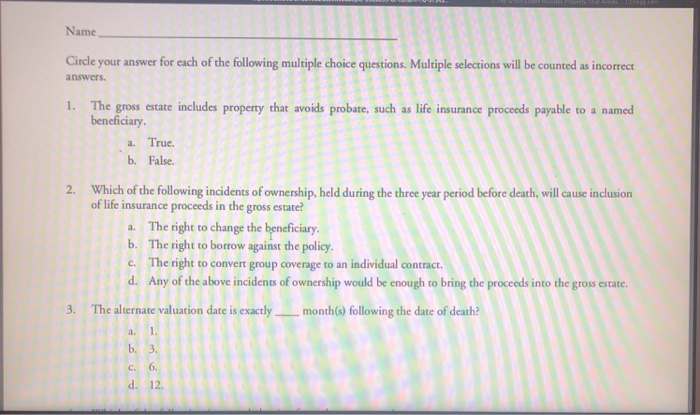

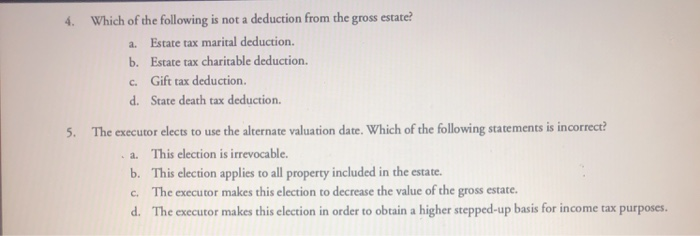

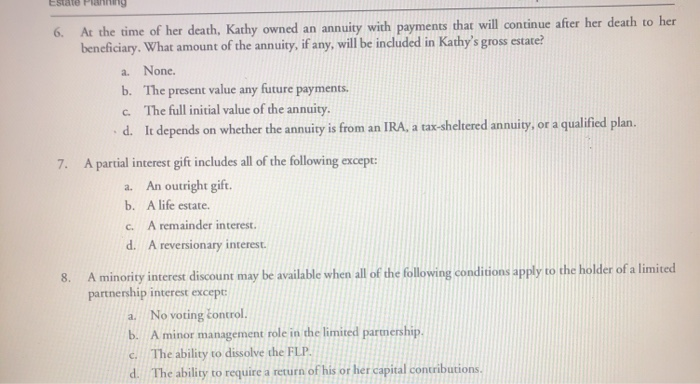

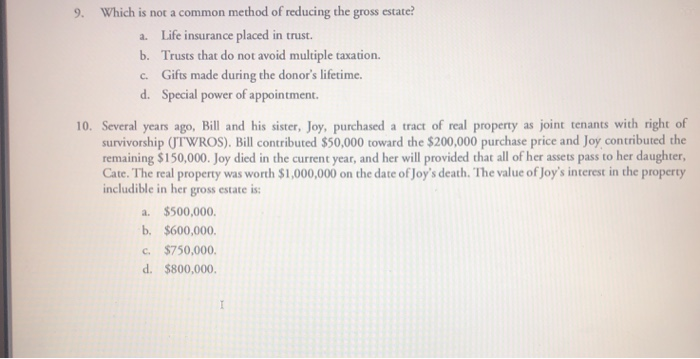

Name Circle your answer for each of the following multiple choice questions. Multiple selections will be counted as incorrect answers. 1. The gross estate includes property that avoids probate, such as life insurance proceds payable to a named beneficiary. a. True. b. False Which of the following incidens of ownership, held during the three year period before death, will cause inclusion of life insurance proceeds in the gross estate 2. a. The right to change the beneficiary. b. The right to borrow against the policy c The d. Any of the above incidents of ownership would be enough to bring the proceeds into the gross estate e right to convert group coverage to an individual contract. 3. The alternate valuation date is exactly _ month(s) following the date of death a. d. 12. 4. Which of the following is not a deduction from the gross estate? a. Estate tax marital deduction. b. Estate tax charitable deduction c. Gift tax deduction d. State death tax deduction. 5 The executor elects to use the alternate valuation date, which of the following statements is incorrect? This election is irrevocable. b. This election applies to all property included in the estate c. The executor makes this election to decrease the value of the gross estate d. The executor makes this election in order to obtain a higher stepped-up basis for income tax purposes a er death to her 6. At the time of her death, Kathy owned an annuity with payments that will continue afer h beneficiary. What amount of the annuiry, if any, will be included in Kathy's gross estate a. None. b. The present value any future payments. c. The full initial value of the annuity d. It depends on whether the annuity is from an IRA, a tax-sheltered annuity, or a qualified plan. 7. A partial interest gift includes all of the following except An outright gift. A life estate. A remainder interest. A reversionary interest. a. b. d. 8. A minority interess discount may be available when all of the following conditions apply to the holder of a limited partnership interest except a. No voting sontrol. b. A minor management role in the limited parmership c./ The ability to dissolve the FLP d. The ability to require a return of his or her capital concributions 9. Which is not a common method of reducing the gross estate? a. b. c. d. Life insurance placed in trust. Trusts that do not avoid multiple taxation. Gifts made during the donor's lifetime. Special power of appointment. 10. Several years ago, Bill and his sister, Joy, purchased a tract of real property as joint tenants with right of survivorship UTWROS). Bill contributed $50,000 toward the $200,000 purchase price and Joy contributed the remaining $150,000. Joy died in the current year, and her will provided that all of her assets pass to her daughter, Cate. The real property was worth $1,000,000 on the date of Joy's death. The value of Joy's interest in the property includible in her gross estate is: a. $500,000. b. $600,000. c. $750,000 d. $800,000