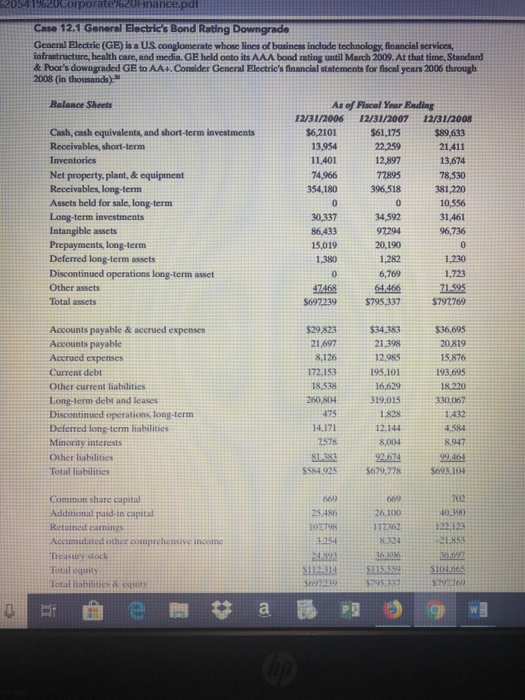

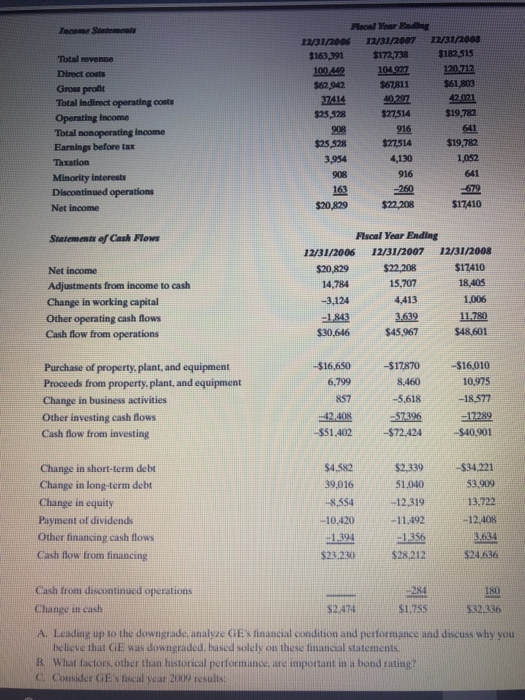

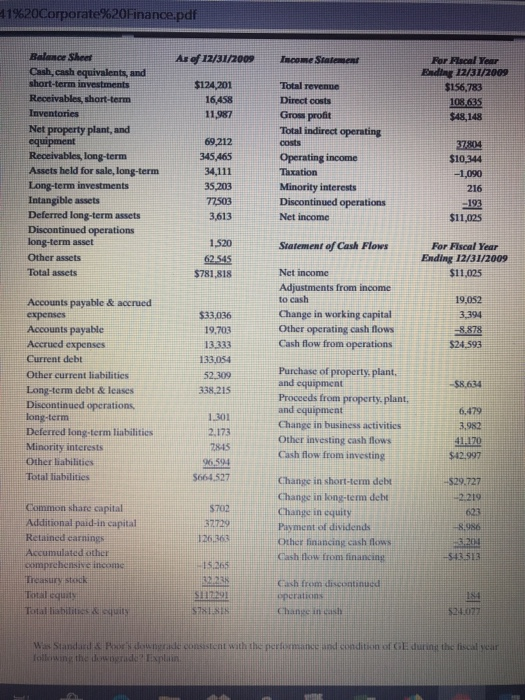

nan Case 12.1 General Electric's Bond Rating Downgrade General Electric (GE) is a US.conglomerate whosc lines of business inclode technology, financial services infrastructure, health care, and media.GE held onto its AAA bond rating until March 2009.At that time, Standard & Poor's downgraded GE to AA+. Consider General Electrie's financial statements for fiscal years 2006 through 2008 (in thousands) Balance Sheets As of Fiscal Year Ending 12/31/2006 12/31/200712/31/2008 $62101 $61,175$89 633 22,259 Cash, cash equivalents, and short-term investments Receivables, short-ternm Inventories Net property, plant, & equipment Receivables,long-term Assets held for sale, long-term Long-term investments Intangible assets 13,954 11,401 74,966 354,180 21,411 13,674 78,530 381,220 10,556 31,461 96,736 77895 396,518 86433 15,019 1,380 97294 nts, long-term 20,190 Deferred long-term assets Discontinued operations long-term asset Other assets Total assets 1,230 1,723 6,769 7468 64.46621.595 697,239$795,337 $797769 Accounts payable & accrued expenses Accounts payable Accrued expenses Current debt Other current liabilities Long-lerm debt and leases Discontinued operations long-term Deferred long-term liabilities Minority interests Other liabilities Total liabilities 536,695 20,819 15,876 193,695 18.220 30,067 $29.823$34 383 21.398 12.985 21,697 8,126 72,153195.101 18,538 260,804319,015 1,828 12.144 8,004 382926749946 584925 $679778$693.104 14.171 1578 8,947 Common share capital Additional paid-in capital Retained carnings Accumulated other comprehensive income 26,100 40,390 112362122123 21853 8324 Total equily lotal liabilitlics&sy Se) 2239 11%20Corporate%20Finance.pdf Balance Sheet Cash, cash equivalents, and short-term investments Receivables, short-term Ar of 12/31/2009 Icome For Fscal Year Eadiay 17/31/2009 $156,783 $124 201 16,458 11,987 Total revenne Direct costs Gross proft Total indirect operating $48,148 Net property plant, and 69,212 345,465 Receivables long-term Assets held for sale, long-term Operating income Taxation Minority interests Discontinued operations Net income $10,344 216 Intangible assets Deferred long-term assets Discontinued operations 3,613 1520 $781,818 $11,025 Statement of Cash Flows For Fiscal Year Ending 12/31/2009 Other assets Total assets Net income Adjustments from income to cash Change in working capital Other operating cash flows Cash flow from operations 19,052 Accounts payable & accrued $33,036 Accounts payable Accrued expenses Current debt Other current liabilitics Long-term debt & leases Discontinued operations long-term Deferred long-term liabilitics Minority interests Other liabilitics Total liabilities 19,703 Purchase of property, plarnt and cquipment 338.215 Proceeds from property-plant, equipment Change in business activitics Other investing cash flows Cash flow from investing 3,982 $42 997 5664.527 Change in short-term debt Change in long-term debt Common share capital Additional paid-in capital Retained carnings Accumulated other comprehensive inicome Treasury stouk Payment of dividends xher financing cash flows h low from financing Ws Slandazd & Ps N downgade consistent with the pertismanesiand condition of GE during the isecal sear nan Case 12.1 General Electric's Bond Rating Downgrade General Electric (GE) is a US.conglomerate whosc lines of business inclode technology, financial services infrastructure, health care, and media.GE held onto its AAA bond rating until March 2009.At that time, Standard & Poor's downgraded GE to AA+. Consider General Electrie's financial statements for fiscal years 2006 through 2008 (in thousands) Balance Sheets As of Fiscal Year Ending 12/31/2006 12/31/200712/31/2008 $62101 $61,175$89 633 22,259 Cash, cash equivalents, and short-term investments Receivables, short-ternm Inventories Net property, plant, & equipment Receivables,long-term Assets held for sale, long-term Long-term investments Intangible assets 13,954 11,401 74,966 354,180 21,411 13,674 78,530 381,220 10,556 31,461 96,736 77895 396,518 86433 15,019 1,380 97294 nts, long-term 20,190 Deferred long-term assets Discontinued operations long-term asset Other assets Total assets 1,230 1,723 6,769 7468 64.46621.595 697,239$795,337 $797769 Accounts payable & accrued expenses Accounts payable Accrued expenses Current debt Other current liabilities Long-lerm debt and leases Discontinued operations long-term Deferred long-term liabilities Minority interests Other liabilities Total liabilities 536,695 20,819 15,876 193,695 18.220 30,067 $29.823$34 383 21.398 12.985 21,697 8,126 72,153195.101 18,538 260,804319,015 1,828 12.144 8,004 382926749946 584925 $679778$693.104 14.171 1578 8,947 Common share capital Additional paid-in capital Retained carnings Accumulated other comprehensive income 26,100 40,390 112362122123 21853 8324 Total equily lotal liabilitlics&sy Se) 2239 11%20Corporate%20Finance.pdf Balance Sheet Cash, cash equivalents, and short-term investments Receivables, short-term Ar of 12/31/2009 Icome For Fscal Year Eadiay 17/31/2009 $156,783 $124 201 16,458 11,987 Total revenne Direct costs Gross proft Total indirect operating $48,148 Net property plant, and 69,212 345,465 Receivables long-term Assets held for sale, long-term Operating income Taxation Minority interests Discontinued operations Net income $10,344 216 Intangible assets Deferred long-term assets Discontinued operations 3,613 1520 $781,818 $11,025 Statement of Cash Flows For Fiscal Year Ending 12/31/2009 Other assets Total assets Net income Adjustments from income to cash Change in working capital Other operating cash flows Cash flow from operations 19,052 Accounts payable & accrued $33,036 Accounts payable Accrued expenses Current debt Other current liabilitics Long-term debt & leases Discontinued operations long-term Deferred long-term liabilitics Minority interests Other liabilitics Total liabilities 19,703 Purchase of property, plarnt and cquipment 338.215 Proceeds from property-plant, equipment Change in business activitics Other investing cash flows Cash flow from investing 3,982 $42 997 5664.527 Change in short-term debt Change in long-term debt Common share capital Additional paid-in capital Retained carnings Accumulated other comprehensive inicome Treasury stouk Payment of dividends xher financing cash flows h low from financing Ws Slandazd & Ps N downgade consistent with the pertismanesiand condition of GE during the isecal sear