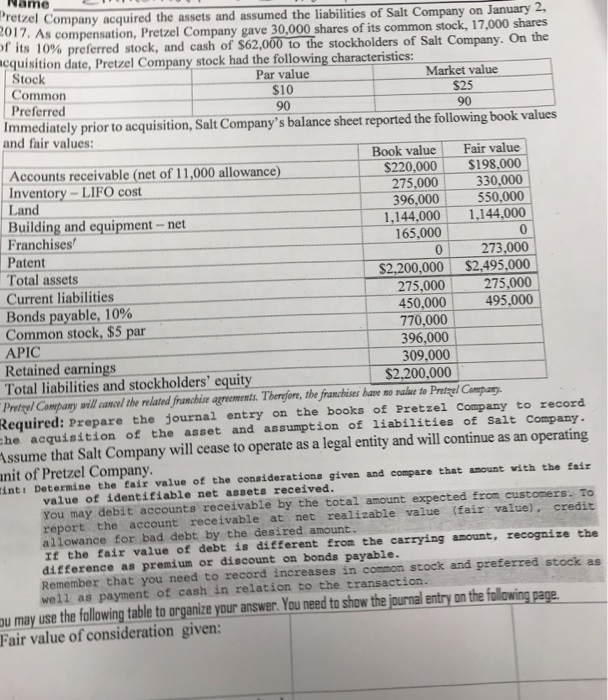

Name Pret 017, f its 10% preferred stock, and cash of S62.00) cquisition date, Pretzel Company stock had the following characteristics: zel Company acquired the assets and assumed the liabilities of Salt Company on January 2. As compensation, Pretzel Company gave 30,000 shares of its common stock, 17,000 shares to the stockholders of Salt Company. On the Stock Par value Market value $25 90 Common $10 Preferred 90 Immediately prior to acquisition, Salt Company's balance sheet reported the following book values and fair values: Book value Fair value 220,000 $198,000 550,000 1,1 1.144,000 Accounts receivable (net of 11,000 allowance) Inventory-LIFO cost Land Building and equipment-net Franchises Patent Total assets Current liabilities 275,000 330.000 396,000 44.000 165,000 0 273,000 $2,200,000 $2,495,000 Bonds payable, 10% Common stock, $5 par APIC 275,000 275,000 450,000 495,000 770,000 396,000 309,000 Retained earnings Total liabilities and stockholders' equity Pretrel Compary will anel the rlated franchin agroments.Theryfon,the framhiss haeno ie io Pritel Compa $2,200,000 Required: Prepare the journal entry on the books of Pretzel Company to record he acquisition of the asset and assumption of liabilities of salt Company ssume that Salt Company will cease to operate as a legal entity and will continue as an operating nit of Pretzel Company inti Determine the fair value of the consideratione given and compare that anount with the Eair value of identifiable net assets received You may debit accounts receivable by the total amount expected from customers. To report the account receivable at net realizable value (fair value), credit allowance for bad debt by the desired amount. If the fair value of debt is different from the carrying amount, recognize the difference as premium or discount on bonds payable. Remember that you need to record increases in common stock and preferred stock as well as payment of cash in relation to the t ransaction. u may use the following table to arganize your answer. You need to show the journal entry on the following page Fair value of consideration given