Question

Namtip Corp. Part I -- Attribute SamplingThe firm of Omala, CPAs, is engaged to conduct the audit of Namtip Corp, a retailer of electronic and

Namtip Corp. Part I -- Attribute SamplingThe firm of Omala, CPAs, is engaged to conduct the audit of Namtip Corp, a retailer of electronic and other high-technology products. Because of technological advances in Namtip Corps inventory products, an important risk that it faces is that prices charged by suppliers reflect current industry prices (which tend to fluctuate relatively significantly, particularly as new technologies are introduced and as older technologies are discontinued). The nature of Namtip Corps inventories is such that a small number of suppliers exist and each supplier has a similar pricing structure. This pricing structure is reflected in an electronic industry pricing guide, which is updated on a daily basis. You are a staff accountant withOmala and have been asked to identify a potential audit approach to address this risk in the 2016 audit. In the past, your firm has decided to place relatively limited reliance on internal control policies related to Namtip Corps purchasing function and has instead conducted relatively extensive substantive procedures related to its inventories. However, the new partner on the Namtip Corp engagement has successfully reduced substantive procedures for the other clients in the retail industry by performing more extensive tests of controls. Because of previous experience in the industry as well as having used this audit approach successfully for other clients, the new partner asks you to evaluate the possibility of using more extensive tests of controls in the audit of Namtip Corp. The following controls are relevant to Namtip Corps processing of vendor invoices: Similar to most retailers in the industry, Namtip Corp has a highly automated inventory monitoring and control system. Based on anticipated product life, current sales, and existing inventory levels, Namtip Corpgenerates an automatic purchase order when inventory levels reach predetermined thresholds. Once a purchase order has been generated, the store manager reviews it prior to transmitting it to the appropriate vendor. This review ensures that the vendor is from an approved list and that the proposed purchase is consistent with the stores objectives and near-term plans (for example, not purchasing a large number of laptop computers just prior to a major promotion for tablets). Upon receipt of the items, warehouse personnel prepare blind copies of a receiving report, noting the quantity of each item received. Purchasing personnel verify the vendors invoices by (1) comparing the invoice to a purchase order by referencing the purchase order number on the vendor invoice, (2) comparing quantities on the vendor invoice to quantities from the receiving report prepared by warehouse personnel, (3) comparing prices on the invoice for reasonableness through reference to industry pricing data, and (4) mathematically verifying the accuracy of the invoice.

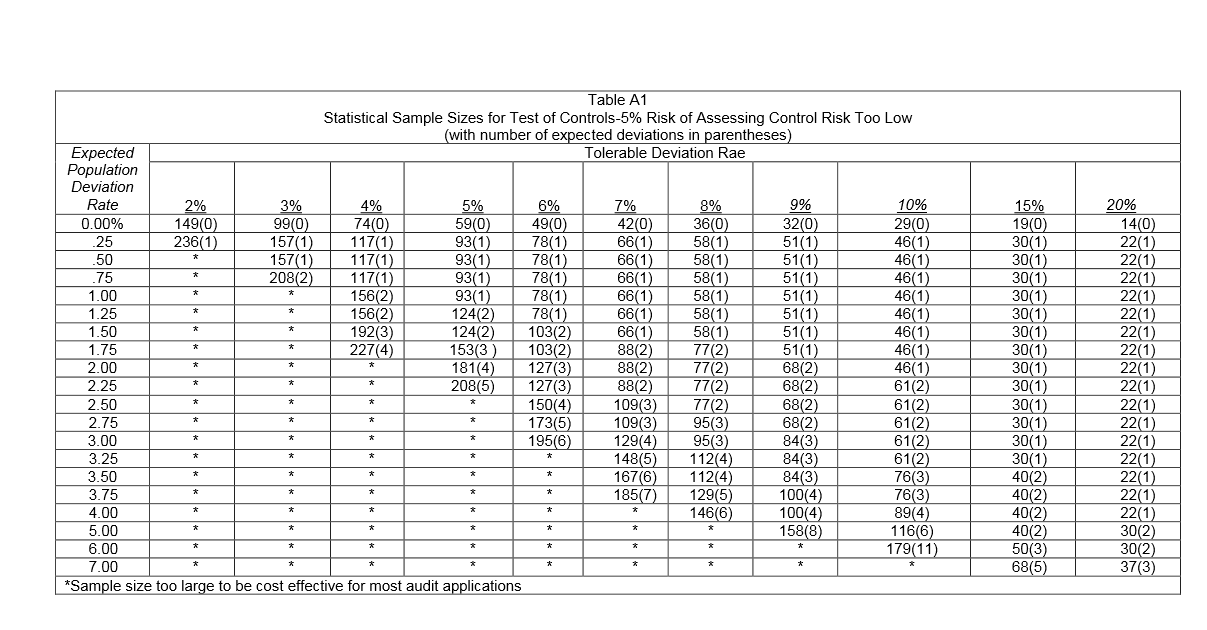

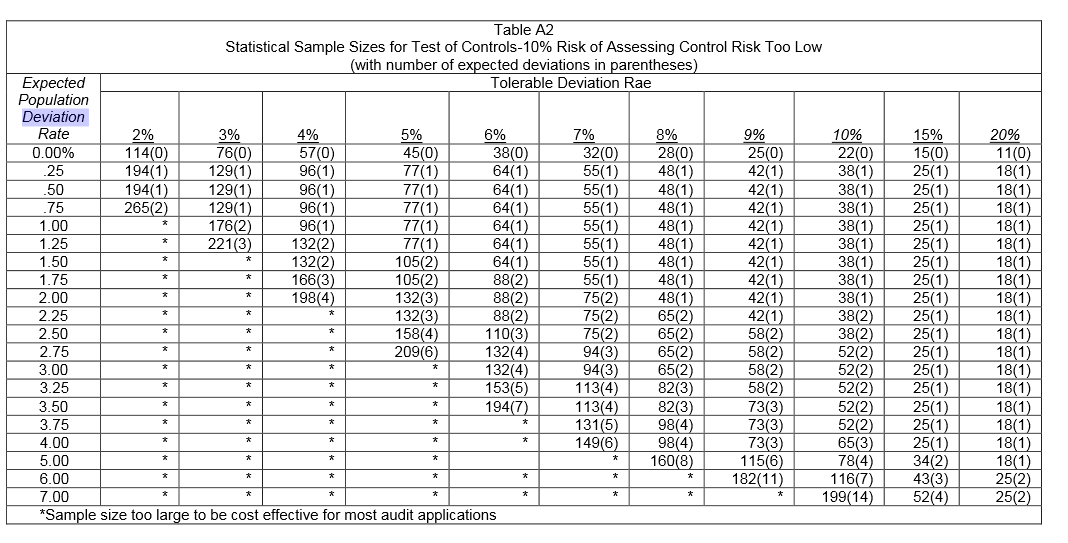

These controls have been in place for a number of years, and Namtip Corp has experienced relatively little turnover in its purchasing and related functions. You did not observe any remediation or major changes with respect to these controls or to Namtip Corps control environment during the past year. You reviewed the 2015 audit documentation, which was prepared by another staff accountant who has since left the firm. Based on your review, you prepared the following notes: The control policy tested by the staff accountant is the employee verification of the reasonableness of prices on the invoices by placing a checkmark or other notation adjacent to the price on the invoice. Using an expected population deviation rate of 1 percent, a tolerable rate of deviation of 7 percent, and a risk of assessing control risk too low (overreliance) of 10 percent, the staff accountant selected a sample of 55 invoices. Tests of controls revealed three misstatements; based on the sample size of 55 and a risk of assessing control risk too low (overreliance) of 10 percent, the upper limit rate of deviation was 11.8 percent. Because this exceeded the tolerable rate of deviation 7 percent, the other staff accountant reduced reliance on the control policy and conducted more extensive substantive procedures. Required Part I a. Comment on the appropriateness of the work done in the 2015audit with respect to testing this control policy.

b. Based on the results of tests of controls in the 2015 audit, provide your initial thoughts regarding the viability of increasing your reliance on this control policy in thecurrent audit.

c. How will your decision to increase the reliance on the control policy affect the samplesize in the 2016 audit? What specific factors will be affected by this decision?

d. Assume that you have established a risk of assessing control risk too low (overreliance) of 5 percent, a tolerable rate of deviation of 6 percent, and an expected

population deviation rate of 1 percent. Using the AICPA sample size tables, determine the necessary sample size in the current audit. Is this sample size consistent with your

expectations compared to that examined in 2015?

e. Using the AICPA sample size tables, determine what factor(s) resulted in the increased sample size from the prior year. Can you determine the extent to which eachfactor contributed to this increase? [Note: Requirements (f)(h) are unrelated to (a)(e).]

f. Refer to the AICPA sample evaluation tables. Assuming a sample size of 100 items,how many deviations would be permissible for you to rely on this control policy using a 5 percent risk of assessing control risk too low (overreliance) and a 6 percent tolerable rate of deviation?

g. Repeat (f), assuming that you decided to reduce your reliance on internal control andestablish a risk of assessing control risk too low (overreliance) of 10 percentand a 6 percent tolerable rate of deviation.

h. What does a comparison of your results in (f) and (g) tell you about the effect of the risk of assessing control risk too low (overreliance) on the upper limit rate of deviation?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started