Answered step by step

Verified Expert Solution

Question

1 Approved Answer

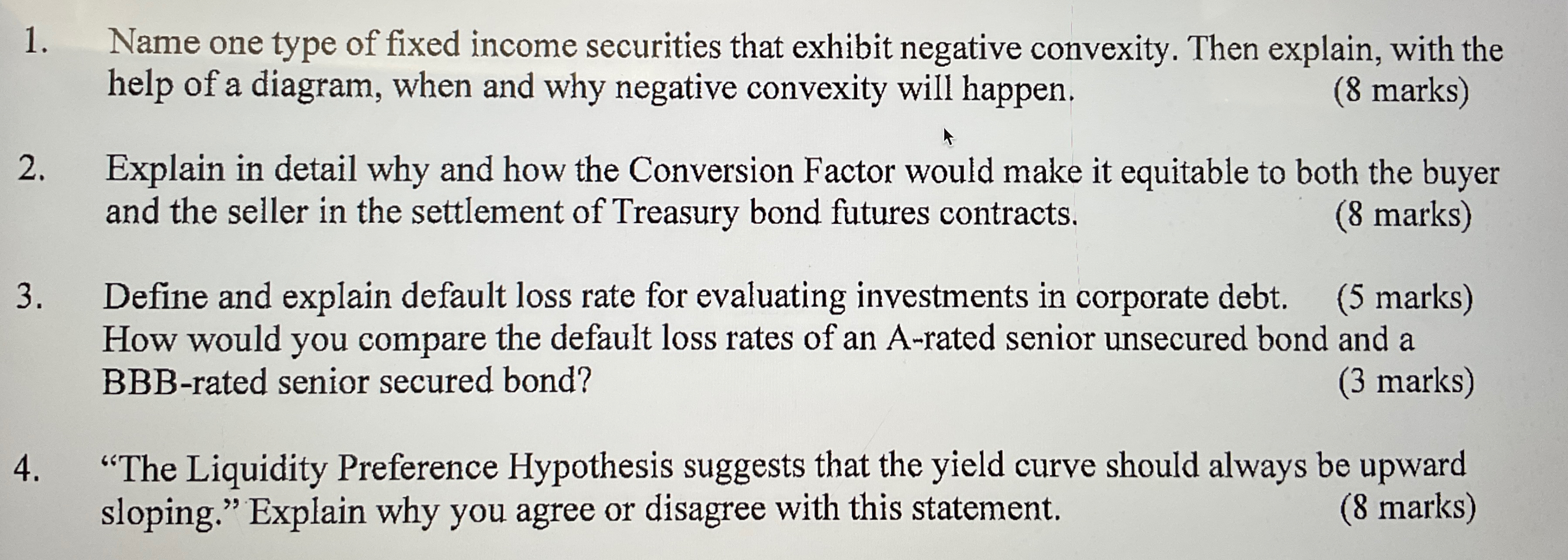

Name one type of fixed income securities that exhibit negative convexity. Then explain, with the help of a diagram, when and why negative convexity will

Name one type of fixed income securities that exhibit negative convexity. Then explain, with the help of a diagram, when and why negative convexity will happen.

marks

Explain in detail why and how the Conversion Factor would make it equitable to both the buyer and the seller in the settlement of Treasury bond futures contracts.

marks

Define and explain default loss rate for evaluating investments in corporate debt. marks How would you compare the default loss rates of an Arated senior unsecured bond and a BBBrated senior secured bond?

marks

"The Liquidity Preference Hypothesis suggests that the yield curve should always be upward sloping." Explain why you agree or disagree with this statement.

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started