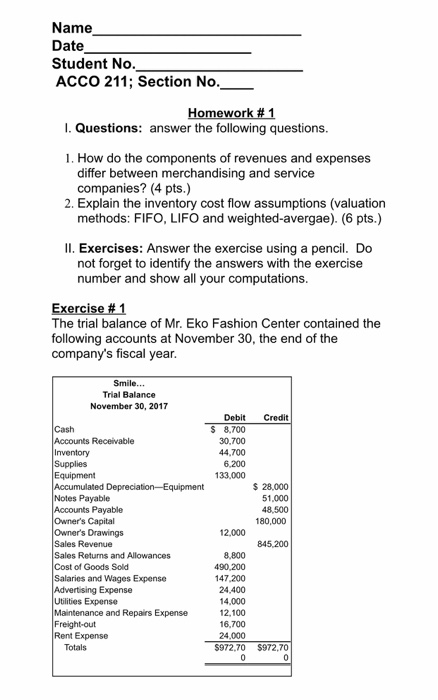

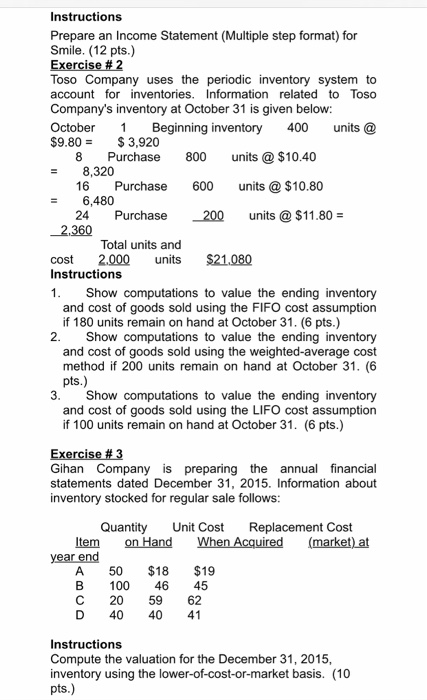

Name Date Student No. ACCO 211; Section No. Homework # 1 1. Questions: answer the following questions. 1. How do the components of revenues and expenses differ between merchandising and service companies? (4 pts.) 2. Explain the inventory cost flow assumptions (valuation methods: FIFO, LIFO and weighted-avergae). (6 pts.) II. Exercises: Answer the exercise using a pencil. Do not forget to identify the answers with the exercise number and show all your computations. Exercise #1 The trial balance of Mr. Eko Fashion Center contained the following accounts at November 30, the end of the company's fiscal year. Smile... Trial Balance November 30, 2017 Credit Debit $ 8.700 30.700 44.700 6.200 133.000 $ 28,000 51.000 48,500 180,000 12,000 Cash Accounts Receivable Inventory Supplies Equipment Accumulated Depreciation-Equipment Notes Payable Accounts Payable Owner's Capital Owner's Drawings Sales Revenue Sales Returns and Allowances Cost of Goods Sold Salaries and Wages Expense Advertising Expense Utilities Expense Maintenance and Repairs Expense Freight-out Rent Expense Totals 845.200 8.800 490,200 147,200 24.400 14.000 12,100 16.700 24,000 $972,70 $972.70 O Instructions Prepare an Income Statement (Multiple step format) for Smile. (12 pts.) Exercise #2 Toso Company uses the periodic inventory system to account for inventories. Information related to Toso Company's inventory at October 31 is given below: October 1 Beginning inventory 400 units $9.80 = $3.920 8 Purchase 800 units @ $10.40 = 8,320 16 Purchase 600 units @ $10.80 = 6,480 24 Purchase 200 units @ $11.80 = 2.360 Total units and cost 2.000 units $21.080 Instructions 1. Show computations to value the ending inventory and cost of goods sold using the FIFO Cost assumption if 180 units remain on hand at October 31. (6 pts.) 2. Show computations to value the ending inventory and cost of goods sold using the weighted average cost method if 200 units remain on hand at October 31. (6 pts.) 3. Show computations to value the ending inventory and cost of goods sold using the LIFO cost assumption if 100 units remain on hand at October 31. (6 pts.) Exercise #3 Gihan Company is preparing the annual financial statements dated December 31, 2015. Information about inventory stocked for regular sale follows: Quantity Unit Cost Replacement Cost Item on Hand When Acquired (market) at year end A 50 $18 $19 B 100 46 45 C 20 5962 D 40 40 41 Instructions Compute the valuation for the December 31, 2015, inventory using the lower-of-cost-or-market basis. (10 pts.) Name Date Student No. ACCO 211; Section No. Homework # 1 1. Questions: answer the following questions. 1. How do the components of revenues and expenses differ between merchandising and service companies? (4 pts.) 2. Explain the inventory cost flow assumptions (valuation methods: FIFO, LIFO and weighted-avergae). (6 pts.) II. Exercises: Answer the exercise using a pencil. Do not forget to identify the answers with the exercise number and show all your computations. Exercise #1 The trial balance of Mr. Eko Fashion Center contained the following accounts at November 30, the end of the company's fiscal year. Smile... Trial Balance November 30, 2017 Credit Debit $ 8.700 30.700 44.700 6.200 133.000 $ 28,000 51.000 48,500 180,000 12,000 Cash Accounts Receivable Inventory Supplies Equipment Accumulated Depreciation-Equipment Notes Payable Accounts Payable Owner's Capital Owner's Drawings Sales Revenue Sales Returns and Allowances Cost of Goods Sold Salaries and Wages Expense Advertising Expense Utilities Expense Maintenance and Repairs Expense Freight-out Rent Expense Totals 845.200 8.800 490,200 147,200 24.400 14.000 12,100 16.700 24,000 $972,70 $972.70 O Instructions Prepare an Income Statement (Multiple step format) for Smile. (12 pts.) Exercise #2 Toso Company uses the periodic inventory system to account for inventories. Information related to Toso Company's inventory at October 31 is given below: October 1 Beginning inventory 400 units $9.80 = $3.920 8 Purchase 800 units @ $10.40 = 8,320 16 Purchase 600 units @ $10.80 = 6,480 24 Purchase 200 units @ $11.80 = 2.360 Total units and cost 2.000 units $21.080 Instructions 1. Show computations to value the ending inventory and cost of goods sold using the FIFO Cost assumption if 180 units remain on hand at October 31. (6 pts.) 2. Show computations to value the ending inventory and cost of goods sold using the weighted average cost method if 200 units remain on hand at October 31. (6 pts.) 3. Show computations to value the ending inventory and cost of goods sold using the LIFO cost assumption if 100 units remain on hand at October 31. (6 pts.) Exercise #3 Gihan Company is preparing the annual financial statements dated December 31, 2015. Information about inventory stocked for regular sale follows: Quantity Unit Cost Replacement Cost Item on Hand When Acquired (market) at year end A 50 $18 $19 B 100 46 45 C 20 5962 D 40 40 41 Instructions Compute the valuation for the December 31, 2015, inventory using the lower-of-cost-or-market basis. (10 pts.)