Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Name of Students 1. Taxable income for an individual is defined as 3. AGI Reduced by itemized deductions b. AGI Reduced by personal and dependency

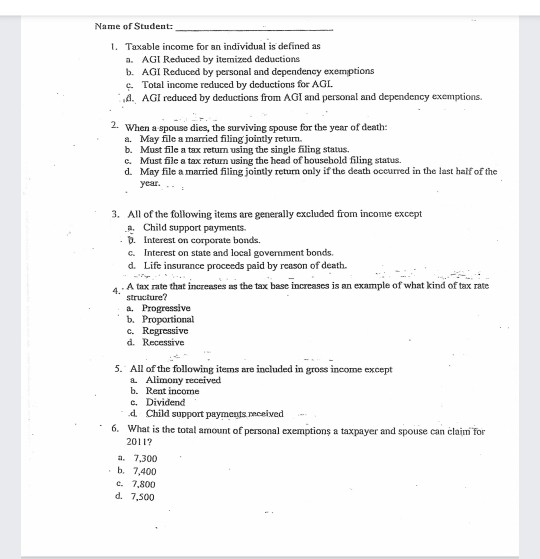

Name of Students 1. Taxable income for an individual is defined as 3. AGI Reduced by itemized deductions b. AGI Reduced by personal and dependency exemptions c. Total income reduced by deductions for AGI. 4. AGI reduced by deductions from AGI and personal and dependency exemptions. 2. When a spouse dies, the surviving spouse for the year of death: a. May file a married filing jointly retum. b. Must file a tax return using the single filing status. c. Must file a tax return using the head of household filing status. d. May file a married filing jointly return only if the death occurred in the last half of the year. 3. All of the following items are generally excluded from income except a. Child support payments. D. Interest on corporate bonds. C. Interest on state and local government bonds. d. Life insurance proceeds paid by reason of death. A tax rate that increases as the tax base increases is an example of what kind of tax rate structure? a. Progressive b. Proportional c. Regressive d. Recessive 4. 5. All of the following items are included in gross income except 2. Alimony received b. Rent income c. Dividend d. Child support payments received 6. What is the total amount of personal exemptions a taxpayer and spouse can claim for 2011? a. 7.300 b. 7,400 c. 7.800 d. 7.500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started