Answered step by step

Verified Expert Solution

Question

1 Approved Answer

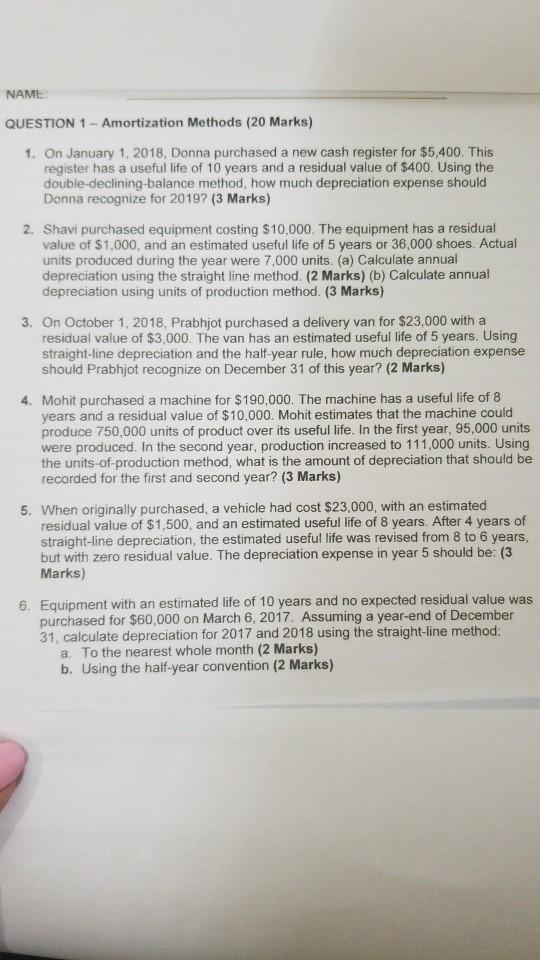

NAME QUESTION 1-Amortization Methods (20 Marks) 1. On January 1, 2018, Donna purchased a new cash register for $5,400. This register has a useful life

NAME QUESTION 1-Amortization Methods (20 Marks) 1. On January 1, 2018, Donna purchased a new cash register for $5,400. This register has a useful life of 10 years and a residual value of $400. Using the double-declining-balance method, how much depreciation expense should Donna recognize for 2019? (3 Marks) 2. Shavi purchased equipment costing $10,000. The equipment has a residual value of $1,000, and an estimated useful life of 5 years or 36,000 shoes. Actual units produced during the year were 7,000 units. (a) Calculate annual depreciation using the straight line method. (2 Marks) (b) Calculate annual depreciation using units of production method. (3 Marks) 3. On October 1, 2018, Prabhjot purchased a delivery van for $23,000 with a residual value of $3,000. The van has an estimated useful life of 5 years. Using straight-line depreciation and the half-year rule, how much depreciation expense should Prabhjot recognize on December 31 of this year? (2 Marks) 4. Mohit purchased a machine for $190,000. The machine has a useful life of 8 years and a residual value of $10,000. Mohit estimates that the machine could produce 750,000 units of product over its useful life. In the first year, 95,000 units were produced. In the second year, production increased to 111,000 units. Using the units-of-production method, what is the amount of depreciation that should be recorded for the first and second year? (3 Marks) 5. When originally purchased, a vehicle had cost $23,000, with an estimated residual value of $1,500, and an estimated useful life of 8 years. After 4 years of straight-line depreciation, the estimated useful life was revised from 8 to 6 years, but with zero residual value. The depreciation expense in year 5 should be: (3 Marks) 6. Equipment with an estimated life of 10 years and no expected residual value was purchased for $60,000 on March 6, 2017. Assuming a year-end of December 31, calculate depreciation for 2017 and 2018 using the straight-line method: a. To the nearest whole month (2 Marks) b. Using the half-year convention (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started