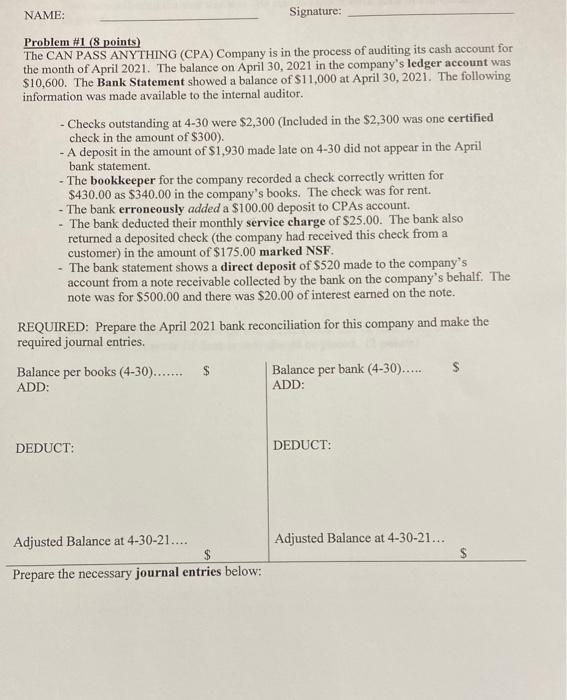

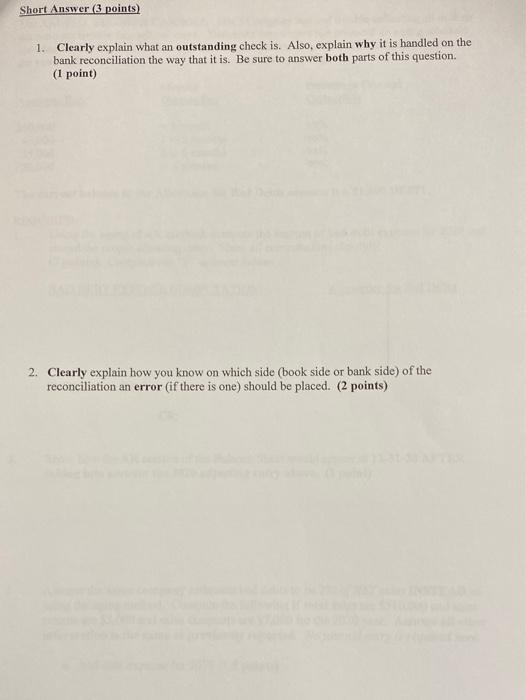

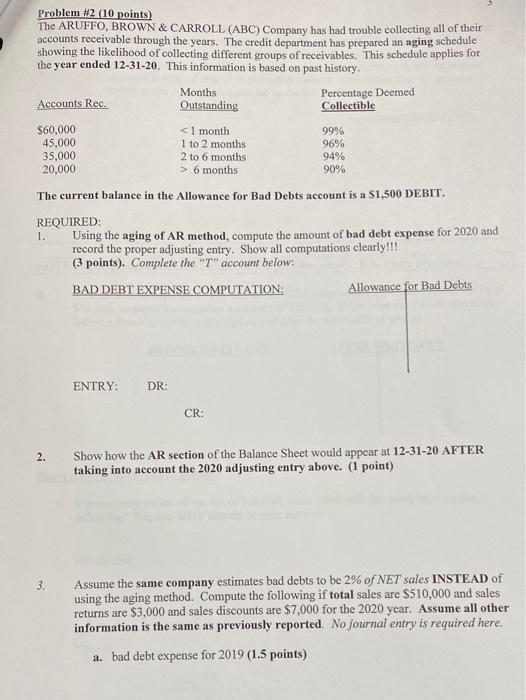

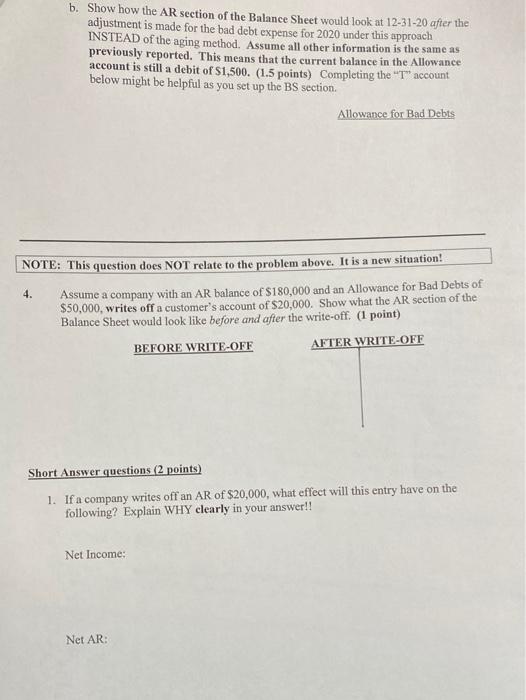

NAME: Signature: Problem #1 (8 points) The CAN PASS ANYTHING (CPA) Company is in the process of auditing its cash account for the month of April 2021. The balance on April 30, 2021 in the company's ledger account was $10,600. The Bank Statement showed a balance of $11,000 at April 30, 2021. The following information was made available to the internal auditor. - Checks outstanding at 4-30 were $2,300 (Included in the $2,300 was one certified check in the amount of $300). - A deposit in the amount of $1,930 made late on 4-30 did not appear in the April bank statement. - The bookkeeper for the company recorded a check correctly written for $430.00 as $340.00 in the company's books. The check was for rent. - The bank erroneously added a $100.00 deposit to CPAs account. - The bank deducted their monthly service charge of $25.00. The bank also returned a deposited check the company had received this check from a customer) in the amount of $175.00 marked NSF. - The bank statement shows a direct deposit of $520 made to the company's account from a note receivable collected by the bank on the company's behalf. The note was for $500.00 and there was $20.00 of interest earned on the note. REQUIRED: Prepare the April 2021 bank reconciliation for this company and make the required journal entries. Balance per books (4-30)....... $ Balance per bank (4-30)..... ADD: ADD: DEDUCT: DEDUCT: Adjusted Balance at 4-30-21... $ Adjusted Balance at 4-30-21.... $ Prepare the necessary journal entries below: Short Answer (3 points) 1. Clearly explain what an outstanding check is. Also, explain why it is handled on the bank reconciliation the way that it is. Be sure to answer both parts of this question. (1 point) 2. Clearly explain how you know on which side (book side or bank side) of the reconciliation an error (if there is one) should be placed. (2 points) Problem #2 (10 points) The ARUFFO, BROWN & CARROLL (ABC) Company has had trouble collecting all of their accounts receivable through the years. The credit department has prepared an aging schedule showing the likelihood of collecting different groups of receivables. This schedule applies for the year ended 12-31-20. This information is based on past history. Months Percentage Deemed Accounts Rec. Outstanding Collectible $60,000 6 months 90% The current balance in the Allowance for Bad Debts account is a S1,500 DEBIT. REQUIRED: 1. Using the aging of AR method, compute the amount of bad debt expense for 2020 and record the proper adjusting entry. Show all computations clearly!!! (3 points). Complete the "T" account below: BAD DEBT EXPENSE COMPUTATION: Allowance for Bad Debts ENTRY: DR: CR: 2. Show how the AR section of the Balance Sheet would appear at 12-31-20 AFTER taking into account the 2020 adjusting entry above. (1 point) 3. Assume the same company estimates bad debts to be 2% of NET sales INSTEAD of using the aging method. Compute the following if total sales are $510,000 and sales returns are $3,000 and sales discounts are $7,000 for the 2020 year. Assume all other information is the same as previously reported. No journal entry is required here. a. bad debt expense for 2019 (1.5 points) b. Show how the AR section of the Balance Sheet would look at 12-31-20 after the adjustment is made for the bad debt expense for 2020 under this approach INSTEAD of the aging method. Assume all other information is the same as previously reported. This means that the current balance in the Allowance account is still a debit of $1,500. (1.5 points) Completing the "T" account below might be helpful as you set up the BS section. Allowance for Bad Debts NOTE: This question does NOT relate to the problem above. It is a new situation! 4. Assume a company with an AR balance of $180,000 and an Allowance for Bad Debts of $50,000, writes off a customer's account of $20,000. Show what the AR section of the Balance Sheet would look like before and after the write-off. (1 point) BEFORE WRITE-OFF AFTER WRITE-OFF Short Answer questions (2 points) 1. If a company writes off an AR of $20,000, what effect will this entry have on the following? Explain WHY clearly in your answer!! Net Income: Net AR