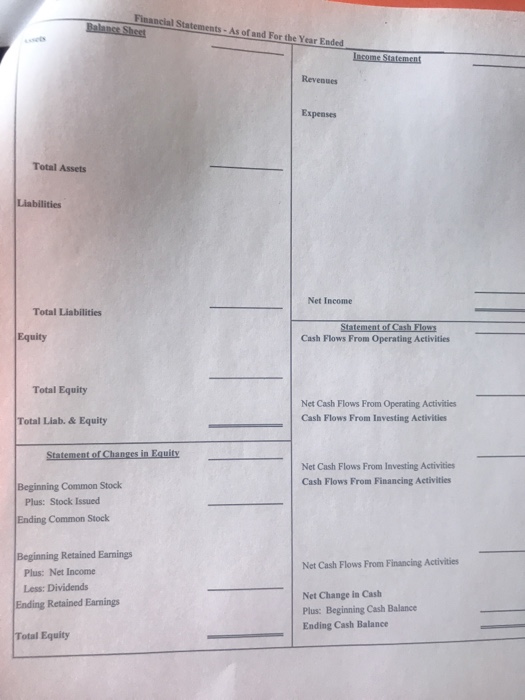

Name: Section Time: Practice Company began its operations on January 1, 2015. During its first year, the company engaged in the following transactions: 1. Issued common stock for $10,000 cash. 2. Borrowed $4,000 cash from a local bank. The note matures in two years. 3. Purchased $500 of supplies on account. 4. Recognized revenue of $8,000 for services provided on account. 5. Paid $3,900 cash for salaries expense 6. Paid $2,400 cash in advance for a one-year lease to rent office space. 7. Purchased $3,500 of office furniture on account. 8. Received $1,800 cash for services to be performed in the future. 9. Collected $3,000 cash from accounts receivable. 10. Paid $1,200 cash for utilities. 11. Paid dividends of $1,000 cash to the stockholders. 12. Invested $2,000 cash in a two-year certificate of deposit. 13. Repaid $1,600 principal on the bank loan described in Event No. 2. 14. Purchased land for $2,700 cash. Adjusting Entries: 15. Recognized $400 of accrued interest expense on the bank loan described in Event No. 2 16The contract described in Event No. 8 was initiated on September ist. It is a nine month service contract. Record the appropriate adjusting entry 17. Counted supplies on hand at December 31". Determined the company had $100 of supplies 18. Recognized accrued salary expense of $300. 19. Recognized accrued interest revenue on the CD purchased in Event No. 12. The CD was purchased on July 1st and has a 5% interest rate. Recognized depreciation expense on the office furniture purchased in Event No. 7The office furniture was purchased on January 1". It has a ten-year life and no salvage value. The company uses straight-line depreciation. 20. 21. Recognized rent expense for the lease in Event No. 6. The lease agreement began on October 1" Required: Analyze the transactions above using the accounting cycle packet. A. Prepare the journal entries B. Post the journal entries to the T-accounts C. Prepare an unadjusted trial balance (optional) D. Prepare the adjusting entries E. Post the adjusting entries to the T-accounts F. Prepare an adjusted trial balance G. Use the adjusted trial balance to prepare closing entries and financial statements H. Prepare a post-closing trial balance (optional) Create a Classified Balance Sheet, Multi-Step Income Statement, Statement of Ownership Equity, and Statement of Cash Flows. Name: Section Time: Practice Company began its operations on January 1, 2015. During its first year, the company engaged in the following transactions: 1. Issued common stock for $10,000 cash. 2. Borrowed $4,000 cash from a local bank. The note matures in two years. 3. Purchased $500 of supplies on account. 4. Recognized revenue of $8,000 for services provided on account. 5. Paid $3,900 cash for salaries expense 6. Paid $2,400 cash in advance for a one-year lease to rent office space. 7. Purchased $3,500 of office furniture on account. 8. Received $1,800 cash for services to be performed in the future. 9. Collected $3,000 cash from accounts receivable. 10. Paid $1,200 cash for utilities. 11. Paid dividends of $1,000 cash to the stockholders. 12. Invested $2,000 cash in a two-year certificate of deposit. 13. Repaid $1,600 principal on the bank loan described in Event No. 2. 14. Purchased land for $2,700 cash. Adjusting Entries: 15. Recognized $400 of accrued interest expense on the bank loan described in Event No. 2 16The contract described in Event No. 8 was initiated on September ist. It is a nine month service contract. Record the appropriate adjusting entry 17. Counted supplies on hand at December 31". Determined the company had $100 of supplies 18. Recognized accrued salary expense of $300. 19. Recognized accrued interest revenue on the CD purchased in Event No. 12. The CD was purchased on July 1st and has a 5% interest rate. Recognized depreciation expense on the office furniture purchased in Event No. 7The office furniture was purchased on January 1". It has a ten-year life and no salvage value. The company uses straight-line depreciation. 20. 21. Recognized rent expense for the lease in Event No. 6. The lease agreement began on October 1" Required: Analyze the transactions above using the accounting cycle packet. A. Prepare the journal entries B. Post the journal entries to the T-accounts C. Prepare an unadjusted trial balance (optional) D. Prepare the adjusting entries E. Post the adjusting entries to the T-accounts F. Prepare an adjusted trial balance G. Use the adjusted trial balance to prepare closing entries and financial statements H. Prepare a post-closing trial balance (optional) Create a Classified Balance Sheet, Multi-Step Income Statement, Statement of Ownership Equity, and Statement of Cash Flows