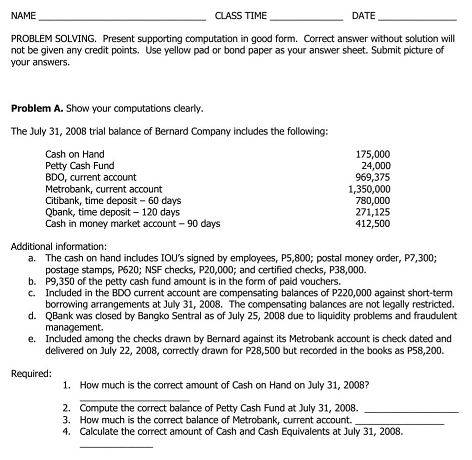

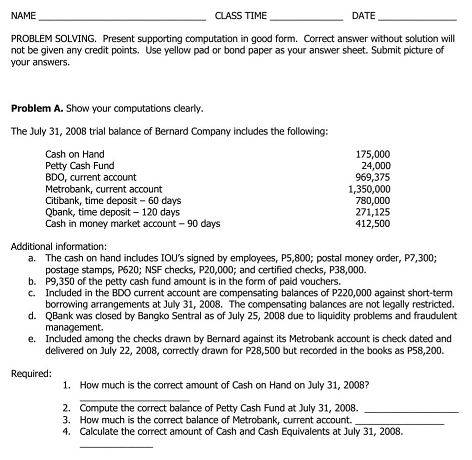

NAME CLASS TIME DATE PROBLEM SOLVING. Present supporting computation in good form. Correct answer without solution will not be given any credit points. Use yellow pad or bond paper as your answer sheet. Submit picture of your answers. Problem A. Show your computations clearly. The July 31, 2008 trial balance of Bernard Company includes the following: Cash on Hand 175,000 Petty Cash Fund 24,000 BDO, current account 969,375 Metrobank, current account 1,350,000 Citibank, time deposit - 60 days 780,000 Qbank, time deposit - 120 days 271,125 Cash in money market account - 90 days 412,500 Additional information: a. The cash on hand includes IOU's signed by employees, P5,800; postal money order, P7,300; postage stamps, P620; NSF checks, P20,000; and certified checks, P38,000. b. P9,350 of the petty cash fund amount is in the form of paid vouchers. C. Included in the BDO current account are compensating balances of P220,000 against short-term borrowing arrangements at July 31, 2008. The compensating balances are not legally restricted. d. QBank was closed by Bangko Sentral as of July 25, 2008 due to liquidity problems and fraudulent management. e. Included among the checks drawn by Bernard against its Metrobank account is check dated and delivered on July 22, 2008, correctly drawn for P28,500 but recorded in the books as P58,200. Required: 1. How much is the correct amount of Cash on Hand on July 31, 2008? 2. Compute the correct balance of Petty Cash Fund at July 31, 2008. 3. How much is the correct balance of Metrobank, current account. 4. Calculate the correct amount of Cash and Cash Equivalents at July 31, 2008. NAME CLASS TIME DATE PROBLEM SOLVING. Present supporting computation in good form. Correct answer without solution will not be given any credit points. Use yellow pad or bond paper as your answer sheet. Submit picture of your answers. Problem A. Show your computations clearly. The July 31, 2008 trial balance of Bernard Company includes the following: Cash on Hand 175,000 Petty Cash Fund 24,000 BDO, current account 969,375 Metrobank, current account 1,350,000 Citibank, time deposit - 60 days 780,000 Qbank, time deposit - 120 days 271,125 Cash in money market account - 90 days 412,500 Additional information: a. The cash on hand includes IOU's signed by employees, P5,800; postal money order, P7,300; postage stamps, P620; NSF checks, P20,000; and certified checks, P38,000. b. P9,350 of the petty cash fund amount is in the form of paid vouchers. C. Included in the BDO current account are compensating balances of P220,000 against short-term borrowing arrangements at July 31, 2008. The compensating balances are not legally restricted. d. QBank was closed by Bangko Sentral as of July 25, 2008 due to liquidity problems and fraudulent management. e. Included among the checks drawn by Bernard against its Metrobank account is check dated and delivered on July 22, 2008, correctly drawn for P28,500 but recorded in the books as P58,200. Required: 1. How much is the correct amount of Cash on Hand on July 31, 2008? 2. Compute the correct balance of Petty Cash Fund at July 31, 2008. 3. How much is the correct balance of Metrobank, current account. 4. Calculate the correct amount of Cash and Cash Equivalents at July 31, 2008