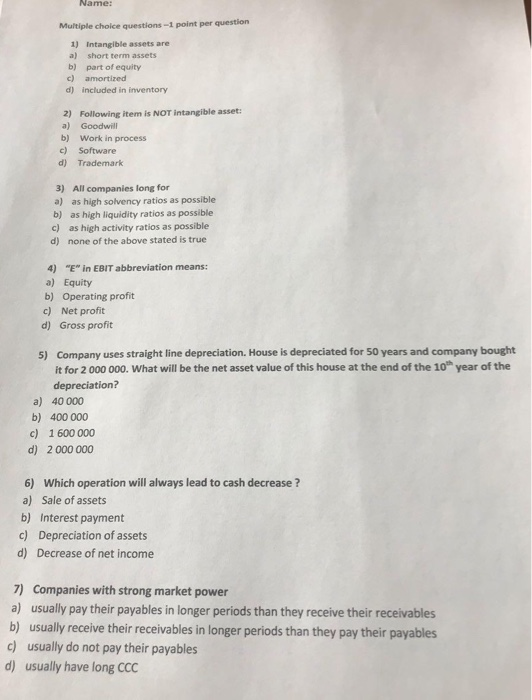

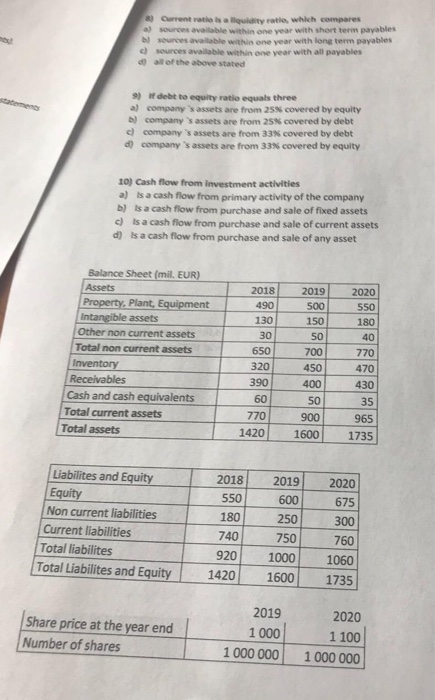

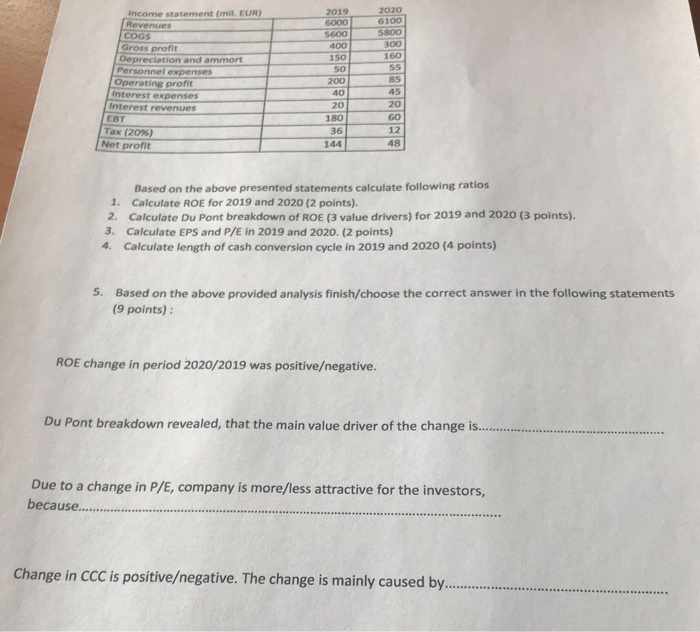

Name: Multiple choice questions-1 point per question 1) a) b) c) d) Intangible assets are short term assets part of equity amortized included in inventory 2) Following item is NOT intangible asset: a) Goodwill b) Work in process c) Software d) Trademark 3) All companies long for as high solvency ratios as possible as high liquidity ratios as possible as high activity ratios as possible none of the above stated is true a) b) c) d) "E" in EBIT abbreviation means: 4) a) Equity b) Operating profit c) Net proft d) Gross profit Company uses straight line depreciation. House is depreciated for 50 years and company bought 5) it for 2 000 000. What will be the net asset value of this house at the end of the 10 year of the depreciation? a) 40 000 b) 400 000 c) 1 600000 d) 2 000 000 Which operation will always lead to cash decrease? 6) a) Sale of assets b) Interest payment c) d) Decrease of net income Depreciation of assets 7) Companies with strong market power a) usually pay their payables in longer periods than they receive their receivables b) usually receive their receivables in longer periods than they pay their payables c) usually do not pay their payables d) usually have long CCC B) arrent ratio is a-arty ratio, which compares a) sources available within one year with short term payables b) sources available within one year with long term payables e) seurces available within one year with all payables d) all of the above stated 9) If debt to equity ratio equals three a) company 's assets are from 25% covered by equity b) company 's assets are from 25% covered by debt c) company 's assets are from 33% covered by debt d) company 's assets are from 33% covered by equity 10) Cash flow from investment activities a) is a cash flow from primary activity of the company b) is a cash flow from purchase and sale of fixed assets c) is a cash flow from purchase and sale of current assets d) is a cash flow from purchase and sale of any asset Balance Sheet (mil. EUR) 2018 19 2020 500 550 180 40 770 Property Plant, Equipment 490 130 30 650 Intangible assets Other non current assets Total non current assets 150 50 700 320 450 470 390 400 50 430 35 770900965 142016001735 Cash and cash equivalents Total current assets Total assets Liabilites and Equity 2018 20192020 675 300 760 920 10001060 Total Liabilites and Equity 14201600 1735 550 180 740 600 250 750 Non current liabilities Current liabilities Total liabilites 2019 1 000 2020 1100 1 000 000 1000 000 Share price at the year end Number of shares 2019 5600 400 150 50 200 40 20 180 36 2020 6100 5800 300 160 Income statement (mil. EUR) Revenues COGS Gross profit tion and ammort Personnel expenses 85 45 20 60 12 48 Operating profit Interest expenses Interest revenues EBT Net profit 144 Based on the above presented statements calculate following ratios 1. Calculate ROE for 2019 and 2020 (2 points). 2. Calculate Du Pont breakdown of ROE (3 value drivers) for 2019 and 2020 (3 points). 3. Calculate EPS and P/E in 2019 and 2020. (2 points) 4. Calculate length of cash conversion cycle in 2019 and 2020 (4 points) 5. Based on the above provided analysis finish/choose the correct answer in the following statements (9 points) ROE change in period 2020/2019 was positiveegative Du Pont breakdown revealed, that the main value driver of the change i.... Due to a change in P/E, company is more/less attractive for the investors, Change in CCC is positiveegative. The change is mainly caused by