Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Name your company You sell Steeler's accessories at the Acrisure Stadium Accounting for the month of September 2023 remaining inventory and Multiple Income Statement

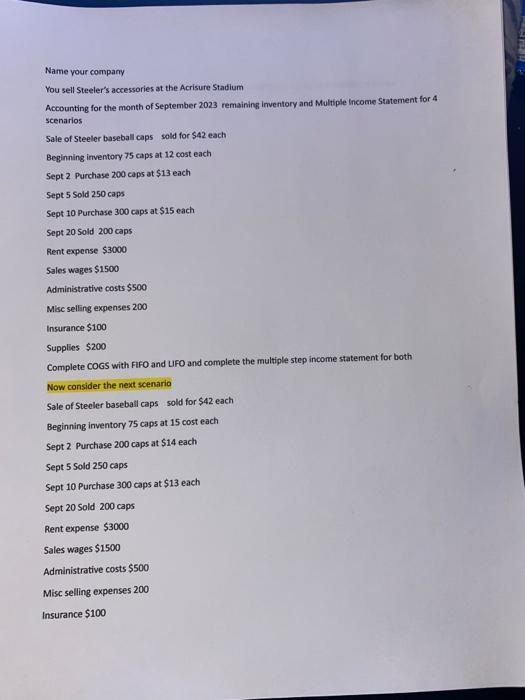

Name your company You sell Steeler's accessories at the Acrisure Stadium Accounting for the month of September 2023 remaining inventory and Multiple Income Statement for 4 scenarios Sale of Steeler baseball caps sold for $42 each Beginning inventory 75 caps at 12 cost each Sept 2 Purchase 200 caps at $13 each Sept 5 Sold 250 caps Sept 10 Purchase 300 caps at $15 each Sept 20 Sold 200 caps Rent expense $3000 Sales wages $1500 Administrative costs $500 Misc selling expenses 200 Insurance $100 Supplies $200 Complete COGS with FIFO and LIFO and complete the multiple step income statement for both Now consider the next scenario Sale of Steeler baseball caps sold for $42 each Beginning inventory 75 caps at 15 cost each Sept 2 Purchase 200 caps at $14 each Sept 5 Sold 250 caps Sept 10 Purchase 300 caps at $13 each Sept 20 Sold 200 caps Rent expense $3000 Sales wages $1500 Administrative costs $500 Misc selling expenses 200 Insurance $100 LEHEN Supplies $200 Complete COGS with FIFO and LIFO and complete the multiple step income statement for both

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To assist you with this accounting problem we need to calculate the Cost of Goods Sold COGS using the FIFO FirstIn FirstOut and LIFO LastIn FirstOut i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started