Question

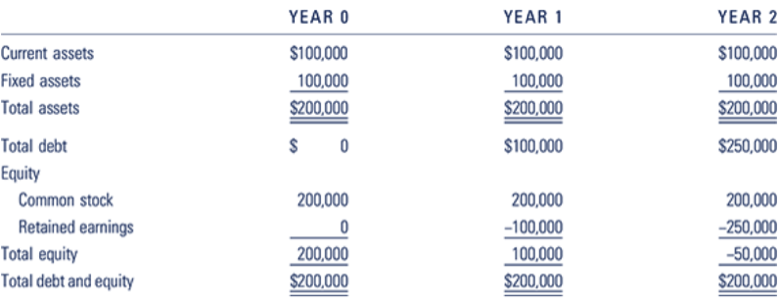

Nancy Corporation is suffering from financial distress as it can be seen from its balance sheet: Two scenarios are possible for Nancy in Year 3:

Nancy Corporation is suffering from financial distress as it can be seen from its balance sheet:

Two scenarios are possible for Nancy in Year 3: In scenario 1, Year 3 for Nancy is expected to result in an additional $150,000 operating loss. In scenario 2, Year 3 is expected to be a ?breakout? year for Nancy when higher sales and lower costs owing to economies of scale are forecasted to produce operating profits of $250,000 in Year 3. Total assets are expected to remain at $200,000 under either scenario. Total debt will be increased to finance additional operating losses. Operating profits will be used to reduce total debt.

Instructions:

a. Show Nancy?s balance sheets under both scenarios.?

b. Based on your analysis, will Nancy Corporation still be balance sheet insolvent in Year 3 under scenario 1? If this trend continues, would you describe Nancy?s financial distress as a temporary or a permanent problem?

c. Based on your analysis, will Nancy Corporation still be balance sheet insolvent in Year 3 under scenario 2? If this trend continues, would you describe Nancy?s financial distress as a temporary or a permanent problem?

d. There are two basic options in the situation of financial distress: liquidation or reorganization. Explain them.?

Current assets Fixed assets Total assets Total debt Equity Common stock Retained earnings Total equity Total debt and equity YEAR 0 $100,000 100,000 $200,000 $0 200,000 0 200,000 $200,000 YEAR 1 $100,000 100,000 $200,000 $100,000 200,000 -100,000 100,000 $200,000 YEAR 2 $100,000 100,000 $200,000 $250,000 200,000 -250,000 -50,000 $200,000

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Answer is inserted through a picture b Balance sheet insolvency means the Total outside liabilitie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started