Advanced: Comparison of alternative strategies using the learning curve and a minimax regret table (a) The Far

Question:

Advanced: Comparison of alternative strategies using the learning curve and a minimax regret table

(a) The Far Flung Toy Company Ltd manufactures plastic toys.

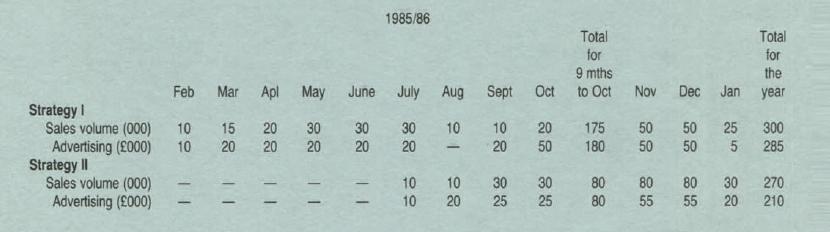

A new toy has been created with an estimated product life of twelve months. There are two alternative marketing strategies for which the forecast sales volume and advertising expenditures are given below.

Strategty I requires the immediate start of production and sales of the toy 10 February 1985. Far Flung would sell the toy for £3.25,

(recommended retail price £4.50). Then at the beginning of November 1985 the recommended ratail price would be reduced to

£3.50, with Far Flung receiving £2.50. A big increase in advertising would be undertaken, aimed at the Christmas market

Strategy II delays taking the product to the market until July 1985 and then builds up steadily towards Christmas. The recommended retail price of £4.00 would be unchanged throughout with Far Flung rece~ving £3.00 per toy.

Labour is the major cost element. There is a learning curve effect on the labour costs. From past experience, when the volume is doubled the new average cost is 80% of that at the previous volume. The formula for 1he learning curve effect is:

y = ax-b

where: yis the average number of hours per batch of 10 toys, a is 52 hours: the time taken for the first batch of 10 toys, x is the cumulative number of batches of 1 0 toys, and b IS the index of learning to be calculated from the 80 per cent learning curve. The labour rate per hour is £6.00.

Other costs not affected by the learning curve are, per batch of 1 0 toys, materials £3.00 and variable overheads £1.1 0, with separable fixed overheads of £4500 per month. However, if strategy II is undertaken separable fixed overheads will be £1500 per month for the first five months of the year and £4500 per month for the remaining seven months. The tooling costs of the project are £40000. Net cash inflows are usually 90% of accrued profit at any intermediate date during a project. There is another project requiring £50 000 outlay on 1 November 1985 and it is hoped that cash from the toy project will contribute to this outlay. Assume all toys made are sold.

You are required to compute and show the profit statements for the two alternative strategies under consideration making use of the learning curve and the information given above. Present sufficient information to enable management to consider the effects of the strategies bearing in mind the corporate cash needs. State with reasons, your recommendations for the strategy to be selected.

(12 marks)

Note: Ignore taxation.

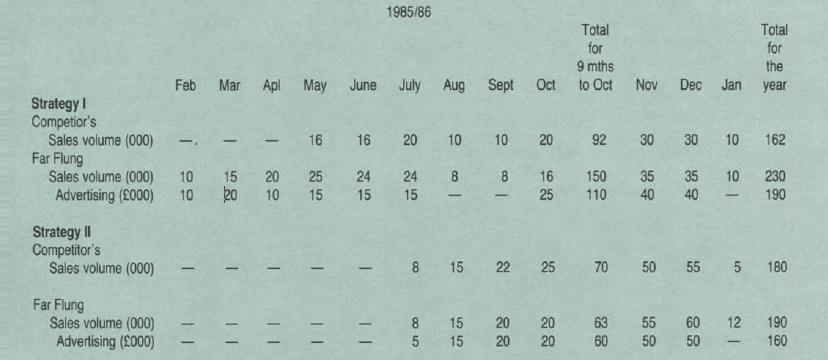

(b) A competitor has learnt of Far Flung's intent to market this particular toy and is considering the manufacture and marketing of a cheaper version of poorer quality in direct competition. If the competitor does enter the market then Far Flung's forecasts under its two strategies would be revised as shown in the following table, which also gives forecasts of the competitor's likely sales volumes.

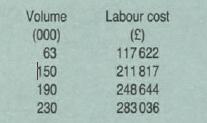

The labour costs using the learning curve have been calculated for the following volumes:

The other costs will be incurred on the same basis as in section (a)

except for the advertising budget revised above. For the competitor the net profits lor the two strategies are estimated at £26 000 and £15000 for I and II respectively. The competitor's choice of strategy is not known.

You are required to:

(i) set out for Far Flung's management, with appropriate financial information, recommendations as to which strategy to adopt. (Remember there is no certainty that the competitor will enter the market but that these are the only two possible strategy combinations.); (8 marks)

and (ii) prepare a minimax regret table and select the appropriate strategy for Far Flung. (Use the information in sections (a)

and

(b) and assume that there are only two market states, either the competitor does not enter the market, or if it does.

it then follows the same strategy as Far Flung.)

Step by Step Answer: