Answered step by step

Verified Expert Solution

Question

1 Approved Answer

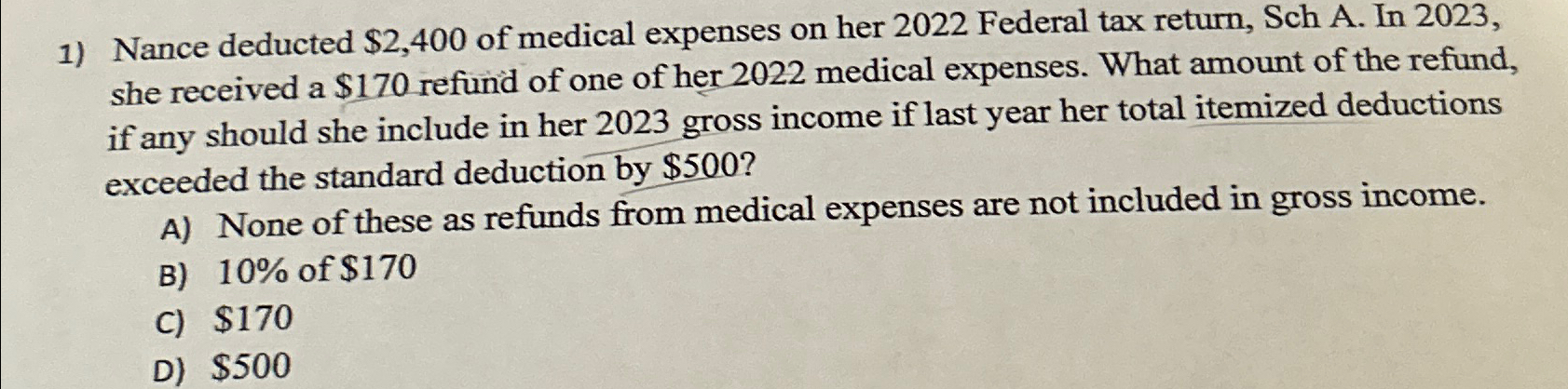

Nance deducted $ 2 , 4 0 0 of medical expenses on her 2 0 2 2 Federal tax return, Sch A . In 2

Nance deducted $ of medical expenses on her Federal tax return, Sch A In she received a $ refund of one of her medical expenses. What amount of the refund, if any should she include in her gross income if last year her total itemized deductions exceeded the standard deduction by $

A None of these as refunds from medical expenses are not included in gross income.

B of $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started