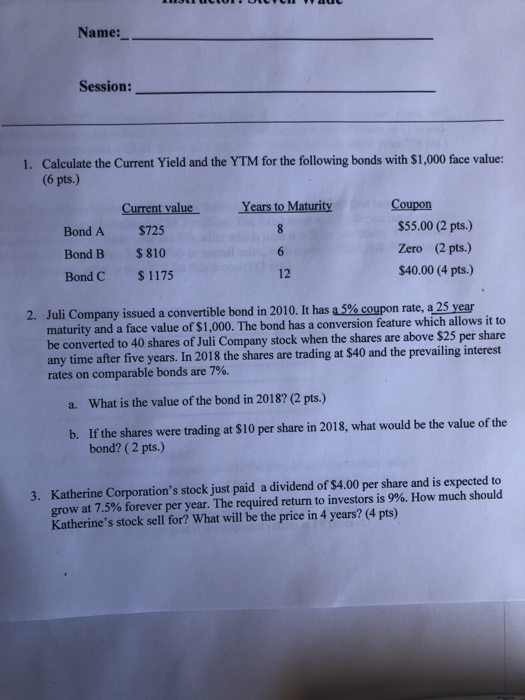

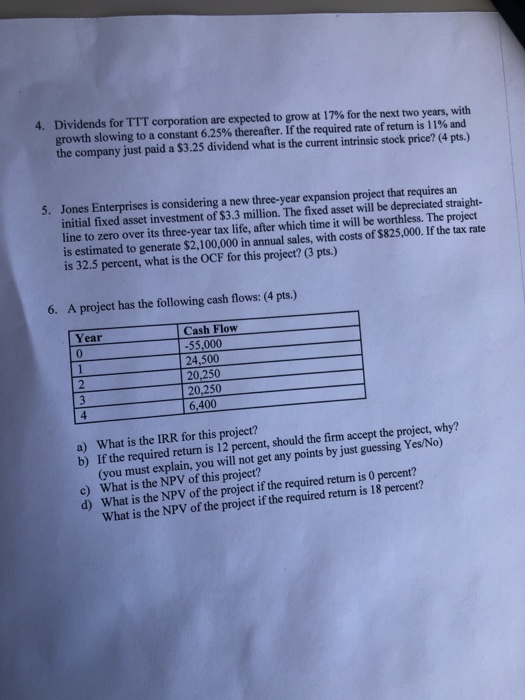

Name: Session: Calculate the Current Yield and the YTM for the following bonds with $1,000 face value: 6 pts.) 1. Current value Years to Maturity Coupon Bond A $725 $55.00 (2 pts.) Bond B$810 Zero (2 pts.) Bond C$1175 $40.00 (4 pts.) 12 Juli Company issued a convertible bond in 2010. It has as%coupon rate, a 25 year maturity and a face value of $1,000. The bond has a conversion feature which allows it to be converted to 40 shares of Juli Company stock when the shares are above $25 per share any time after five years. In 2018 the shares are trading at $40 and the prevailing interest rates on comparable bonds are 7%. 2. a. What is the value of the bond in 2018? (2 pts.) If the shares were trading at $10 per share in 2018, what would be the value of the bond? (2 pts.) b. Katherine Corporation's stock just paid a dividend of $4.00 per share and is expected to grow at 7.5% forever per year. The required return to investors is 9%. How much should Katherine's stock sell for? What will be the price in 4 years? (4 pts) 3. 4. Dividends for TTT corporation are expected to grow at 17% for the next two years, with growth slowing to a constant 625% thereafter. If the required rate of retum is 1 1% and the company just paid a $3.25 dividend what is the current intrinsic stock price? (4 pts.) 5. Jones Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $3.3 million. The fixed asset will be depreciated straight- line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $2,100,000 in annual sales, with costs of $825,000. If the tax rate is 32.5 percent, what is the OCF for this project? (3 pts.) 6. A project has the following cash flows: (4 pts.) Year Cash Flow 55,000 0 24,500 2 20,250 6,400 a) What is the IRR for this project? b) If the required return is 12 percent, should the firm accept the project, why? (you must explain, you will not get any points by just guessing Yes/No) c) What is the NPV of this project? d) What is the NPV of the project if the required return is 0 percent? What is the NPV of the project if the required return is 18 percent