $150 million of long term notes with a fixed interest rate of 1.38% dae to their scheduled maturities. During the next five years, we have scheduled long-term debt maturities of $952 million due in 2016 and $900 million due in 2019. Interest payments were 5326 million in 2014, 8340 million in 2013 and $378 million in 2012. All of our existing unsecured and unsubordinated indebtedness rank equally in right of payment Page 4 of 4