Advanced : Preparation of a flexible budget Gray Ltd will commence operations at the beg1nning of the

Question:

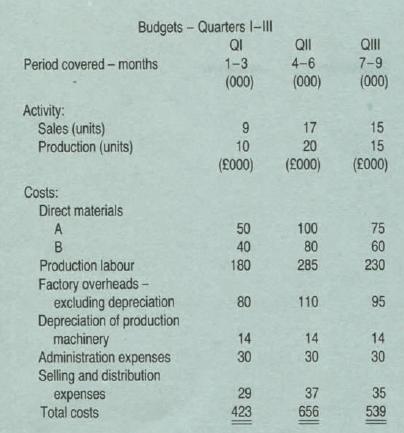

Advanced : Preparation of a flexible budget Gray Ltd will commence operations at the beg1nning of the year and the budgets for activity and costs for the firs t three quarters of operation are shown below.

The figures 1n the budgets for quarters I to Ill reflect Gray's cost structures which have the following major features:

(i) the fixed element of any cost is completely independent of activity levels;

(ii) any variable element of each cost displays a simple linear relationship to volume except that the variable labour costs become 50% higher for activity 1n excess of 19 000 units per quarter due to the necessity for overtime working;

(ni) the variable element of selling and distribution expenses is a function of sales. all other costs with a variable element are a function of production volume.

In quarter IV the sales volume could range from an extreme low volume of 15 000 units to an extreme h1gh volume of 21 000 units but w1th a most likely volume of 18000 units. In month 9 it will be possible to accurately estimate sales for quarter IV and the production level for that quarter will be set equal to the sales volume. Activity for each quarter is spread evenly throughout that quarter.

Cost structures will remain the same in quarters I to Ill but are expected to differ in quarter IV only m the following respects:

(i) Matenal A will rise in price by 20%

(ii) All production labour wage rates will nse by 121k 0 o (iii) Variable labour input per unit of output w11l decrease, due to the learning curve effect, such that only 80% of the previous labour 1nput per unit of output is required in quarter IV The threshold for overtime working remains at 19000 units per quarter.

(iv) Fixed factory overheads and the fixed element of selling and distribution costs will each rise by 20%. (The vanable element of selling and distribution costs w1ll be unaltered.)

The effect of these changes is considered too small to reqUire a change in the standard cost per unit of £30 which is used for stock valuation.

Sales price in quarter IV, £40, will be identical to the price charged 1n the previous three quarters. All sales are made on terms wh1ch are strictly net and allow two months credit. However, the actual payment pattern expected w1lllead to :

70% of all sales being paid in accordance with the credit terms .

100% of all sales being pa1d for withm 3 months.

All cash expenses relating to product1on are paid for 1n the month production takes place and similarly expenses relating to selling and distribution are paid for in the month of sale.

Required~

(a) Produce a statement which analyses, under each cost classification given in the budgets, the variable cost per umt and the fixed costs which will be effective 1n quarter IV.

(c. 6 marks)

(b) Prepare a flexible budget of estimated production costs for quarter IV. The budget should be drawn up with step pocnts which will facilitate simple interpolation of costs for production levels between those presented in the budget and will also show expected costs for the most likely production level.

(c. 4 marks)

(c) (i) Prepare statements show1ng the profit and the cash flow to be derived during quarter IV at the expected, extreme high and extreme low levels of actMty.

(c. 8 marks)

(ii) Briefly comment on the reasons for any differences between the behaviour of cash flow and profit at the three levels of activity.

Step by Step Answer: