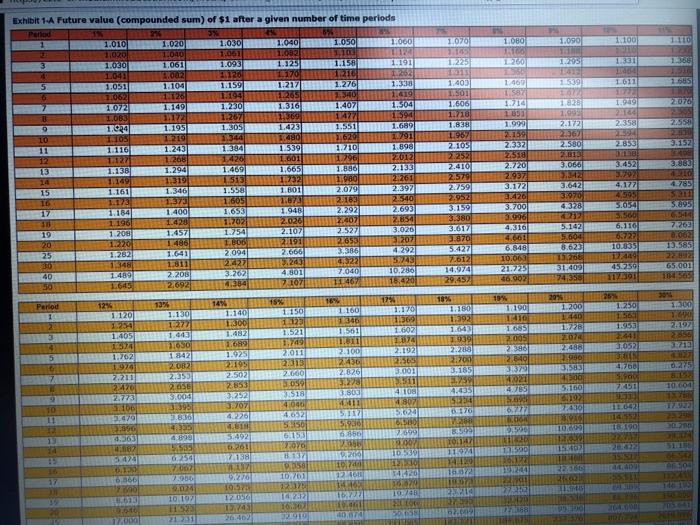

Nancy Cardoza invested $2,850 in ExxonMobil stock because her research indicated the company should average a return for Investors of 9 percent over the next 5 years. If ExxonMobil investors do earn 9 percent each year, what will her $2,850 investment be worth at the end of 5 years? Use Exhibit 1-A. (Round time value factor to 3 decimal places and final answer to 2 decimal places.) Future value C 1.090 161001 TO PAT 1.611 1539 16 1828 1.969 1.316 2358 2.558 3.152 2.172 2367 2.580 2.312 3.066 T5.542 3.642 3970 43328 1422 5.142 15605 36452 3.79 4.177 4,5951 5.054 5.500 6.110 6.72 10.835 19 5.895 Exhibit 1A Future value (compounded sum) of $1 after a given number of time periods Patlad 216 1 1.010 1.020 1.030 1.040 1.050 1.060 10701.080 1.020 1.040 1.061 1.00 1100 012 1165 1100 3 1.030 1.061 1.0931 1.3251 1.158 1.191 1225 1260 1041 2002 11120 110 11210 5 1.051 1.104 1.1591 1.217 1.276 1.338 1.403 1/460 11062 1,194 1.265 1,340 1.419 LET 150 1.37 11.0721 1.149 1.230 1.407 1.504 1.606 1.714 0 1.013 1.172 1:267 11369 LA 1594 1.718 1650 0 1024 1.1951.305 1.423 1.551 1.6891 1.838 1999 TO 1.105 1344 0 11620 1./911 11967 2.159 11 1.116 1.243 1.539 1.7101 1.898 2.105 2332 12 1206 132 1.001 1296 1220121 27252 2518 13 1.136 1.200 1.469 1,665 1.8901 2.133 2.410 2./20 14 1.149 1310 1.513 117321 11.08 21261 2579 2.937 15 1.161 1.346 1.558 1.801 2.0791 2.397 2:59 3.172 16 13731 3673 231831 2.54022952 32426 17 1.14 1.400 116531 1.9461 2.2921 2.6951 3.159 3.700 1.196 1.428 1.702 2.026 2.407 2854 3380 339796 19 1.208 1.457 1.754 2.107 2.527 3.026 3.617 4.316 20 1.220 1480 1.800 2.191 276533 3207 3.870 4.661 25 1.282 1.641 2.094 2.666 4292 5.427 6.848 30 1:34 1.811 27427 23 4,522 3943 7612 10.06 40 1.489 2.205 3.262 4301 7.040 10.280 14.974 21.7251 50 1.645 2.6921134 7107 11.462 16.30 29,452 46.902 13% 15% Period 16% 18% 12% 10% 1 1120 1.130 1.140 1.150 1160 1.170 1.180 E1190 2 1.250 1:277 11300 1393 1536 1410 3 1.003 1.405 11521 1.482 1.685 1.561 103 1.602 4 15 1.689 1.700 1.011 2.005 1.07 1039 1.842 1.925 2:28 2.100 1.702 2011 230 2.02 2199 3313 23563 2704 2.8401 7 2.211 2.502 2.353 2.000 2001 2.8261 3.185 379 20SE 2470 2853 039 311 3.28 1.759 17021 2.773 2 3.00 3:252 31518 3.5031 4.035 4 108 110 3198 3.707 4040 2011 4807 5234 3279 8.36 4652 5:11 5.0241 0176 3,90 4:33 4.618 T53150 590 BBC TO 6.13 6. 4899 1690 9.500 5:492 60 13 14 52535 1261 12.07 20 1907 1014 1:500 13 6254 7.13 10. 20 T0050 10.7 1220 10701 12401 14420 Te 2.024 109 127 023 10.107 120 12:12 19:/48 1132 10.. . 17.00 26.40 07 SO 87623 13260 31.400 7.263 0.062 1385 22 2 65.001 114 565 117539 26 1.250 15 1.300 2192 2356 1650 CE 20% 1.200 140 1.72 22074 2.488 2050 3.5831 200 55100 19 430 5 2430 4.760 791 POSAD PS 677 1142 1890 190 orer AL 119 14 1510 TI KU UCE ADO MI RE DLARE CEC