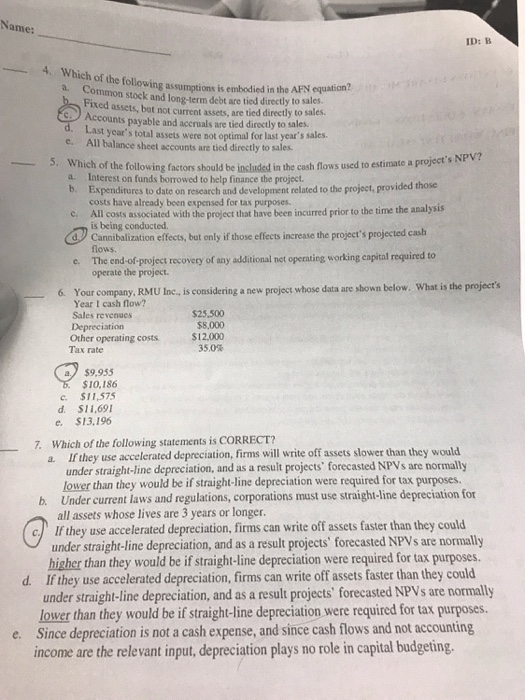

Name: ID: B 4. Which of the following assumptions is embodied in the AFN equation? Common stock and long-term debt are tied directly to sales. Fixed assets, bat not current assets, are tied directly to sales. .Accounts payable and accruals are tied directly to sales Last c year's total assets were not optimal for last year's sales. All balance sheet accounts are tied directly to sales s NPV? 5.Which of the following factors should be includesd in the cash flows used to estimate a pro a. Interest on funds borrowed to help finance the project b. Expenditures to date on research and development related to the project, provided those costs have already been expensed for tax purposes All costs associated with the project that have been incurred prior to the time the analysis c. is being conducted. Cannibalization effects, bat only if those effects increase the project's projected cash flows c. The end-of-project recovery of any additional net operating working capital required to operate the project 6. Your company, RMU Inc., is consdering a new project whose daia are shown below. Whst is the projeer's Year I cash flow? Sales revenues Depreciation Other operating costs$12.000 $25,500 $8,000 35.0% Tax rate a$9,955 $10,186 . $11,575 d. S11,691 e. $13,196 Which of the following statements is CORRECT? a 7. If they use accelerated depreciation, firms will write off assets sl under straight-line depreciation. and as a result projects' forecasted NPVs are normally lower than they would be if straight-line depreciation were required for tax purposes Under current laws and regulations, corporations must use straight-line depreciation for all assets whose lives are 3 years or longer. b. cJ If they use accelerated depreciation, firms can write off assets faster than they could under straight-line depreciation, and as a result projects' forecasted NPVs are normally higher than they would be if straight-line depreciation were required for tax purposes If they use accelerated depreciation, firms can write off assets faster than they could d. under straight-line depreciation, and as a result projects' forecasted NPVs are normally lower than they would be if straight-line depreciation were required for tax purposes Since depreciation is not a cash expense, and since cash flows and not accounting e. income are the relevant input, depreciation plays no role in capital budgeting