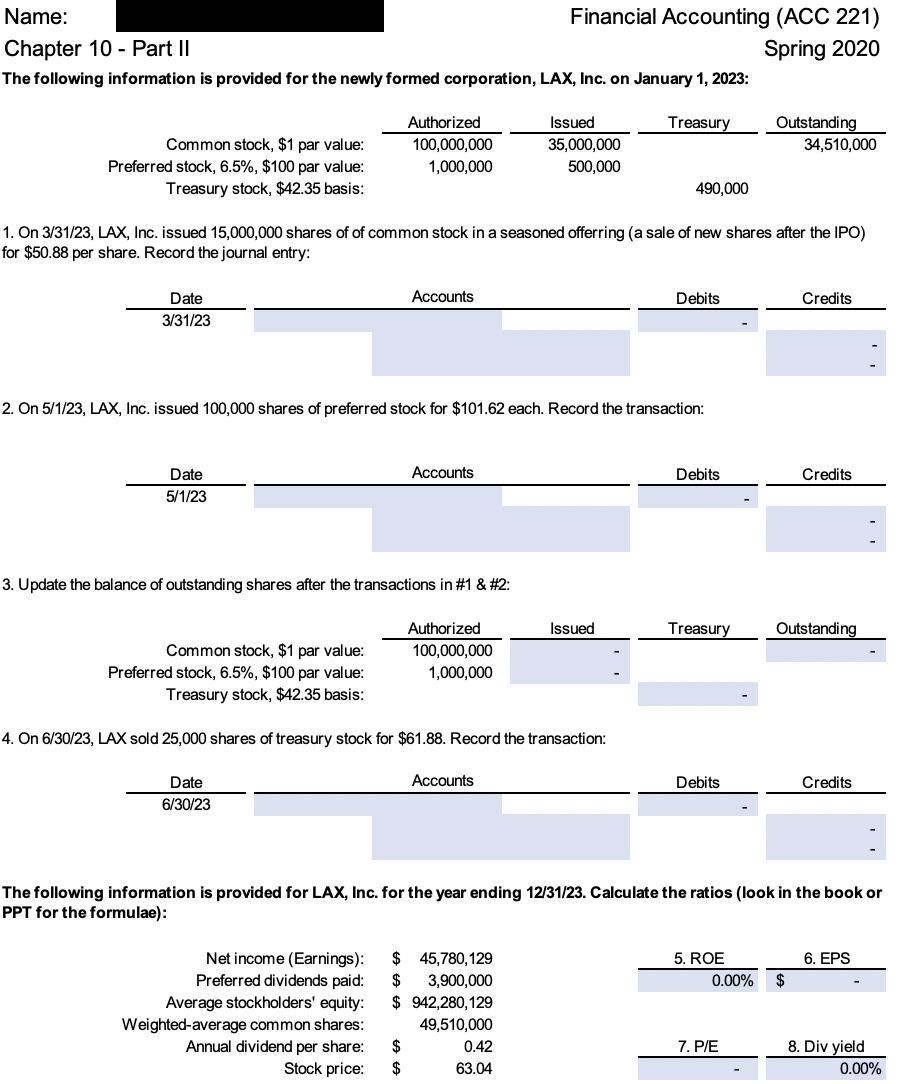

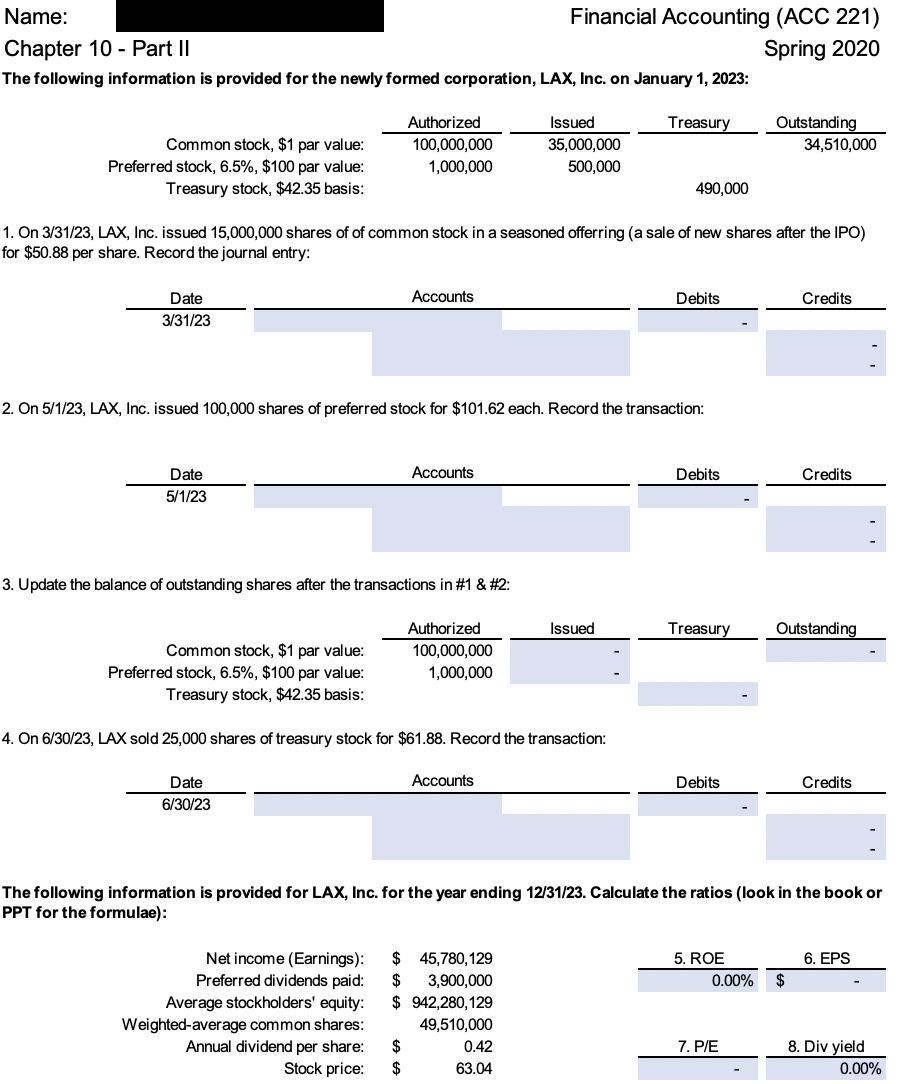

Name: Financial Accounting (ACC 221) Chapter 10 - Part II Spring 2020 The following information is provided for the newly formed corporation, LAX, Inc. on January 1, 2023: Treasury OULS Authorized 100,000,000 1,000,000 Common stock, $1 par value: Preferred stock, 6.5%, $100 par value: Treasury stock, $42.35 basis: Issued 35,000,000 500,000 Outstanding 34,510,000 490,000 1. On 3/31/23, LAX, Inc. issued 15,000,000 shares of of common stock in a seasoned offerring (a sale of new shares after the IPO) for $50.88 per share. Record the journal entry: Accounts Debits Credits Date 3/31/23 2. On 5/1/23, LAX, Inc. issued 100,000 shares of preferred stock for $101.62 each. Record the transaction: - Accounts Debits Date 5/1/23 Credits 3. Update the balance of outstanding shares after the transactions in #1 & #2: Issued Treasury Outstanding Common stock, $1 par value: Preferred stock, 6.5%, $100 par value: Treasury stock, $42.35 basis: Authorized 100,000,000 1,000,000 4. On 6/30/23, LAX sold 25,000 shares of treasury stock for $61.88. Record the transaction: Accounts Debits Credits Date 6/30/23 The following information is provided for LAX, Inc. for the year ending 12/31/23. Calculate the ratios (look in the book or PPT for the formulae): 6. EPS 5. ROE 0.00% $ Net income (Earnings): Preferred dividends paid: Average stockholders' equity: Weighted-average common shares: Annual dividend per share: Stock price: $ 45,780, 129 $ 3,900,000 $ 942,280, 129 49,510,000 0.42 $ 63.04 7. P/E 8. Div yield 0.00% Name: Financial Accounting (ACC 221) Chapter 10 - Part II Spring 2020 The following information is provided for the newly formed corporation, LAX, Inc. on January 1, 2023: Treasury OULS Authorized 100,000,000 1,000,000 Common stock, $1 par value: Preferred stock, 6.5%, $100 par value: Treasury stock, $42.35 basis: Issued 35,000,000 500,000 Outstanding 34,510,000 490,000 1. On 3/31/23, LAX, Inc. issued 15,000,000 shares of of common stock in a seasoned offerring (a sale of new shares after the IPO) for $50.88 per share. Record the journal entry: Accounts Debits Credits Date 3/31/23 2. On 5/1/23, LAX, Inc. issued 100,000 shares of preferred stock for $101.62 each. Record the transaction: - Accounts Debits Date 5/1/23 Credits 3. Update the balance of outstanding shares after the transactions in #1 & #2: Issued Treasury Outstanding Common stock, $1 par value: Preferred stock, 6.5%, $100 par value: Treasury stock, $42.35 basis: Authorized 100,000,000 1,000,000 4. On 6/30/23, LAX sold 25,000 shares of treasury stock for $61.88. Record the transaction: Accounts Debits Credits Date 6/30/23 The following information is provided for LAX, Inc. for the year ending 12/31/23. Calculate the ratios (look in the book or PPT for the formulae): 6. EPS 5. ROE 0.00% $ Net income (Earnings): Preferred dividends paid: Average stockholders' equity: Weighted-average common shares: Annual dividend per share: Stock price: $ 45,780, 129 $ 3,900,000 $ 942,280, 129 49,510,000 0.42 $ 63.04 7. P/E 8. Div yield 0.00%