Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Name: Class: Date: Acctg 1B-1 Multiple Choice Indicate the answer choice that best completes the statement or answers the question. 1. Benton and Orton are

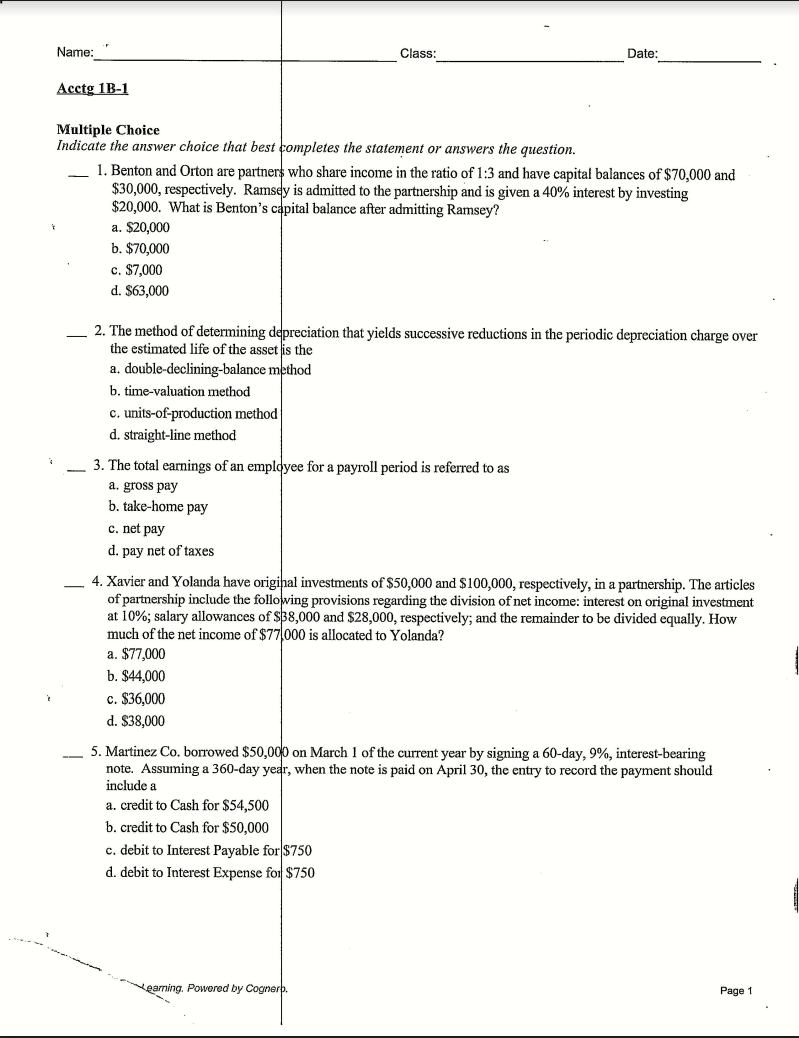

Name: Class: Date: Acctg 1B-1 Multiple Choice Indicate the answer choice that best completes the statement or answers the question. 1. Benton and Orton are partner who share income in the ratio of 1:3 and have capital balances of $70,000 and $30,000, respectively. Ramsey is admitted to the partnership and is given a 40% interest by investing $20,000. What is Benton's capital balance after admitting Ramsey? a. $20,000 b. $70,000 c. $7,000 d. $63,000 2. The method of determining depreciation that yields successive reductions in the periodic depreciation charge over the estimated life of the asset is the a. double-declining-balance method b. time-valuation method c. units-of-production method d. straight-line method - 3. The total earnings of an employee for a payroll period is referred to as a. gross pay b. take-home pay c. net pay d. pay net of taxes 4. Xavier and Yolanda have original investments of $50,000 and $100,000, respectively, in a partnership. The articles of partnership include the following provisions regarding the division of net income: interest on original investment at 10%; salary allowances of $38,000 and $28,000, respectively; and the remainder to be divided equally. How much of the net income of $77,000 is allocated to Yolanda? a. $77,000 b. $44,000 c. $36,000 d. $38,000 5. Martinez Co. borrowed $50,000 on March 1 of the current year by signing a 60-day, 9%, interest-bearing note. Assuming a 360-day year, when the note is paid on April 30, the entry to record the payment should include a a. credit to Cash for $54,500 b. credit to Cash for $50,000 c. debit to Interest Payable for $750 d. debit to Interest Expense for $750

Name: Class: Date: Acctg 1B-1 Multiple Choice Indicate the answer choice that best completes the statement or answers the question. 1. Benton and Orton are partner who share income in the ratio of 1:3 and have capital balances of $70,000 and $30,000, respectively. Ramsey is admitted to the partnership and is given a 40% interest by investing $20,000. What is Benton's capital balance after admitting Ramsey? a. $20,000 b. $70,000 c. $7,000 d. $63,000 2. The method of determining depreciation that yields successive reductions in the periodic depreciation charge over the estimated life of the asset is the a. double-declining-balance method b. time-valuation method c. units-of-production method d. straight-line method - 3. The total earnings of an employee for a payroll period is referred to as a. gross pay b. take-home pay c. net pay d. pay net of taxes 4. Xavier and Yolanda have original investments of $50,000 and $100,000, respectively, in a partnership. The articles of partnership include the following provisions regarding the division of net income: interest on original investment at 10%; salary allowances of $38,000 and $28,000, respectively; and the remainder to be divided equally. How much of the net income of $77,000 is allocated to Yolanda? a. $77,000 b. $44,000 c. $36,000 d. $38,000 5. Martinez Co. borrowed $50,000 on March 1 of the current year by signing a 60-day, 9%, interest-bearing note. Assuming a 360-day year, when the note is paid on April 30, the entry to record the payment should include a a. credit to Cash for $54,500 b. credit to Cash for $50,000 c. debit to Interest Payable for $750 d. debit to Interest Expense for $750 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started