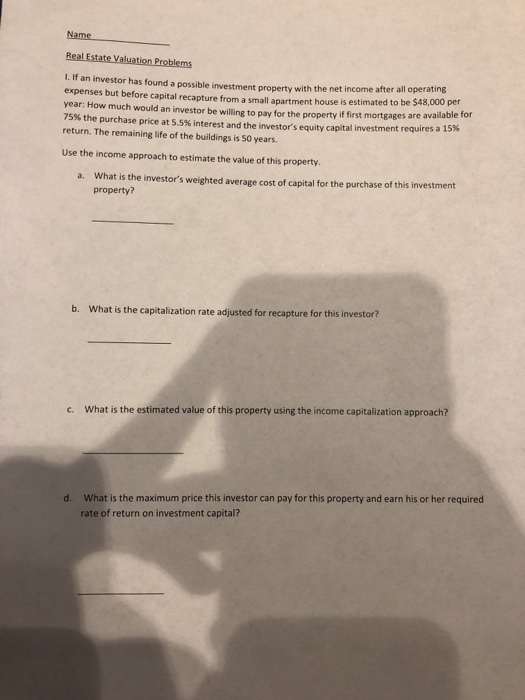

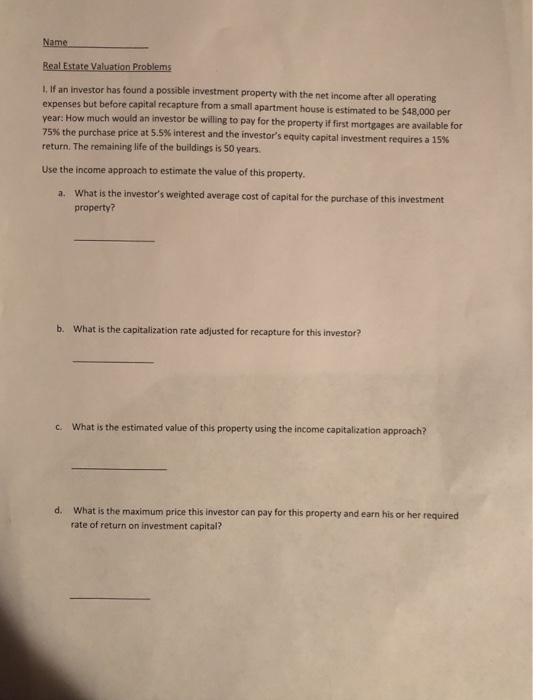

Name Real Estate Valuation Problems 1. If an investor has found a possible investment property with the net income after all operating expenses but before capital recapture from a small apartment house is estimated to be $48.000 per year: How much would an investor be willing to pay for the property if first mortgages are available for 75% the purchase price at 5.5% interest and the investor's equity capital investment requires a 15% return. The remaining life of the buildings is 50 years. Use the income approach to estimate the value of this property. a. What is the investor's weighted average cost of capital for the purchase of this investment property? b. What is the capitalization rate adjusted for recapture for this investor? c. What is the estimated value of this property using the income capitalization approach? d. What is the maximum price this investor can pay for this property and earn his or her required rate of return on investment capital? Name Real Estate Valuation Problems 1. If an investor has found a possible investment property with the net income after all operating expenses but before capital recapture from a small apartment house is estimated to be $48,000 per year: How much would an investor be willing to pay for the property if first mortgages are available for 75% the purchase price at 5.5% interest and the investor's equity capital investment requires a 15% return. The remaining life of the buildings is 50 years. Use the income approach to estimate the value of this property. a. What is the investor's weighted average cost of capital for the purchase of this investment property? b. What is the capitalization rate adjusted for recapture for this investor? c. What is the estimated value of this property using the income capitalization approach? d. What is the maximum price this investor can pay for this property and earn his or her required rate of return on investment capital? Name Real Estate Valuation Problems 1. If an investor has found a possible investment property with the net income after all operating expenses but before capital recapture from a small apartment house is estimated to be $48.000 per year: How much would an investor be willing to pay for the property if first mortgages are available for 75% the purchase price at 5.5% interest and the investor's equity capital investment requires a 15% return. The remaining life of the buildings is 50 years. Use the income approach to estimate the value of this property. a. What is the investor's weighted average cost of capital for the purchase of this investment property? b. What is the capitalization rate adjusted for recapture for this investor? c. What is the estimated value of this property using the income capitalization approach? d. What is the maximum price this investor can pay for this property and earn his or her required rate of return on investment capital? Name Real Estate Valuation Problems 1. If an investor has found a possible investment property with the net income after all operating expenses but before capital recapture from a small apartment house is estimated to be $48,000 per year: How much would an investor be willing to pay for the property if first mortgages are available for 75% the purchase price at 5.5% interest and the investor's equity capital investment requires a 15% return. The remaining life of the buildings is 50 years. Use the income approach to estimate the value of this property. a. What is the investor's weighted average cost of capital for the purchase of this investment property? b. What is the capitalization rate adjusted for recapture for this investor? c. What is the estimated value of this property using the income capitalization approach? d. What is the maximum price this investor can pay for this property and earn his or her required rate of return on investment capital