Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NAME SECTION ACC 221 Test Version EB MULTIPLE CHOICE. multiple choice question is worth 2 points) Choose the one alternative that best completes the statement

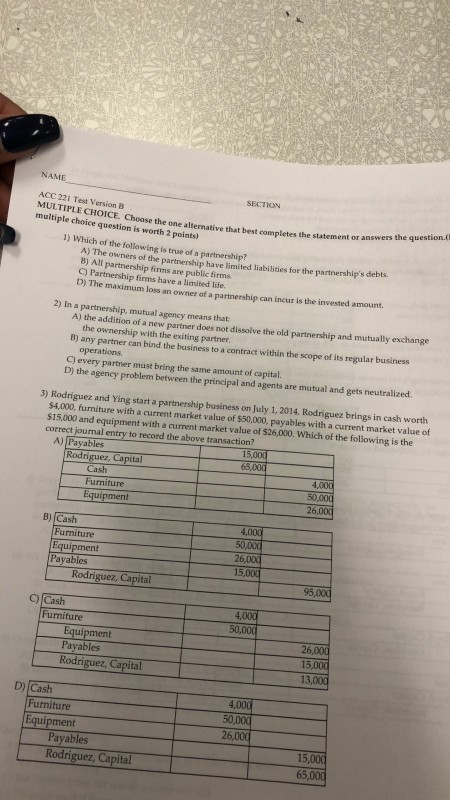

NAME SECTION ACC 221 Test Version EB MULTIPLE CHOICE. multiple choice question is worth 2 points) Choose the one alternative that best completes the statement or answe rs the question.( 1) Which of the following is true of a partnership? A) The owners of the partnership have limited liabilities for the partnership's debts. B) All partnership firms are public firms C) Partnership firms have a limited life. D) The maximum loss an owner of a partnership can incur is the invested amount. 2) In a partnership, mutual agency means that A) the addition of a new partner does not dissolve the old partnership and mutually exchange the ownership with the exiting partner B) any partner can bind the business to a contract within the scope of its regular business D) the agency problem between the principal and agents are mutual and gets neutralized 3) Rodriguez and Ying start a partnership business on July 1, 2014. Rodriguez brings in cash worth $15,000 and equipment with a current market value of $26,000. Which of the following is the operations C) every partner must bring the same amount of capital. 54,000, furniture with a current market value of $50,000, payables with a current market value of correct journal entry to record the above transaction? Rodri Furniture B) Cash Furniture 50 ment Rodriguez, Capital 95 C) Cash Furniture Payables 15,00 13 D) Cash Furniture ment Payables Rodriguez, Capital 26,00 15 65

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started