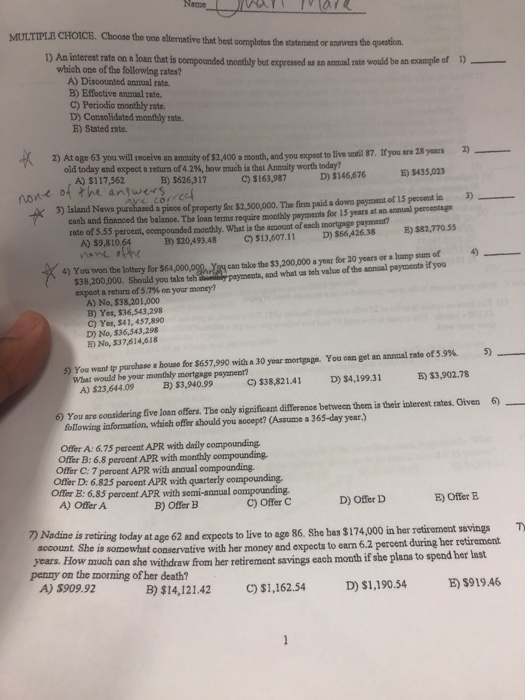

Name MULTPLE CHOICE. Choose the one atitermative that best completes the statement or ananwers the qpetion rate on a loan that is compounded monthly but expressed as an nmual rate would bo an example of 1) which one of tho following rates? A) Discounted annual rato. B) Effective annual rate. C) Periodio monthly rate D) Consolidated monthly rato. E) Stated rato. you will receive an annuity of $2,400 a month, and you expeot to live until 87. If you are 28 years ) Old today End expect a return of42%, how much is that Annaity worth today? A) $117,562 D) 146576 E 9435,023 B) $626,317 C) 3163,987 non istand News purehased a piece of property Sor $2,500,000. The firm paid a dows paymeat of 15 percent in3) cash and financed the balance. The loan terms require monthly payments for 15 years at an arnual percentage rate of 5.55 percent, compounded moothly. What is the amount of ench mortgage payment? A) $9,810.64 B) $20,493,48 C)$13,607.1D) $66,426.38 E) $82,770.55 4) You won the lottery for $64,000,00 You can take the $3,200,000 a year for 20 years or a lamp sum of $38,200,000. Should you take teh ..ot a return of5.7% on your money? A) No, $38,201,000 B) Yes, $36,543,298 C) Yes, $41, 457,890 D) No, $36,543,298 E) No, $37,614,618 ts, and what us teh value of the annual payments if you You want tp parchase a house for $657,990 with a 30 year mortgage. You onn get an annual rate of 5.9%. 5) What would be your monthly mortgage payment? A) $23,644.09 B)$3,940.99 $38,821.41 D) $4,199.31 E) $3,902.78 6) You are considering five loan offers. The only significant difference between them is their interest rates. Civen 6) following information, which offer should you accept? (Assume a 363-day year) Offer A: 6.75 percent APR with daily compounding Offer B: 6.8 peroent APR with monthly compounding. Offer C: 7 percent APR with annual compounding Offer D: 6.825 percent APR with quarterly compounding Offer B: 6.85 percent APR with semi-annual oompounding. A) Offer A B) Offer E D) Offer D C)Offer C B) Offer B 7) Nadine is retiring today at age 62 and expects to live to age 86. She has $174,000 in her rotirement savings aocount She is somewhat years. How muoh oan she withdraw from her retirement savings each month if she plans to spend ber last penny on the morning of her death? A) $909.92 t conservative with her money and expects to earn 6.2 percent during her retirement B) $14,121.42 ),162.54 D,190.549