Answered step by step

Verified Expert Solution

Question

1 Approved Answer

< Name: Msci-Sample Questions.pdf C. long pays the short $105.00. Phone: 6. If the volatility of returns of an underlying security increases, then: A.

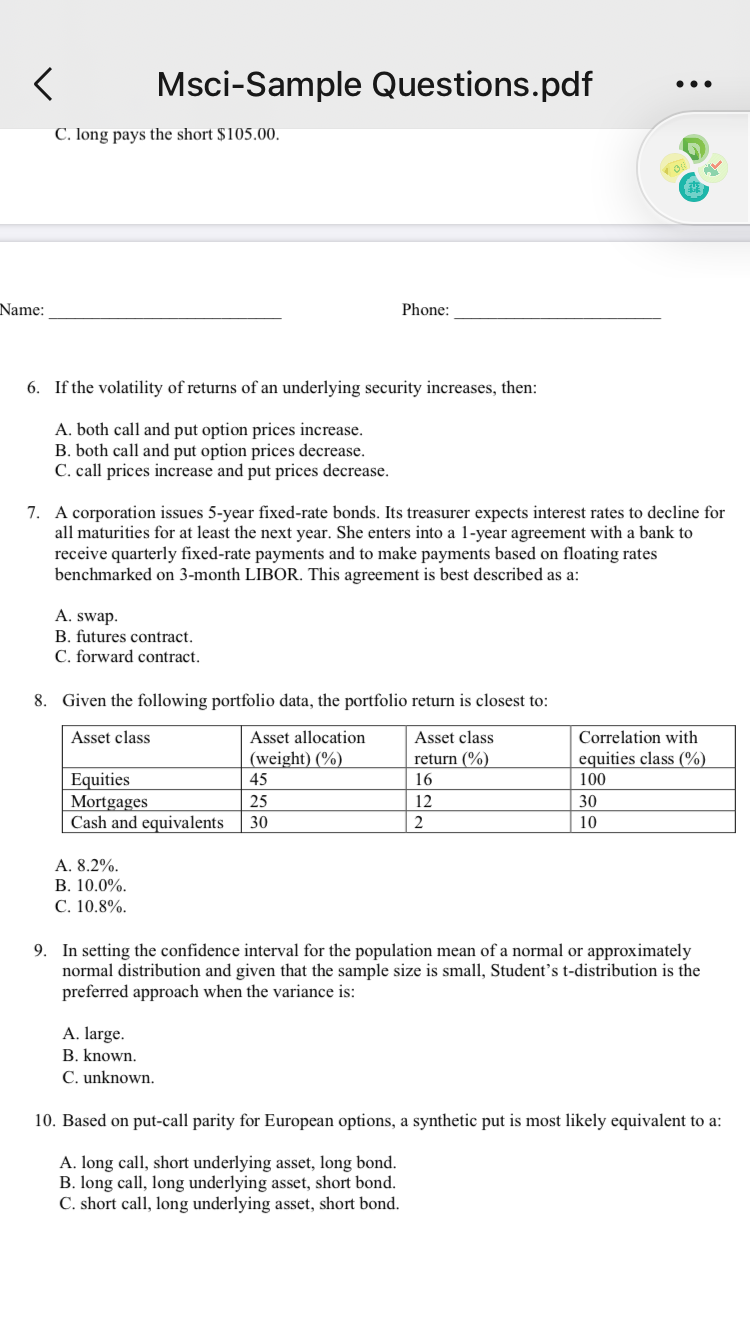

< Name: Msci-Sample Questions.pdf C. long pays the short $105.00. Phone: 6. If the volatility of returns of an underlying security increases, then: A. both call and put option prices increase. B. both call and put option prices decrease. C. call prices increase and put prices decrease. 7. A corporation issues 5-year fixed-rate bonds. Its treasurer expects interest rates to decline for all maturities for at least the next year. She enters into a 1-year agreement with a bank to receive quarterly fixed-rate payments and to make payments based on floating rates benchmarked on 3-month LIBOR. This agreement is best described as a: A. swap. B. futures contract. C. forward contract. 8. Given the following portfolio data, the portfolio return is closest to: Asset class Asset allocation Asset class (weight) (%) return (%) Correlation with equities class (%) Equities 45 16 100 Mortgages 25 12 30 Cash and equivalents 30 2 10 A. 8.2%. B. 10.0%. C. 10.8%. 9. In setting the confidence interval for the population mean of a normal or approximately normal distribution and given that the sample size is small, Student's t-distribution is the preferred approach when the variance is: A. large. B. known. C. unknown. 10. Based on put-call parity for European options, a synthetic put is most likely equivalent to a: A. long call, short underlying asset, long bond. B. long call, long underlying asset, short bond. C. short call, long underlying asset, short bond.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started