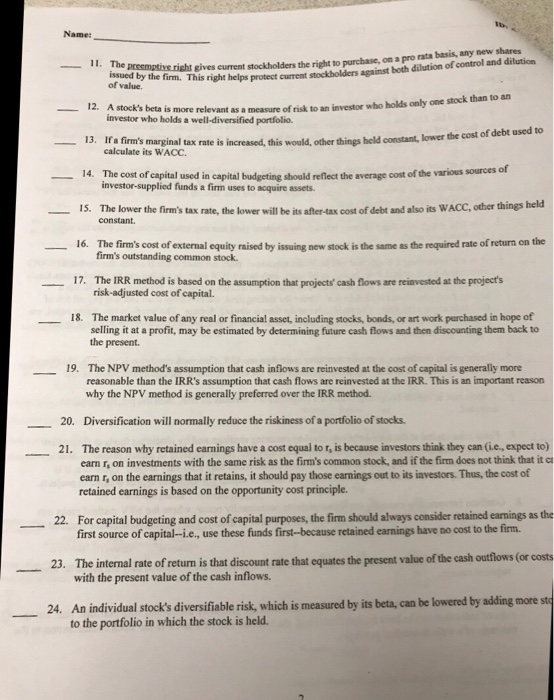

Name: preemptive right gives curremt stockholders the right to purchase, on a pro rata basis, any new shares issued of value. h rght helps protect current stockholders against both dilution of control and dilution 12. who holds only one stock than to an A stock's beta is more relevant as a measure of risk to an investor investor who holds a well-diversified portfolio. 13. If a firm's marginal tax rate is increased, this would, other things held constant, lower the cost of debt used to calculate its WACC. 14. The cost of capital used in capital budgeting should reflect the average cost of the various sources investor-supplied funds a firm uses to acquire assets 1S. The lower the firm's tax rate, the lower will be its after-tax cost of debt and also its WACC, other things held 16. The firm's cost of external equity raised by issuing new stock is the same as the required rate of return on the constant. firm's outstanding common stock 17. The IRR method is based on the assumption that projects' cash flows are reinvested at the project's risk-adjusted cost of capital. 18. The market value of any real or financial asset, including stocks, bonds, or art work purchased in hope of selling it at a profit, may be estimated by determining future cash flows and then discounting them back to the present. 19. The NPV method's assumption that cash inflows are reinvested at the cost of capital is generally more reasonable than the IRR's assumption that cash flows are reinvested at the IRR. This is an important reason why the NPV method is generally preferred over the IRR method. 20. Diversification will normally reduce the riskiness of a portfolio of stocks. 21. The reason why retained carnings have a cost equal to r, is because investors think they can (ie, expect to) earn r, on investments with the same risk as the firm's common stock, and if the firm does not think that it earn r, on the earnings that it retains, it should pay those earnings out to its investors. Thus, the cost of retained earnings is based on the opportunity cost principle. 22. For capital budgeting and cost of capital purposes, the firm should always consider retained eanings as the 23. The internal rate of retur is that discount rate that equates the present value of the 24. An individual stock's diversifiable risk, which is measured by its beta, can be lowered by adding more st first source of capital-i.e, use these funds first-because retained earnings have no cost to the firm. the cash outflows (or costs with the present value of the cash inflows. to the portfolio in which the stock is held