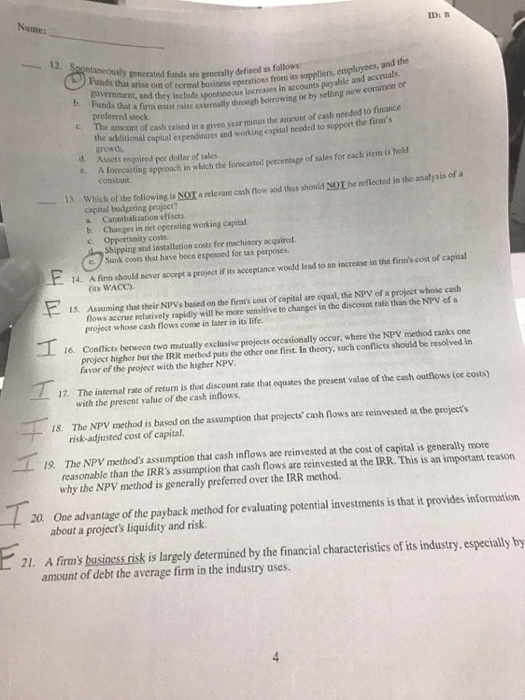

Name: ID: B Funds thut grnerafed funds ate generally defiood as follows: government st basiness operations from its soppliers, employees, and t preferred stock and the bundide spontsneous lincreases in accounts payable and accruals b. Funds that a firm e or rm mast raise externally throegh borrowing or by selling new coramorn c. The amount of cash raised in a given year minos the amount of cash nceded to finance the additional cupial expenditures and working capital needed to support the firm's d. Assets required per dellar of sales e. A forecastin g approach in wbich the forecasted percentage of sales for each item is held 13. Which of the following is NOT a relevant cash flow and tdhas should NOT be reflected in the analysis of a capital badgeting project? a. Cannibalization effects b. Changes in net operating working capital c. Opportinity costs Shipping and iatallation costs for machisery acqaired. e. Sunk costs that have been expensed for tax parposes. ts WACC) fnows accrue relatively rapidly will be more sensitive to changes in the discount rate than the NPV of a 1 A fim should sever scoept a project if its cceptance would lead to an increase in the firm's cost of capital 1 Assuming thas their NPVs based on the firm's cost of eapitnl are equal, the NPV of a projest whose cash project whose cash flows come in later in its life. 6. Conflicts between two mutually exclasive projects occasionally occur, where the NPV method ranks one project higher but the IRR method pats the other one first. In theory, such conflicts should be resolved in favor of the project with the higher NPV 17. The internal rate of return is that discount rate that equates the present value of the cash outflows (or costs) with the present value of the cash inflows 18. The NPV method is based on the assumption that projects' cash nows are reinvested at the project's risk-adjusted cost of capital. 19. The NPV method's assumption that cash inflows are reinvested at the cost of capital is generally more reasonable than the IRR's assumption that cash flows are reinvested at the IRR. This is an important reason 20. One advantage of the payback method for evaluating potential investments is that it provides information 2. A firm's business risk is largely determined by the financial characteristics of its industry, especially by why the NPV method is generally preferred over the IRR method about a project's liquidity and risk amount of debt the average firm in the industry uses